Published Date:

Welcome to our weekly newsletter that provides the most recent updates and insights regarding AML, financial crime compliance, and emerging risks.

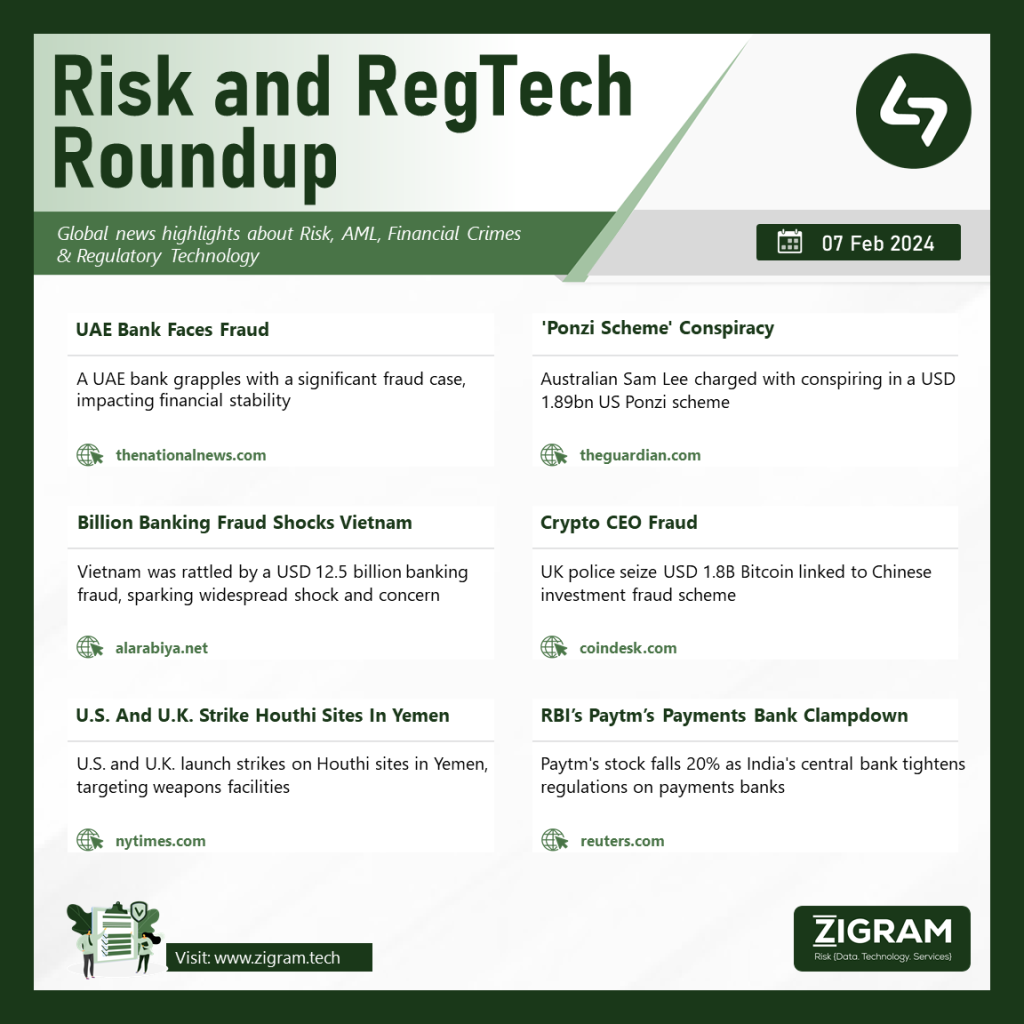

This week Amid a financial shockwave, a prominent UAE bank contends with a substantial fraud, prompting concerns over its repercussions on financial stability. The incident raises questions about regulatory measures and highlights potential economic ramifications, urging a comprehensive investigation into the fraud’s depth and impact on the bank and the wider financial landscape. Furthermore, Australian individual Sam Lee is officially charged in the US for allegedly conspiring in a massive $1.89 billion Ponzi scheme. The case underscores the global reach of financial crimes, raising questions about regulatory oversight and international cooperation. Authorities are set to delve into the details of the alleged conspiracy, examining the extent of involvement and potential impact on victims across borders in this significant fraud case.

Moving on Vietnam is in turmoil as a colossal $12.5 billion banking fraud sends shockwaves across the nation. The unprecedented scale of the scam has raised widespread concern, triggering urgent investigations and calls for enhanced regulatory measures. Authorities are grappling with the aftermath, assessing the impact on the financial sector and the broader economy while working to restore confidence in the wake of this shocking and unprecedented financial scandal. In a major crackdown, UK law enforcement takes action against Chinese investment fraud, seizing a substantial $1.8 billion in Bitcoin. The move underscores the global nature of financial crimes involving cryptocurrencies and reflects coordinated efforts to combat fraudulent activities. Investigations will likely delve into the intricate details of the scheme, emphasizing the challenges posed by the anonymous and decentralized nature of cryptocurrencies in tackling cross-border financial fraud.

Moving forth The U.S. and U.K. conducted large-scale strikes on 13 Houthi sites in Yemen, targeting weapons facilities and air defense systems. The action follows recent U.S. strikes on Iranian-backed forces in Syria and Iraq. Despite warnings, Houthi attacks on shipping persist, affecting global trade. The strikes aim to disrupt Houthi capabilities but face defiance. Tensions rise as the Biden administration navigates an escalating situation in the Middle East. Lastly, Paytm, India’s prominent digital payment platform, witnesses a 20% plunge in its shares after the Reserve Bank of India imposes strict measures on payments banks. The regulatory clampdown raises concerns about the company’s financial stability and underscores the evolving landscape of digital finance in India. Investors and industry observers closely watch how Paytm navigates these challenges amid the heightened regulatory scrutiny impacting the payments sector in the country.

- #BankingScandal

- #PonziScheme

- #BitcoinFraud

- #HouthiStrikes

- #Paytm

- #RiskManagement

- #GlobalEconomy

- #FinancialNews

- #CrossBorderFraud