Published Date:

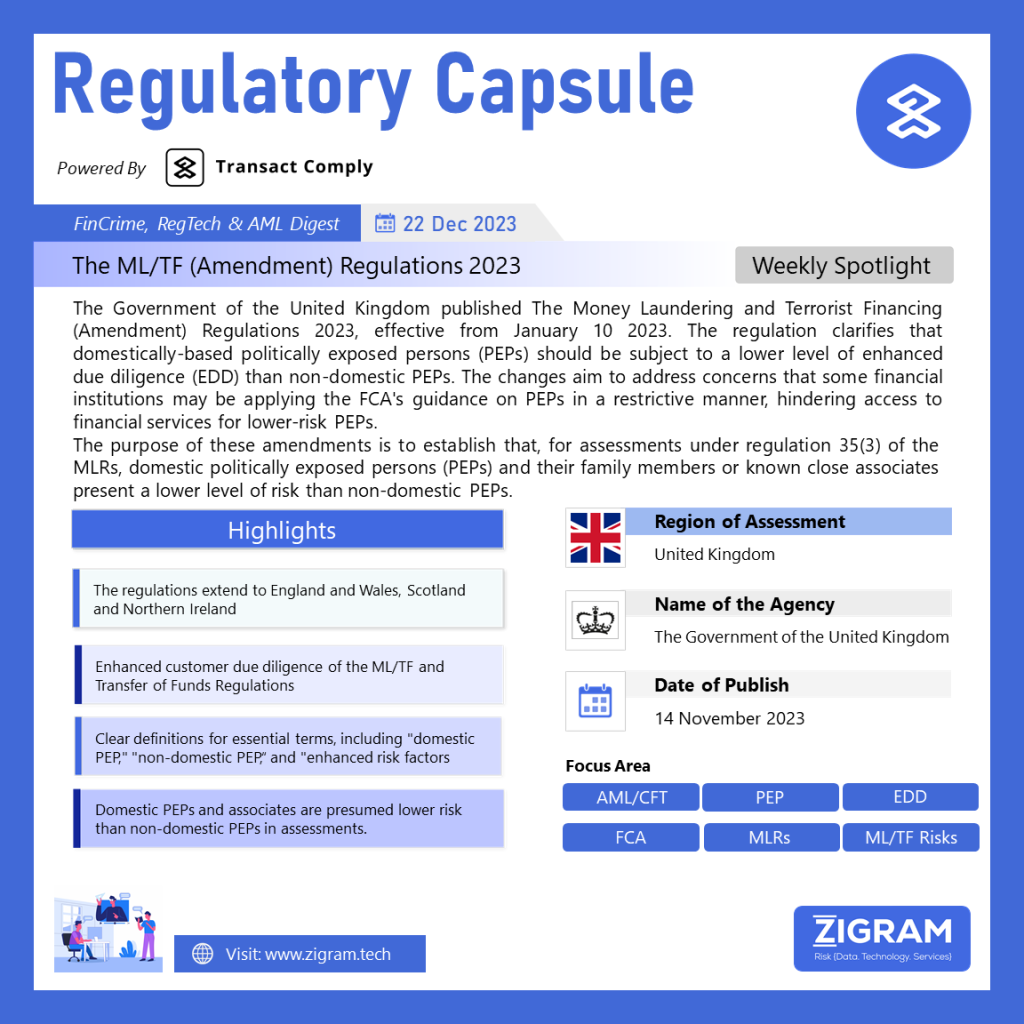

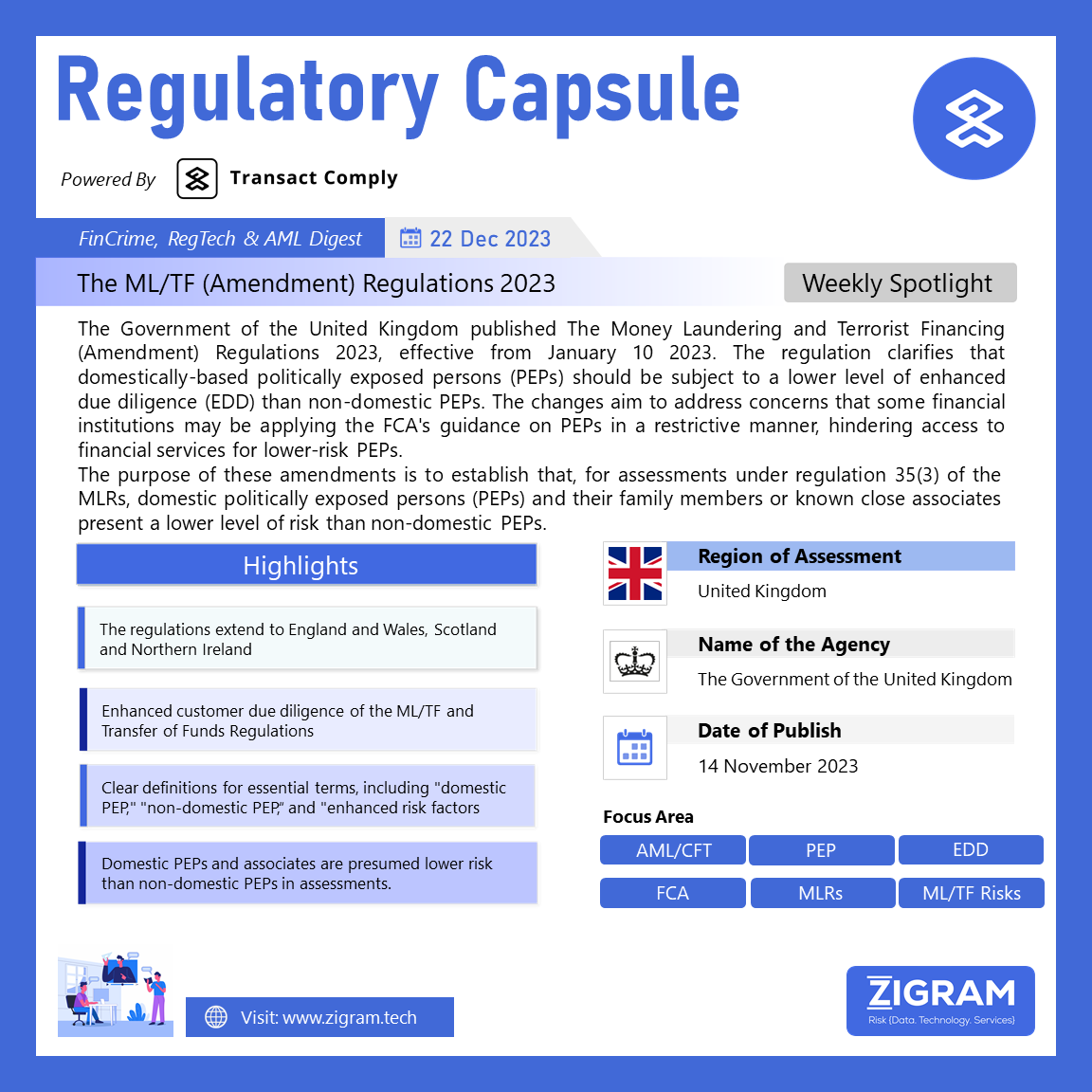

The Government of the United Kingdom has introduced The Money Laundering and Terrorist Financing (Amendment) Regulations 2023, effective from January 10, 2024. These regulations specifically address concerns about financial institutions applying restrictive measures, as per the Financial Conduct Authority’s (FCA) guidance, on politically exposed persons (PEPs), hindering access to financial services for lower-risk PEPs.

The key focus of these amendments lies in differentiating between domestically-based PEPs and non-domestic PEPs, aiming to streamline the application of enhanced due diligence (EDD). The regulations are an amendment to the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, emphasizing the need to reassess the risk posed by domestic PEPs and their associates.

For domestically-based PEPs, including family members or known close associates, the starting point for risk assessment is set as presenting a lower level of risk compared to their non-domestic counterparts. Unless there are enhanced risk factors present, the extent of enhanced customer due diligence measures to be applied to domestic PEPs is stipulated to be less than that for non-domestic PEPs. In this context, enhanced risk factors refer to considerations beyond the individual’s status as a domestic PEP or their association with one, highlighting the need to evaluate additional risk elements.

