Published Date:

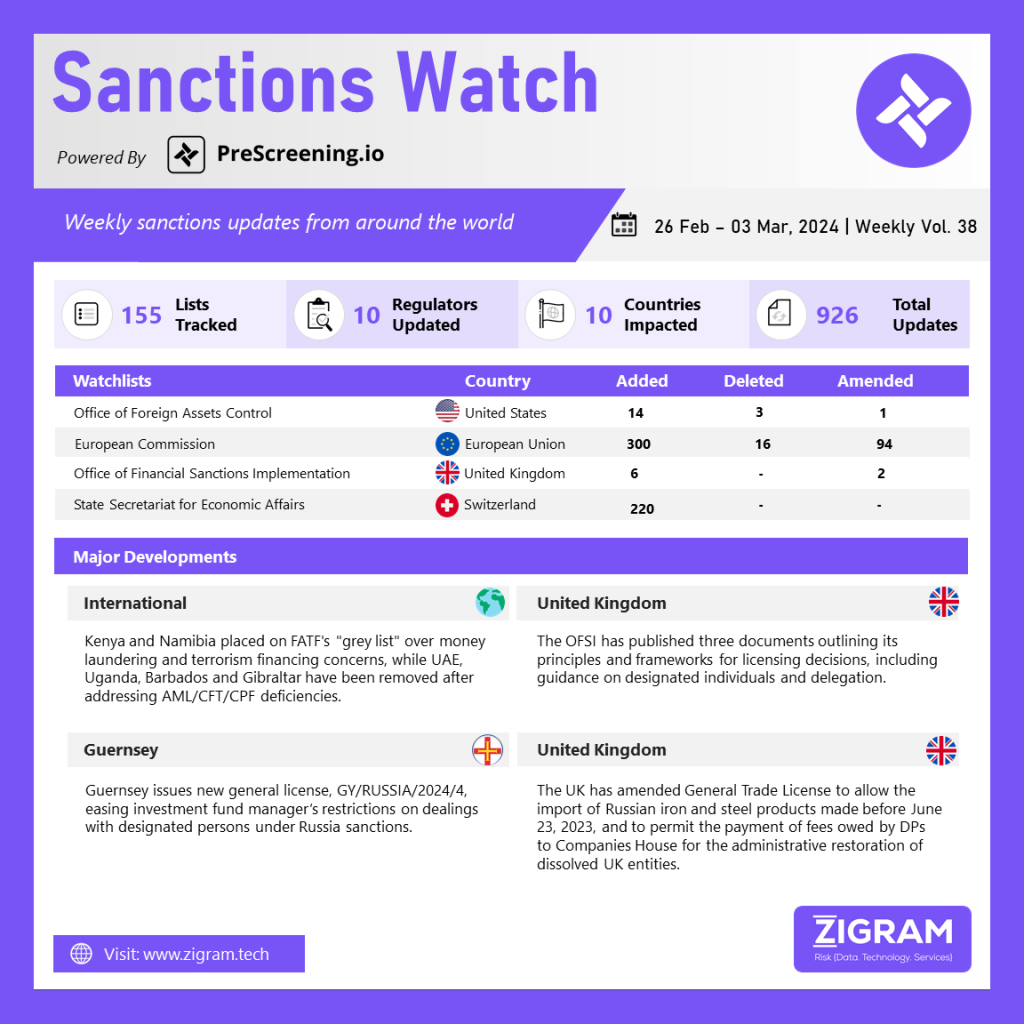

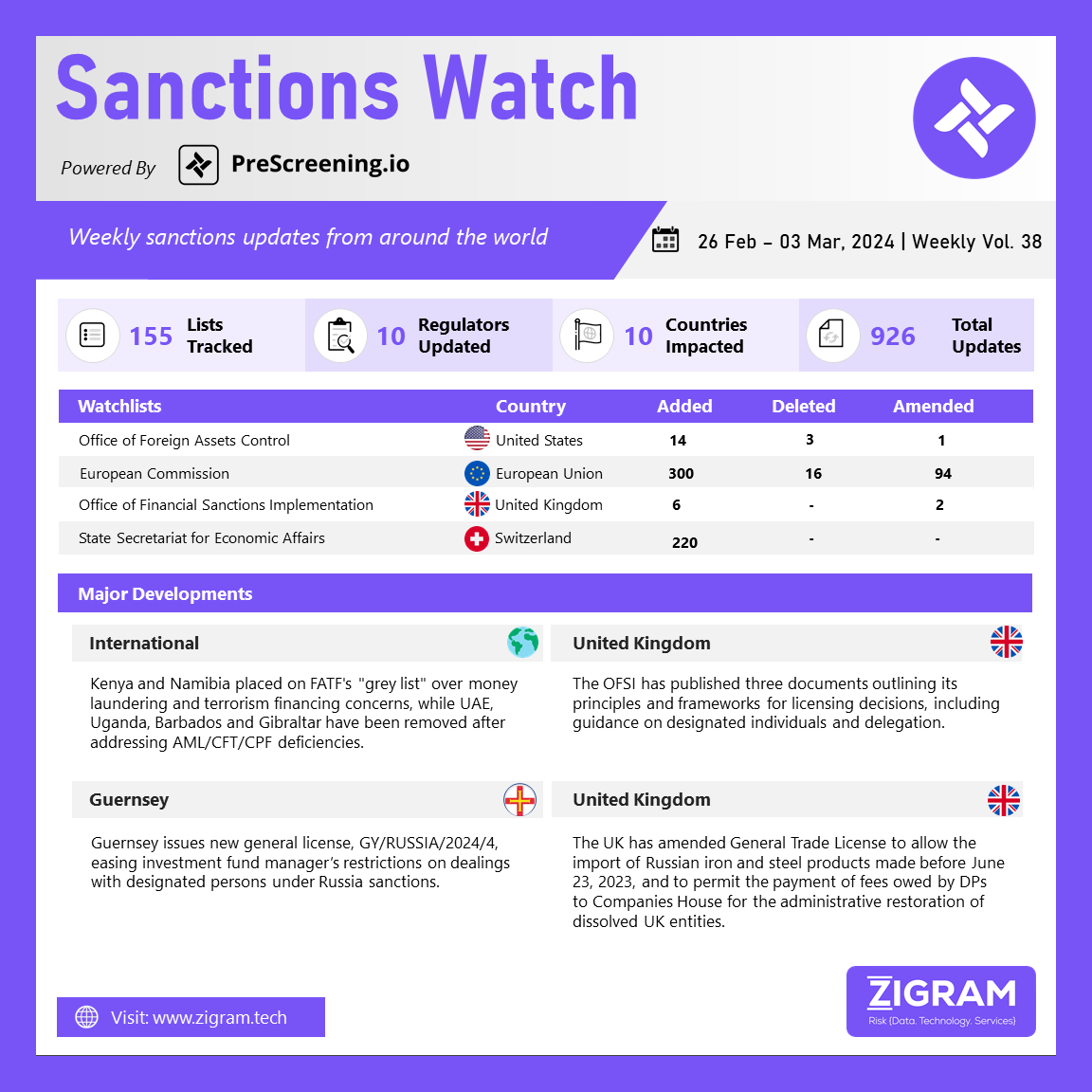

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The Financial Action Task Force (FATF) recently announced the addition of Kenya and Namibia to its grey list, a classification indicating jurisdictions subject to increased monitoring. This decision came during the task force’s plenary meetings in Paris. Concurrently, FATF removed Barbados, Gibraltar, Uganda and the UAE from the grey list. These jurisdictions were recognized for their substantial progress in addressing identified strategic deficiencies in anti-money laundering, counter-financing of terrorism and counter-proliferation financing (AML/CFT/CPF). FATF’s actions highlight its commitment to ensuring countries comply with international standards to combat money laundering and terrorist financing. The removal of countries from the grey list reflects positively on their efforts to strengthen their AML/CFT/CPF frameworks, potentially improving their standing in the global financial community.

The Office of Financial Sanctions Implementation has released three documents detailing the principles and frameworks governing its licensing decisions, available on the UK licensing section of its website. Following Mr Justice Saini’s suggestion in R v Fridman in October 2023, OFSI is considering making its internal licensing guidance public as a good administrative practice. One of these documents, the Designated Individuals Licensing Principles, outlines 16 principles guiding OFSI’s decisions on license applications. These include considerations such as the integrity of the sanctions regime, appropriateness of the activity and health and safety concerns. It also lists activities that OFSI generally does not license, such as international travel or payments for luxury recreational assets. Additionally, the Licensing delegation framework helps OFSI caseworkers determine whether a decision should be made by a Minister, considering factors like impacts on UK