Published Date:

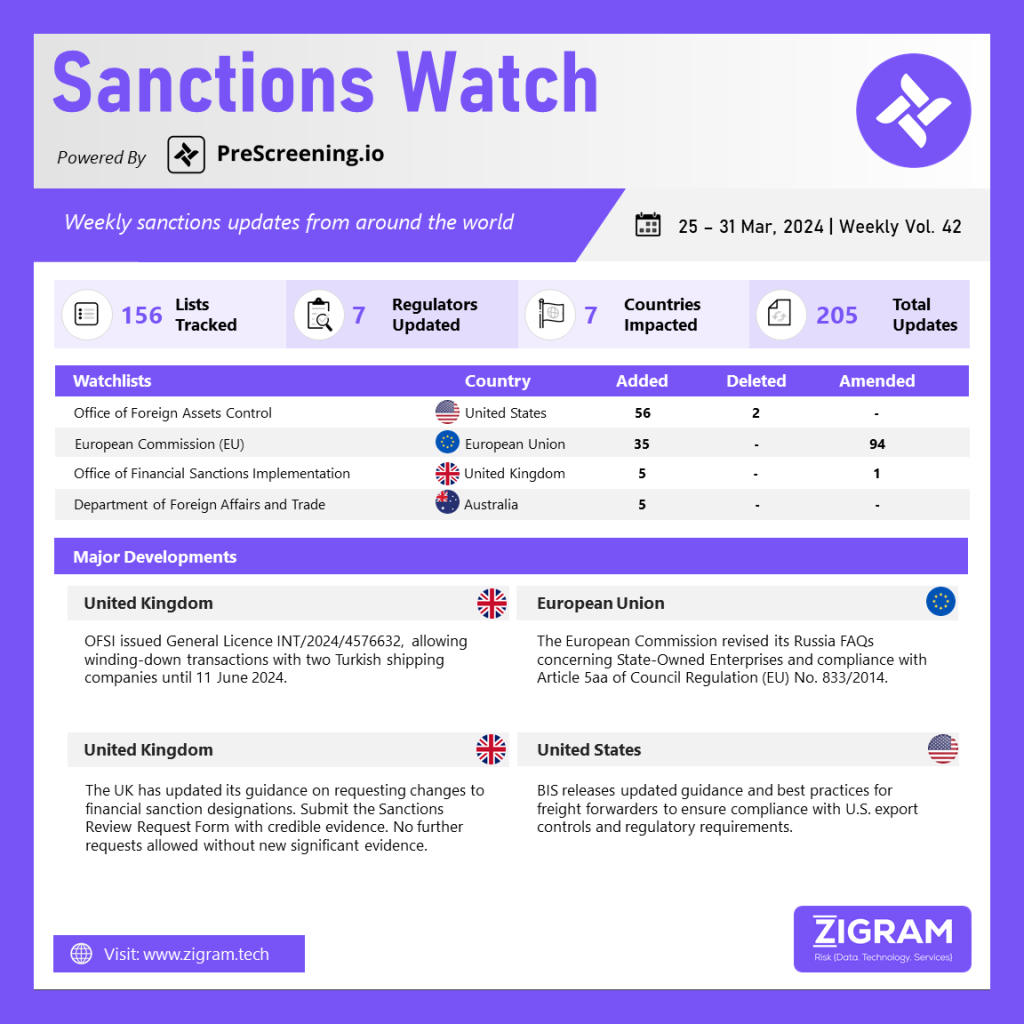

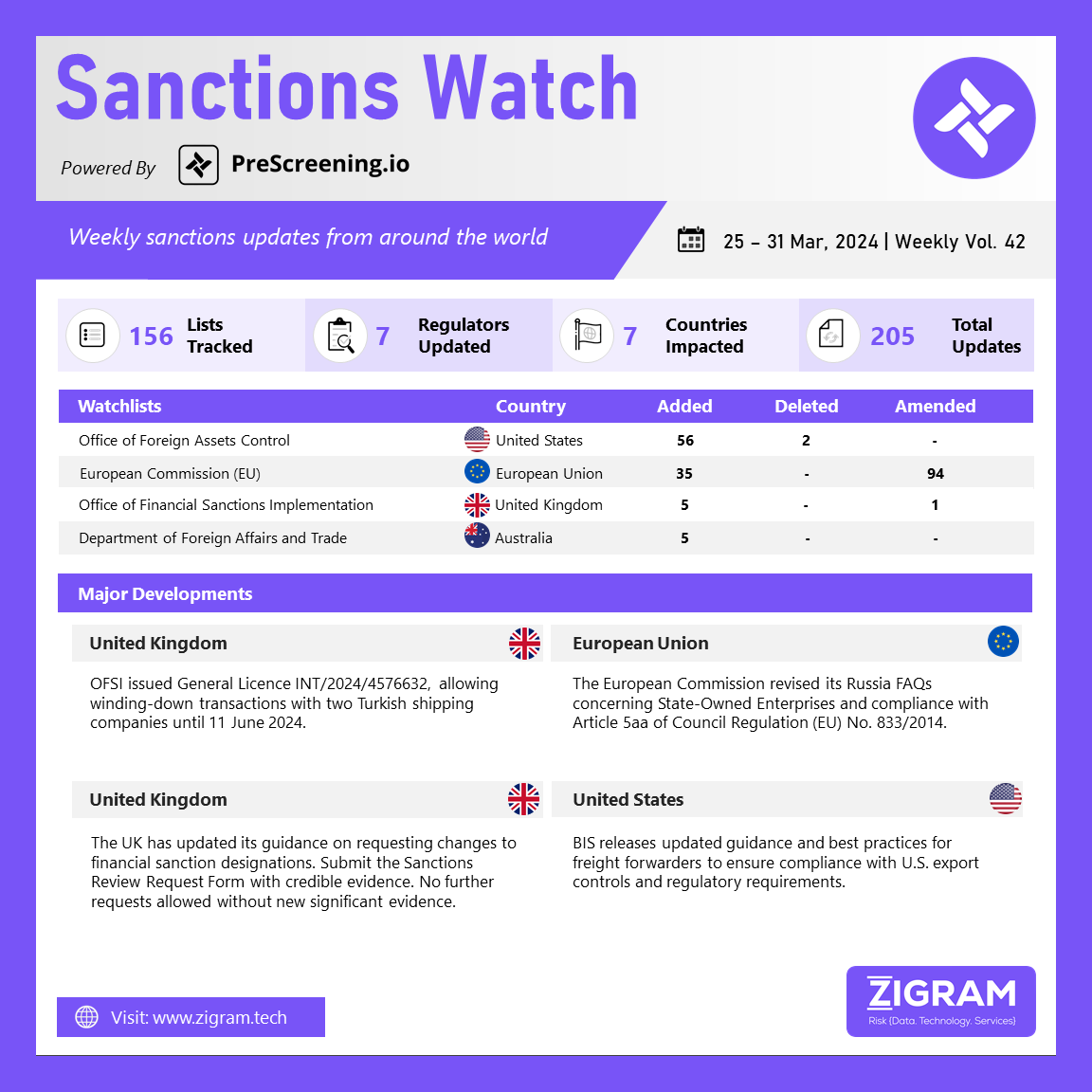

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The Office of Financial Sanctions Implementation (OFSI) has issued General Licence INT/2024/4576632 – Active Denizcilik and Beks Ships Transit to Port and Wind Down (notice), which allows certain activities until 11 June 2024: insurers can provide insurance for specific vessels managed by Active Denizcilik to reach their port of discharge or a safe port before completing cargo discharge; other service providers (e.g., navigational, meteorological, or technical management services) can offer necessary services for the same purpose; Active Denizcilik can pay insurers up to $850,000 for insurance and $3,732,000 for additional services; and individuals and entities are permitted to conclude transactions involving Active Denizcilik, certain vessels, Beks Shipping, or its vessels.

The EU Commission has recently updated two of its Frequently Asked Questions (FAQs) regarding Russia and state-owned enterprises. One question addresses whether an EU operator indirectly engages with an entity targeted by Article 5aa when providing insurance coverage to a vessel calling into a port owned by this entity. The answer clarifies that providing insurance coverage for such vessels is not prohibited under Article 5aa, as it is not considered a direct or indirect transaction with the entity. However, if insured damage occurs, an EU insurer can only make a direct payment to the port or reimburse liabilities for damages if the port is owned by an entity targeted by Article 5aa, and if the purpose of the vessel’s entry into the port was the transport of goods, as outlined in exemptions under specific paragraphs. Another question addresses whether an EU insurer can provide and pay out an insurance claim for damage occurring in a port owned by an entity in Annex XIX. The answer explains that under exemptions in Article 5aa, EU insurers can provide coverage to vessels calling at such ports, with the condition that due diligence is conducted to ensure the damage occurred during the transport of specific goods, as detailed in the exemptions.

