Published Date:

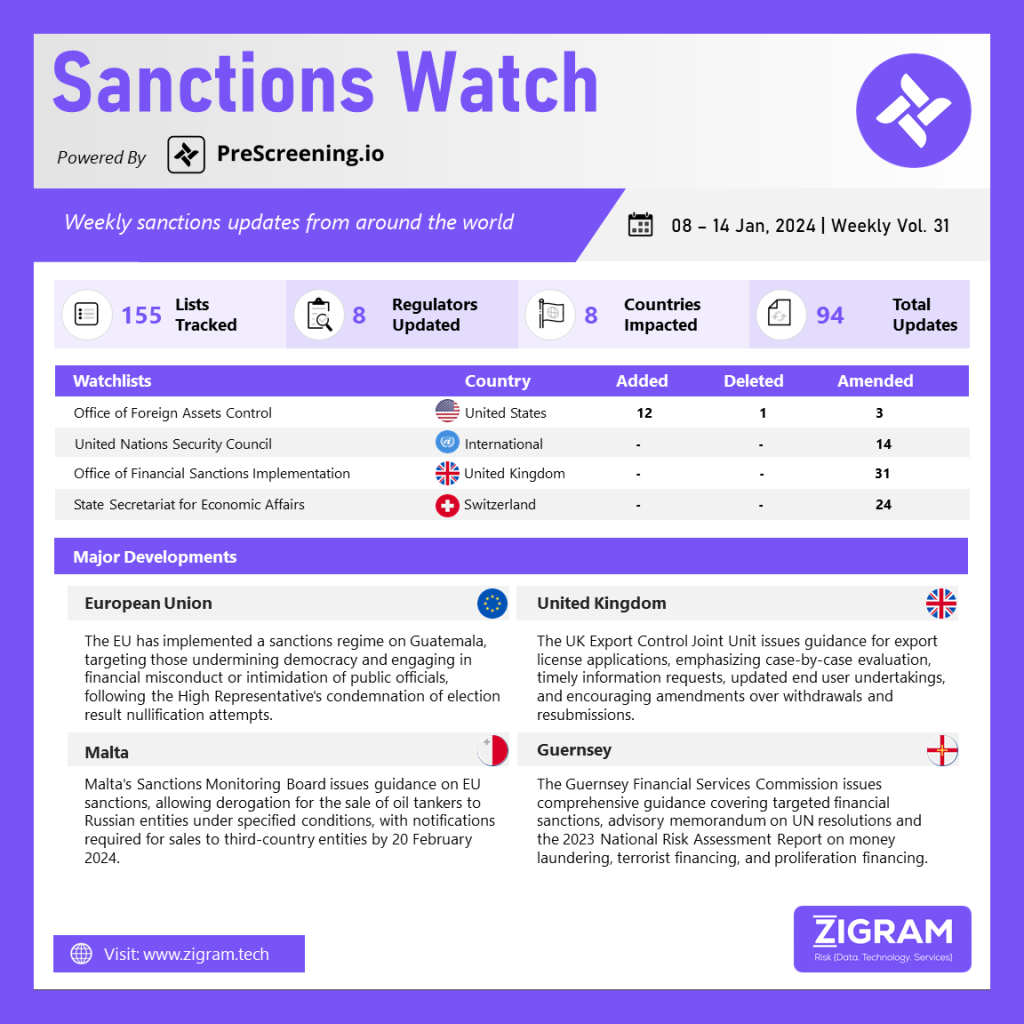

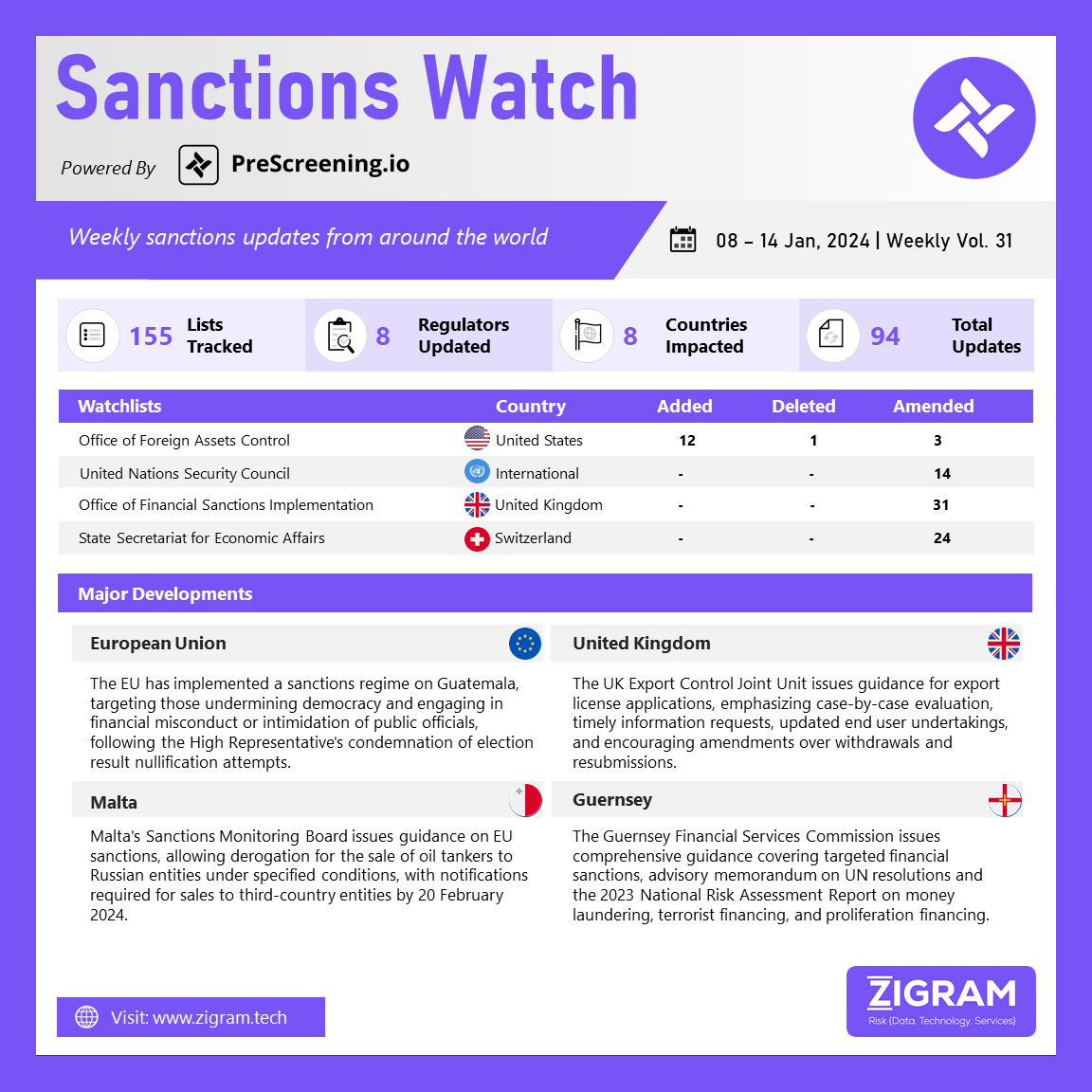

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The European Union has implemented a sanctions regime for Guatemala, empowering sanctions against those disrupting democracy, rule of law, and peaceful power transition. Targets include individuals and entities engaged in actions such as persecuting or intimidating public officials, democratically-elected authorities, civil society, media, and judicial operators. Sanctions also apply to financial misconduct involving public funds and unauthorized capital export. This action follows the condemnation by the High Representative of the Union for Foreign Affairs, addressing attempts to nullify results in Guatemala’s general and presidential elections. The sanctions aim to uphold democratic principles and discourage actions detrimental to Guatemala’s political stability and institutional integrity.

The United Kingdom Export Control Joint Unit has released guidance offering “reminders and good practice” for export license applications. The advisory emphasizes the individual scrutiny of each application against the Strategic Export Licensing Criteria, taking into account trade sanctions, embargoes, and other restrictions at the destination. Information requests remain open for 20 days, with flexibility for extended deadlines if customer responses are delayed. The guidance encourages the utilization of the revised end user undertakings template. Additionally, applicants are advised to prioritize amendments over withdrawals and resubmissions whenever feasible. These guidelines aim to streamline the application process, ensuring thorough evaluation while providing practical tips for a smoother and more efficient licensing procedure.

