Published Date:

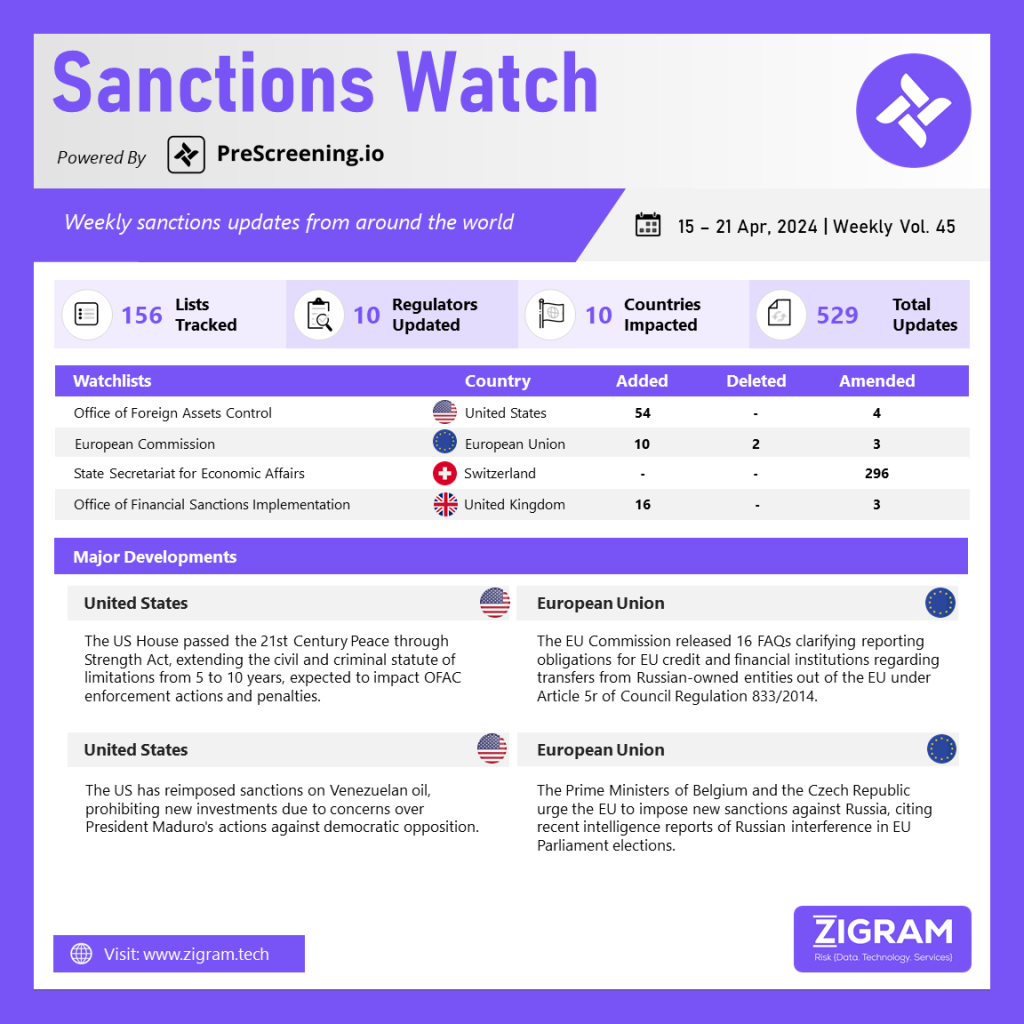

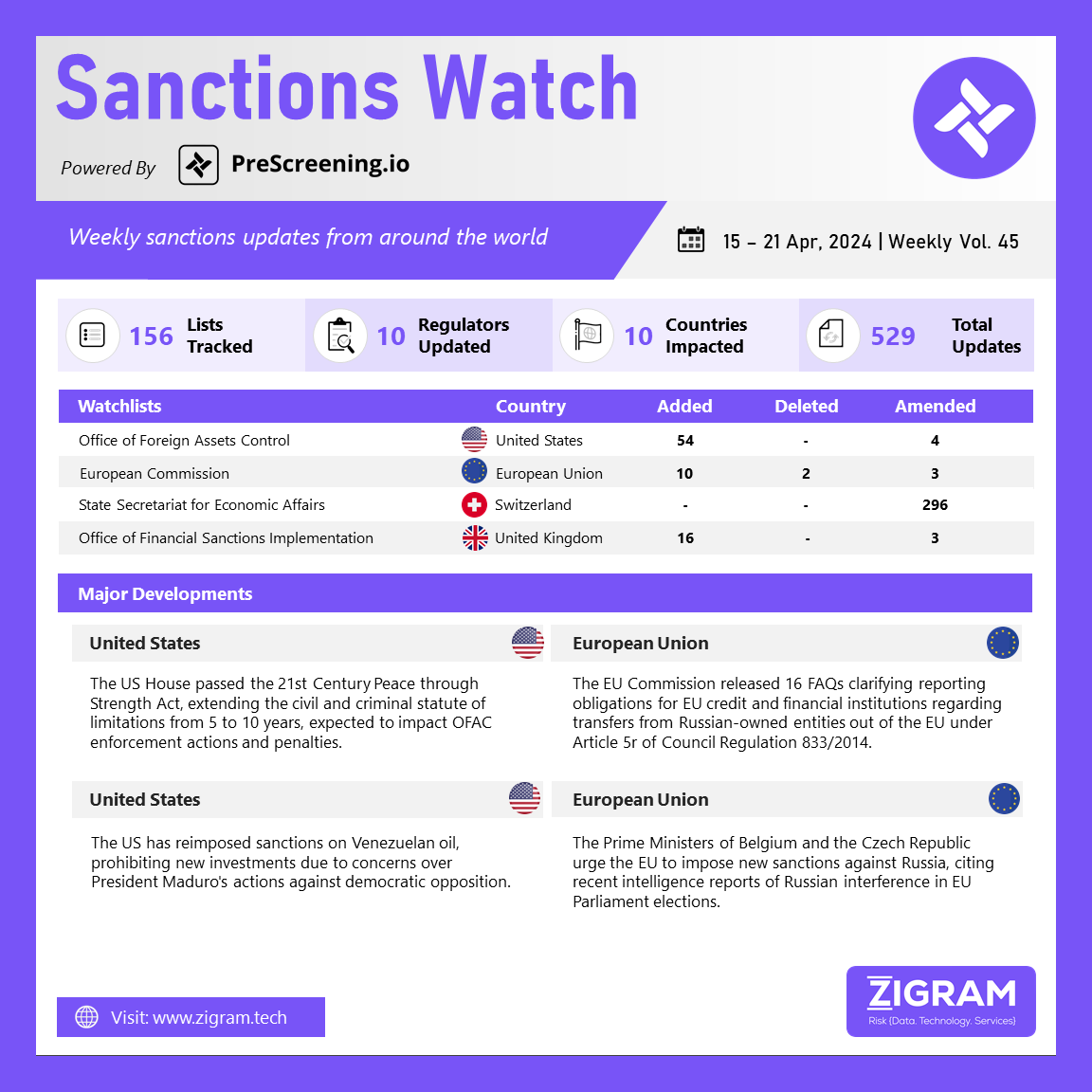

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The US House recently approved the 21st Century Peace through Strength Act, which is expected to become law soon. Section 3111 of this bill proposes extending the five-year statute of limitations for civil and criminal sanctions violations to ten years. While unable to revive expired enforcement actions or indictments upon enactment, this extension holds considerable significance. It broadens the spectrum for potential enforcement actions and is poised to impact civil monetary penalties, as the Office of Foreign Assets Control (OFAC) is likely to reduce its reliance on tolling agreements during investigations. OFAC views such agreements as a form of cooperation that can mitigate enforcement responses to apparent violations, potentially resulting in decreased civil monetary penalties. Consequently, this extension stands to reshape the landscape of sanctions enforcement in the United States, marking a pivotal development in regulatory practice.

The EU Commission has released 16 FAQs regarding the obligation of Russian-owned entities and EU credit and financial institutions to report transfers from Russian-owned entities out of the EU. These FAQs are accessible on our EU guidance page and our Russia page. Article 5r of Council Regulation 833/2014 stipulates that the reporting requirement applies to all financial assets and benefits. It includes funds held in a branch of an EU financial institution located outside the EU but excludes subsidiaries of EU operators situated outside the EU. The regulation applies to entities directly or indirectly owned by Russian entities or individuals, with “indirect ownership” referring to ownership through a chain of intermediaries. The criterion of “control” is irrelevant to Article 5r. Additionally, EU credit and financial institutions are obligated to report transfers, even if the Russian-owned entity has already reported. The EU Commission has also provided a reporting template for this purpose.

