Published Date:

The detailed assessment report on Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) measures in the British Virgin Islands (VI) during March 15–30, 2023, reveals a series of findings and recommendations to strengthen the existing system.

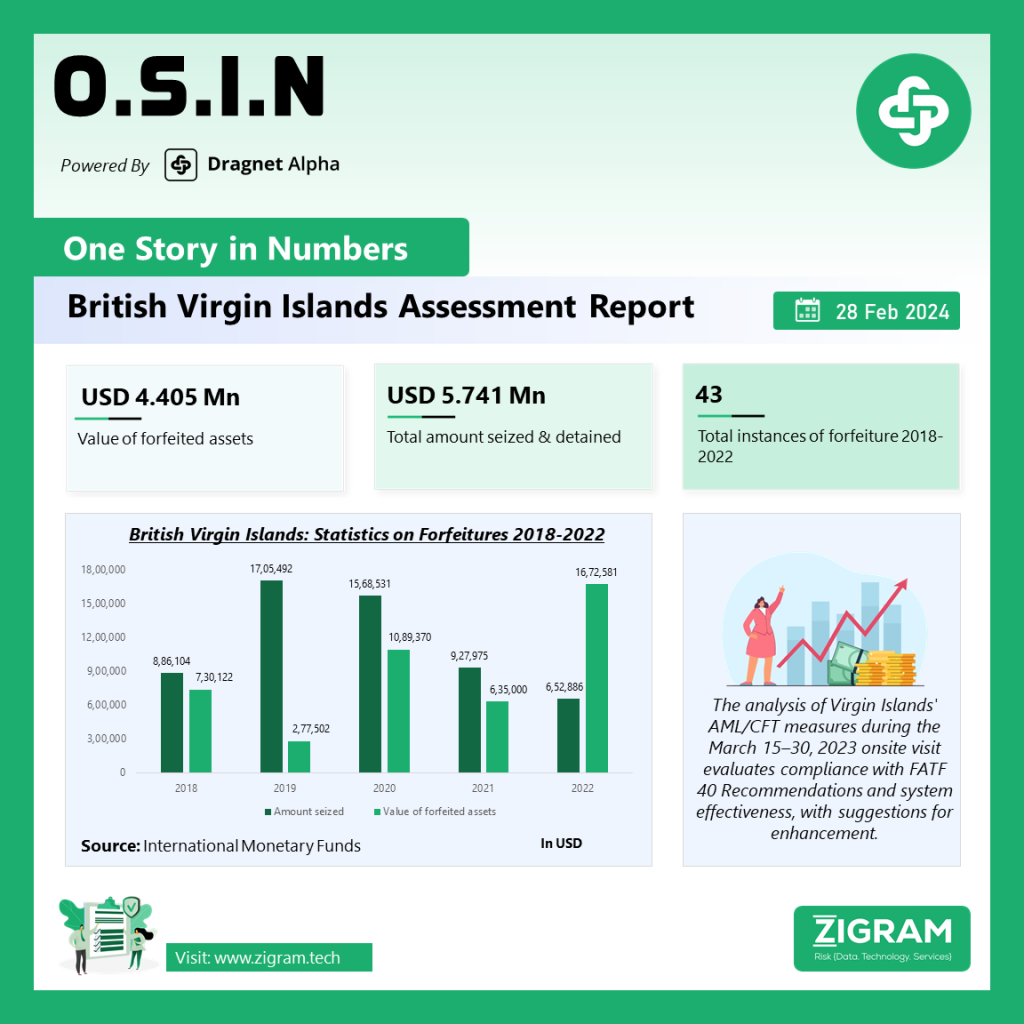

During the review period, there were 43 forfeiture cases in VI, primarily stemming from cash proceeds discovered during arrests rather than from comprehensive financial investigations. Notably, all cases of Proceeds of Criminal Conduct (PCC) prosecuted before the Magistrate’s Court resulted in forfeitures, with recent submissions to the Office of the Director of Public Prosecutions (ODPP) for confiscation procedures related to domestic predicate offenses. However, non-cash assets were forfeited in only a few cases, highlighting limitations in asset recovery efforts.

The report highlights several key findings regarding VI’s AML/CFT measures:

1. Limited Understanding of Risks: The understanding of money laundering (ML) and terrorist financing (TF) risks in VI is narrow, particularly concerning the involvement of VI entities in illicit activities abroad, impacting the effectiveness of the AML/CFT system.

2. Use of Financial Intelligence: Financial intelligence is utilized for background checks and regulatory compliance rather than ML/TF investigations by competent authorities, including the Financial Services Commission (FSC) and Financial Investigation Agency (FIA).

3. Challenges in Intelligence Quality: Quality issues with the FIA’s Analysis and Investigations Unit’s intelligence have affected the progress of ML and TF investigations by the Royal Virgin Island’s Police Force’s Financial Crime Unit (FCU). Collaborative efforts have been initiated to address these challenges.

4. Low Prosecution Rates: Despite being a significant financial center, VI has low rates of ML prosecutions and convictions, primarily due to limited financial investigations and resource constraints within the FCU. Large-scale investigations and cross-border efforts are lacking.

5. Limited Asset Recovery Efforts: While significant cash seizures have occurred, asset confiscation is not a policy objective, with minimal efforts in identifying and locating criminal assets domestically and abroad. The asset management regime is underdeveloped.

In conclusion, the report emphasizes the need for VI to enhance its understanding of ML/TF risks, improve the quality of financial intelligence, strengthen investigative capacities, and prioritize asset recovery efforts. Recommendations include enhancing cooperation among relevant authorities, allocating more resources to AML/CFT enforcement, and implementing policies to facilitate the identification and confiscation of criminal assets. These measures aim to bolster VI’s AML/CFT framework and mitigate vulnerabilities to financial crime.

- #AML

- #CFT

- #FinancialCrime

- #AssetRecovery

- #FinancialIntelligence

- #TerroristFinancing

- #Compliance

- #FinancialRegulation

- #LawEnforcement

- #FinancialInvestigations

- #AntiMoneyLaundering

- #FinancialCenter

- #BritishVirginIslands

- #RiskAssessment

- #Prosecution

- #Confiscation

- #AssetManagement

- #IMF