interests or national security, media or parliamentary attention and reputational risks. The framework also clarifies that significant changes to a designated person’s authorizations or obligations under the counter-terrorism regime require Ministerial approval, excluding certain administrative amendments or corrections.

Guernsey has updated its Russia sanctions rules for investment funds with the issuance of a new general license, GY/RUSSIA/2024/4, replacing the previous one. This update aims to ease restrictions for investment fund managers dealing with the investment interests of designated persons (DPs) subject to Russian sanctions. Previously, managers could only handle DPs’ investments without connection to Guernsey. The new general license allows dealing even if the sole Guernsey connection is that a local manager handles the investment in a collective investment scheme (CIS). However, managers must notify the States Policy & Resources Committee before relying on the license and file monthly reports on their activities. This change reflects an ongoing effort to balance adherence to sanctions with the needs of the Guernsey investment industry.

The United Kingdom has revised the General Trade License for sanctioned iron and steel to allow the import of Russian iron and steel products manufactured or produced before June 23, 2023, changing the previous date of April 21, 2023. Additionally, the UK has amended General License – INT/2023/3626884 to authorize the payment of fees owed by designated persons (DPs) to Companies House. This payment is for the administrative restoration of a previously incorporated entity in the UK that was struck off and dissolved by the Registrar of Companies at Companies House, including any associated filing fees and penalties.

- #FATF

- #Kenya

- #Namibia

- #GreyList

- #DesignatedPerson

- #OFSI

- #Guernsey

- #Russia

- #GeneralLicense

- #EuropeanUnion

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #RegulatoryObligations

- #SanctionsBreaches

- #Compliance