Regulation Name: Guidelines to Notice MAS 626 on Prevention of Money Laundering and Countering the Financing of Terrorism – Banks

Publishing Date: 28 March 2024

Region: Singapore

Agency: Monetary Authority of Singapore

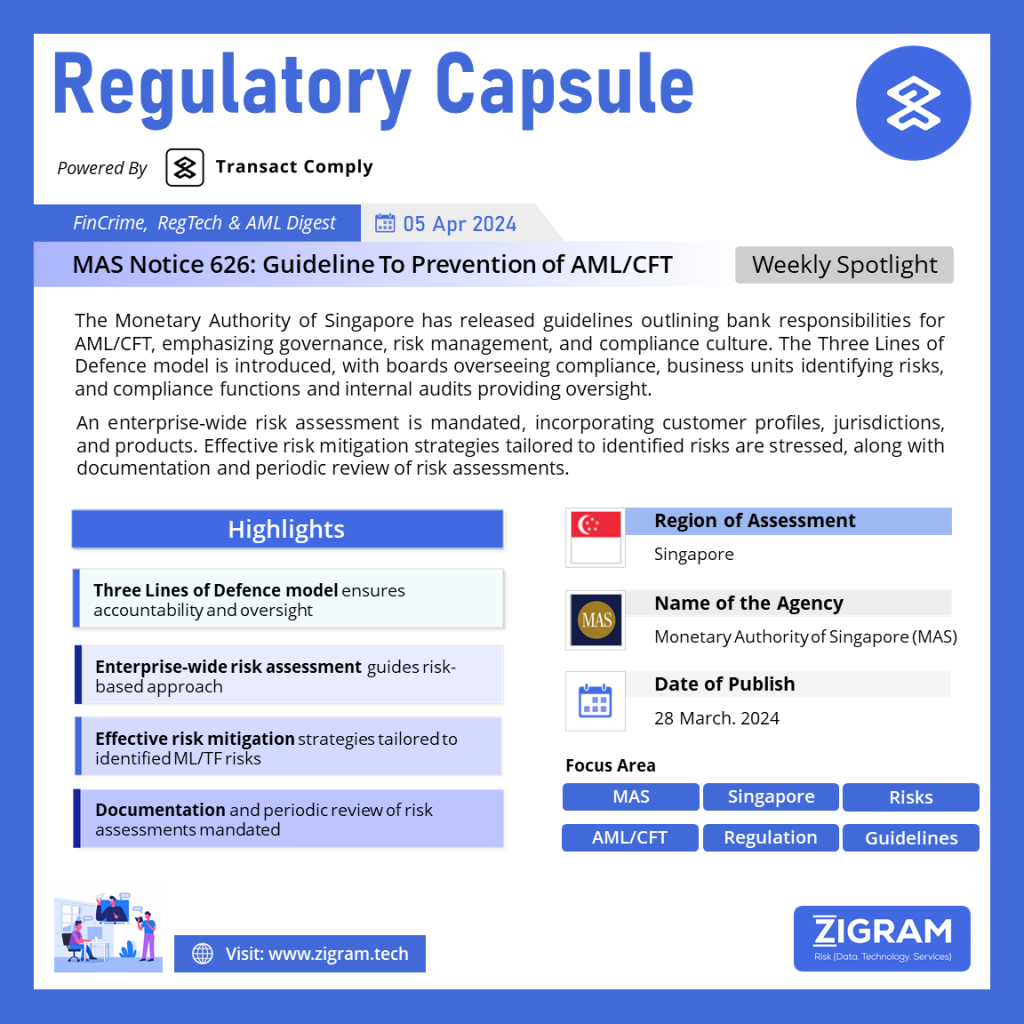

In the wake of increasing global concerns surrounding money laundering and terrorism financing, regulatory bodies have issued comprehensive guidelines for banks to bolster their anti-money laundering (AML) measures. These guidelines, encapsulated in MAS Notice 626, emphasize the imperative for banks to fortify their defenses against financial crime while fostering a culture of compliance and governance throughout their organizations.

Central to these guidelines is the concept of the Three Lines of Defence, delineating clear responsibilities for boards of directors, senior management, business units, AML/CFT compliance functions, and internal audit functions. This framework underscores the importance of accountability and oversight at every level, ensuring robust risk management and controls.

A key aspect of regulatory compliance outlined in the guidelines is the requirement for banks to conduct thorough enterprise-wide ML/TF risk assessments. These assessments, incorporating factors such as customer profiles, jurisdictions, and product offerings, serve as the cornerstone for implementing a risk-based approach to AML/CFT.

Moreover, the guidelines stress the necessity of effective risk mitigation strategies tailored to the identified ML/TF risks. From monitoring customer behaviors to assessing compliance arrangements and leveraging technology-based solutions, banks are urged to deploy a multifaceted approach to mitigate financial crime risks effectively.

Documentation and periodic review of risk assessments are also emphasized, with banks mandated to maintain detailed records of their risk management processes and ensure regular updates to reflect changing risk landscapes.

In essence, the MAS 626 Guidelines represent a proactive stance in the fight against money laundering and terrorism financing. By adhering to these guidelines and fostering a culture of vigilance and compliance, banks can significantly enhance their ability to detect and deter financial crime, safeguarding the integrity of the global financial system.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AML

- #CFT

- #RegulatoryCompliance

- #MonetaryAuthorityOfSingapore

- #Singapore

- #FinancialCrime

- #RiskManagement

- #Banking

- #Governance

- #ComplianceCulture

- #EnterpriseRiskAssessment

- #ThreeLinesOfDefence

- #Documentation

- #PeriodicReview