The United Kingdom has recently updated its guidelines regarding the procedure for requesting changes to or the removal of a financial sanction designation under The Counter-Terrorism (Sanctions) (EU Exit) Regulations 2019. Designated Persons (DPs) or their representatives, with verified authorization to act, are required to complete a Sanctions Review Request Form thoroughly. Providing verifiable and corroborated evidence from reliable sources is crucial, and any non-English evidence must be officially translated. Once a review request is submitted, further requests can only be made if significant new information, previously unconsidered, is available. Furthermore, Chapter 4 of the Sanctions Act outlines the process for seeking a court review of the Office of Financial Sanctions Implementation (OFSI)’s decision.

The Bureau of Industry and Security (BIS) within the Department of Commerce has issued updated guidance and best practices for freight forwarders and exporters, aimed at enhancing compliance with U.S. export controls and regulatory standards. Matthew S. Axelrod, Assistant Secretary for Export Enforcement, highlighted the crucial role of the freight forwarding community in ensuring the secure and lawful movement of goods globally. The guidance underscores the necessity of a risk-based compliance program to prevent the diversion of sensitive items to unauthorized destinations, including entities involved in terrorism or other illicit activities. By adhering to these guidelines, freight forwarders and exporters contribute significantly to safeguarding the integrity of the global supply chain and curbing illegal exports. The document provides detailed insights into freight forwarder responsibilities, considerations for selecting a freight forwarder, antiboycott regulations, and specific red flags for freight forwarders and U.S. principal parties in interest (USPPIs).

- #OFSI

- #GeneralLicence

- #EuropeanUnion

- #FAQs

- #Russia

- #Vessels

- #UnitedKingdom

- #DesignatedPersons

- #BIS

- #IllegalExports

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #RegulatoryObligations

- #SanctionsBreaches

- #Compliance

- #Designated

- #RegulatoryFramework