Published Date:

This week’s Subject Matter is about The Know Your Customer (KYC) Master Direction, RBI

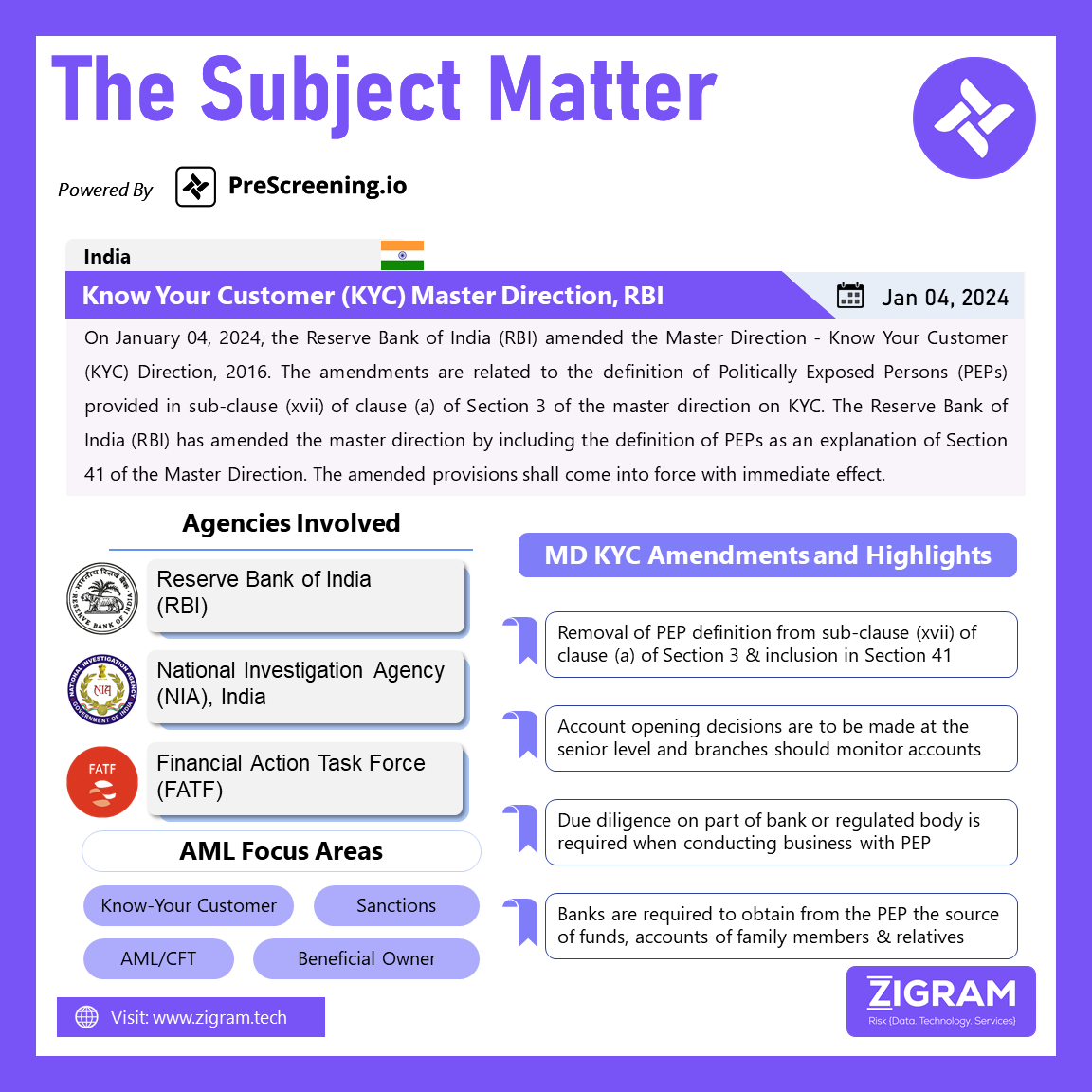

On January 04, 2024, the Reserve Bank of India (RBI) amended the Master Direction – Know Your Customer (KYC) Direction, 2016. The amendments are related to the definition of Politically Exposed Persons (PEPs) provided in sub-clause (xvii) of clause (a) of Section 3 of the master direction on KYC. The Reserve Bank of India (RBI) has amended the master direction by including the definition of PEPs as an explanation of Section 41 of the Master Direction. The amended provisions shall come into force with immediate effect.

The provisions of these directions shall apply to every entity regulated by the Reserve Bank of India, including branches and majority-owned subsidiaries of the REs that are located abroad, to the extent that they are not contradictory to the local laws in the host country.

The legal framework for anti-money laundering (AML) and countering the financing of terrorism (CFT) in India is outlined in the Prevention of Money-Laundering Act, 2002, and the Prevention of Money-Laundering (Maintenance of Records) Rules, 2005. The regulated entities (REs) must adhere to specific customer identification procedures when conducting transactions, whether through the establishment of an account-based relationship or another method, and they must also keep track of their transactions.

The Financial Action Task Force (FATF), an intergovernmental body established in 1989 by the ministers of its member jurisdictions, sets standards and promotes the effective implementation of legal, regulatory, and operational measures for combating money laundering, terrorist financing, and other related threats to the integrity of the international financial system. With India as a member of FATF, efforts are continuously made to prevent banks and other financial institutions from being used as a channel for money laundering (ML) or terrorist financing (TF) and to ensure the integrity and stability of the financial system, both nationally and internationally, through the prescription of various rules and regulations.

The Master Direction defines “Politically Exposed Persons” (PEPs) as individuals who have been entrusted with prominent public functions by a foreign country, including the Heads of state or government, senior politicians, senior government or judicial or military officers, senior executives of state-owned corporations and important political party officials. The Master Direction for Clarification now includes the definition of PEPs as an explanation in Section 41, streamlining identification and reinforcing anti-money laundering (AML) measures for REs in managing potential risks associated with PEPs’ financial transactions.

- #moneylaundering

- #compliance

- #antimoneylaundering

- #prescreening

- #prescreening

- #subjectmatter

- #amlcft

- #sanctions

- #peps

- #kyc

- #customerduediligence

- #prolifrationfinancing

- #suspicioustransactionreport

- #beneficialownership

- #rbi

- #india