Published Date:

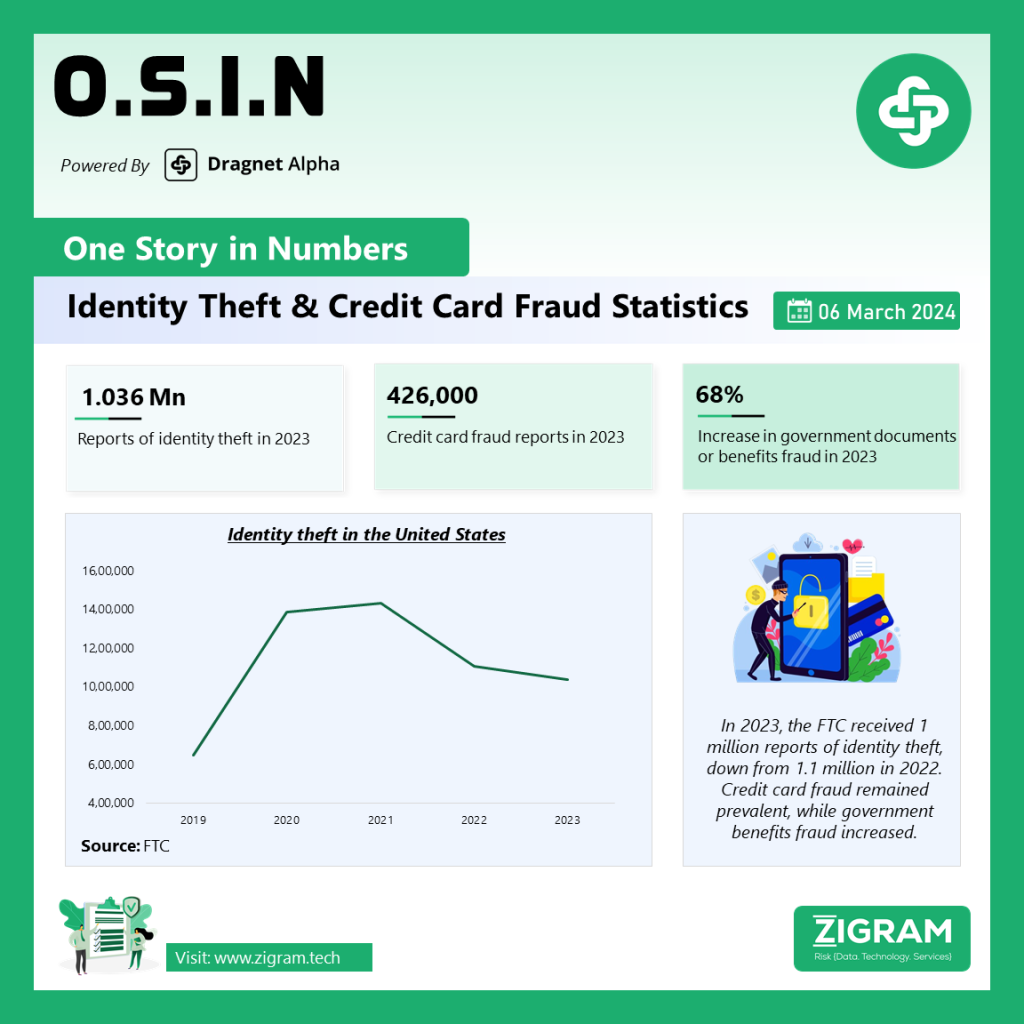

Identity theft and credit card fraud continue to be significant concerns, as highlighted by statistics from the Federal Trade Commission (FTC) and other sources. In 2023, the FTC received approximately 1 million reports of identity theft, slightly down from 1.1 million in 2022 but still maintaining a high level compared to pre-pandemic levels. The statistics paint a bleak picture, indicating that despite a slight decline, identity theft and credit card fraud remain prevalent issues in the United States.

The trend of identity theft has been on the rise since 2020, with reports doubling between 2019 and 2020 and continuing to grow in 2021, reaching nearly 1.4 million impacted individuals. Although there was a slight decrease in reports in 2023, with 1.037 million cases compared to 1.108 million in 2022, the numbers remain significantly higher than before the pandemic.

Credit card fraud remains the most common form of identity theft, with 426,000 cases reported to the FTC in 2023. While this reflects a 5% decrease from 2022, it still represents a 53% increase compared to 2019, indicating a persistent threat to consumers’ financial security.

Another concerning trend is the resurgence of government documents or benefits fraud, which increased by 68% in 2023, with 102,000 reported cases. This type of fraud had previously declined by 85% in 2022 but saw a significant uptick in 2023, highlighting the adaptability of fraudsters in exploiting changing circumstances, such as the winding down of government benefits related to the COVID-19 pandemic.

Government documents or benefits fraud, along with phone or utilities fraud, were the only types of identity theft to see year-over-year growth in 2023. Meanwhile, other forms of identity theft, such as email and social media fraud, insurance fraud, medical services fraud, and online shopping fraud, remained prevalent but exhibited varying trends.

Medical services fraud, for instance, saw a significant decline since the onset of the pandemic, with reported cases dropping from 45,000 in 2020 to just 14,000 in 2023. Conversely, email and social media fraud nearly doubled during the same period, rising from 10,000 cases in 2019 to 19,000 cases in 2023.

These statistics underscore the multifaceted nature of identity theft and credit card fraud, with fraudsters utilizing a range of tactics to exploit vulnerabilities in various sectors. The prevalence of these crimes highlights the importance of robust cybersecurity measures and heightened consumer awareness to mitigate risks and protect personal information.

Furthermore, the data collected by the FTC likely underestimates the true extent of identity fraud, as many cases may go unreported by consumers. Therefore, it is imperative for individuals to remain vigilant and report any suspicious activity promptly to authorities.

In conclusion, while there has been a slight decline in reported cases of identity theft and credit card fraud in 2023, these crimes continue to pose significant challenges for individuals, businesses, and government agencies. Addressing these challenges requires a multifaceted approach, including enhanced security measures, improved consumer education, and collaboration between public and private sector stakeholders to combat fraud effectively.

- #IdentityTheft

- #CreditCardFraud

- #Cybersecurity

- #FTC

- #FraudPrevention

- #FinancialSecurity

- #ConsumerProtection

- #Cybercrime

- #DataBreach

- #IdentityProtection

- #SecurityAwareness

- #GovernmentFraud

- #MedicalFraud

- #SocialMediaFraud

- #EmailFraud

- #InternetSafety

- #DigitalSecurity

- #FraudStatistics