Malta’s Sanctions Monitoring Board (SMB) has issued guidelines regarding the EU’s prohibition on selling or transferring ownership of oil tankers to individuals or entities based in Russia. Introduced in the 12th package of EU Russia sanctions on December 18, 2023, the guidance outlines key points. It highlights a derogation allowing competent authorities to authorize such sales with conditions specified in Malta’s derogation application template. Additionally, if tankers are sold or transferred to a third-country individual or entity, notification must be made to the competent authority of the Member State where the owner is a citizen, resident, or established, following a provided notification template. The notification should include details like the identities of the seller and purchaser, incorporation documents, IMO ship identification number, and Call Sign of the tanker. Notably, sales or transfers occurring between December 5, 2022, and December 19, 2023, must be reported to competent authorities by February 20, 2024.

The Guernsey Financial Services Commission has issued comprehensive guidance across various webpages, shedding light on its approach to sanctions, terrorist financing, and proliferation financing. The guidance encompasses a range of topics, such as Targeted Financial Sanctions, providing overarching compliance guidance for firms, accompanied by a set of frequently asked questions (FAQs). Additionally, an Advisory Memorandum delves into the intricate relationship between the UN, terrorism, and terrorist financing, offering insights into UN resolutions, Guernsey legislation, and specific guidelines tailored for businesses. Furthermore, the Commission has released the 2023 National Risk Assessment Report on Money Laundering, Terrorist Financing, and Proliferation Financing, featuring illuminating case studies to enhance understanding and awareness within the financial sector. This multifaceted guidance underscores the Commission’s commitment to fostering compliance, transparency, and vigilance in the face of evolving financial risks.

- #Guatemala

- #FinancialMisconduct

- #GeneralElections

- #PoliticalStability

- #ExportControlJointUnit

- #ExportLicense

- #EU

- #Malta

- #Prohibition

- #Embargoes

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #Russia

- #Guidelines