The regulations provide definitions to clarify terms such as “domestic PEP,” referring to a politically exposed person entrusted with prominent public functions by the United Kingdom, and “non-domestic PEP,” denoting a politically exposed person outside the UK. The distinction is crucial in determining the appropriate level of enhanced due diligence.

The amendments align with the Financial Services and Markets Act 2023, aiming to achieve the outcome specified in section 77(3) of the Act. Specifically, the regulations intend to guide assessments under regulation 35(3) of the MLRs, emphasizing that when the customer is a domestic PEP or associated with one, the default assumption is a lower risk level compared to non-domestic PEPs. The application of enhanced customer due diligence measures is therefore expected to be less stringent, provided no enhanced risk factors are identified.

These regulatory changes seek to provide clarity and flexibility in the application of enhanced due diligence for politically exposed persons within the United Kingdom, addressing concerns of undue restrictions on lower-risk PEPs’ access to financial services. The distinctions between domestic and non-domestic PEPs play a central role in determining the appropriate level of scrutiny in line with the regulatory amendments.

- #AMLRegulations

- #PEPAssessment

- #DueDiligence

- #RegulatoryUpdates

- #UKLawChanges

- #FCACompliance

- #DomesticPEP

- #FinancialSecurity

- #GovernmentRegulations

- #UKFinance

- #PEPClassification

- #AMLCompliance