In October 2023, the US relaxed sanctions on Venezuela, allowing transactions in its oil and gas sector. However, citing concerns about President Maduro’s actions against democratic opposition, the US has reinstated sanctions effective 17 April 2024, prohibiting new investments in Venezuelan oil or gas. Under General License No. 44A, companies currently transacting with Petróleos de Venezuela SA (PdVSA) have until 31 May 2024 to conclude these dealings. The Office of Foreign Assets Control (OFAC) has issued 5 FAQs clarifying its Venezuela sanctions, advising companies unable to finalize transactions by the deadline to seek OFAC’s guidance. OFAC also stated its willingness to consider specific license requests from companies aiming to engage in transactions previously authorized under GL44.

Belgium and the Czech Republic are urging the European Union to impose sanctions in response to Russian interference in the upcoming EU elections. In an open letter dated April 16, Belgian Prime Minister Alexander de Croo and Czech President Peter Fiala highlighted the discovery of early interference in several member states. Belgian security services uncovered a network, partly based in the Czech Republic, involved in cash transfers to support pro-Russian politicians in the European Parliament. The leaders called for new EU sanctions to counter this influence, emphasizing the need for a coordinated effort to address pro-Russian disinformation and interference. They proposed establishing a new restrictive measure regime and deploying an emergency crisis mechanism, similar to the one used during the COVID-19 pandemic, to monitor and combat disinformation. The European parliamentary elections are scheduled for June 6-9.

- #MonetaryPenalties

- #OFAC

- #Enforcement

- #Law

- #FAQ

- #EuropeanUnion

- #Russia

- #UnitedStates

- #Venezuela

- #OilandGas

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #RegulatoryObligations

- #SanctionsBreaches

- #Belgium

- #CzechRepublic

- #EUElections