Published Date:

The AML/CFT Supervision Report delves into the performance of anti-money laundering (AML) and counter-terrorist financing (CTF) supervisors spanning the period between 6th April 2022 and 5th April 2023. It aligns with the Treasury’s mandate, as stipulated in Section 51 of the Money Laundering Regulations, requiring the annual publication of a comprehensive overview of supervisory activities. In compliance with this obligation, the report encompasses data on supervisory and enforcement actions undertaken by both Public Sector and Professional Body Supervisors. Notable changes in supervisory activities and fines issued by supervisors are highlighted within.

The Treasury’s role in appointing AML/CTF supervisors is pivotal in ensuring adherence to the Money Laundering Regulations by businesses within their purview. Seeking to enhance transparency, accountability, and best practices in supervision, the Treasury collaborates with supervisors to craft this annual report. By consolidating information on supervisory activities from designated AML/CTF supervisors, this report fulfills the Treasury’s obligation while providing insights into the efficacy of AML/CTF supervision. This marks the Treasury’s eleventh annual report on AML/CTF supervision, reaffirming its commitment to robust financial oversight and compliance.

Compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations is crucial in safeguarding financial systems and preventing illicit activities. The Money Laundering Regulations (MLRs) mandate supervisors to ensure that regulated firms adhere to these regulations and impose effective, proportionate, and dissuasive measures on those breaching the rules.

Understanding Regulatory Measures

Effective Discipline:

The MLRs demand disciplinary actions that deter future non-compliance while being proportionate to the gravity of the breach. Supervisors wield a range of enforcement tools including fines, public censures, and registration suspension or cancellation. Referral to law enforcement agencies is also a recourse for severe violations.

Varied Sanctioning Powers:

Supervisors like HM Revenue & Customs (HMRC), the Financial Conduct Authority (FCA), and the Gambling Commission (GC) derive their sanctioning powers from relevant legislations such as the Proceeds of Crime Act and the Gambling Act. These powers are utilized to address breaches effectively.

Sector-Specific Guidance:

HM Treasury, in collaboration with supervisors and industry experts, formulates sector-specific guidance. This guidance assists firms in detecting and deterring criminal activities while optimizing resource allocation based on risk assessment. Compliance with this guidance is considered in evaluating AML obligations.

Informing Supervised Entities:

Supervisors are mandated to disseminate up-to-date AML/CTF requirements to their supervised populations through various channels including online platforms, webinars, and direct communication. This ensures that firms remain informed and equipped to meet their compliance obligations.

Refusal of Licenses and Fit-for-Practice Tests

Scrutinizing Key Personnel:

Public sector supervisors subject key personnel in regulated firms to tests to assess their suitability for operating in roles susceptible to facilitating money laundering or terrorist financing.

Rigorous Application Processes:

Supervisors like the FCA and GC issue ‘minded to refuse’ letters before rejecting license applications, prompting firms to withdraw applications preemptively. HMRC, as a non-membership organization, scrutinizes applicants during the registration process, refusing licenses where deemed necessary.

Sector-Specific Licensing:

The GC regulates individuals and issues licenses under the Gambling Act, with a focus on AML compliance. Similarly, HMRC conducts fit and proper tests for individuals in various sectors to ensure integrity and competence.

Enforcement and Fines

Utilizing Enforcement Tools:

Supervisors are tasked with investigating breaches and employing effective, proportionate, and dissuasive sanctions. While fines are a common tool, the appropriateness of sanctions is determined case by case.

Trends in Enforcement:

Enforcement actions fluctuate over reporting periods. The comparison between fines imposed across supervisors reveals variations influenced by historical precedents and the nature of breaches.

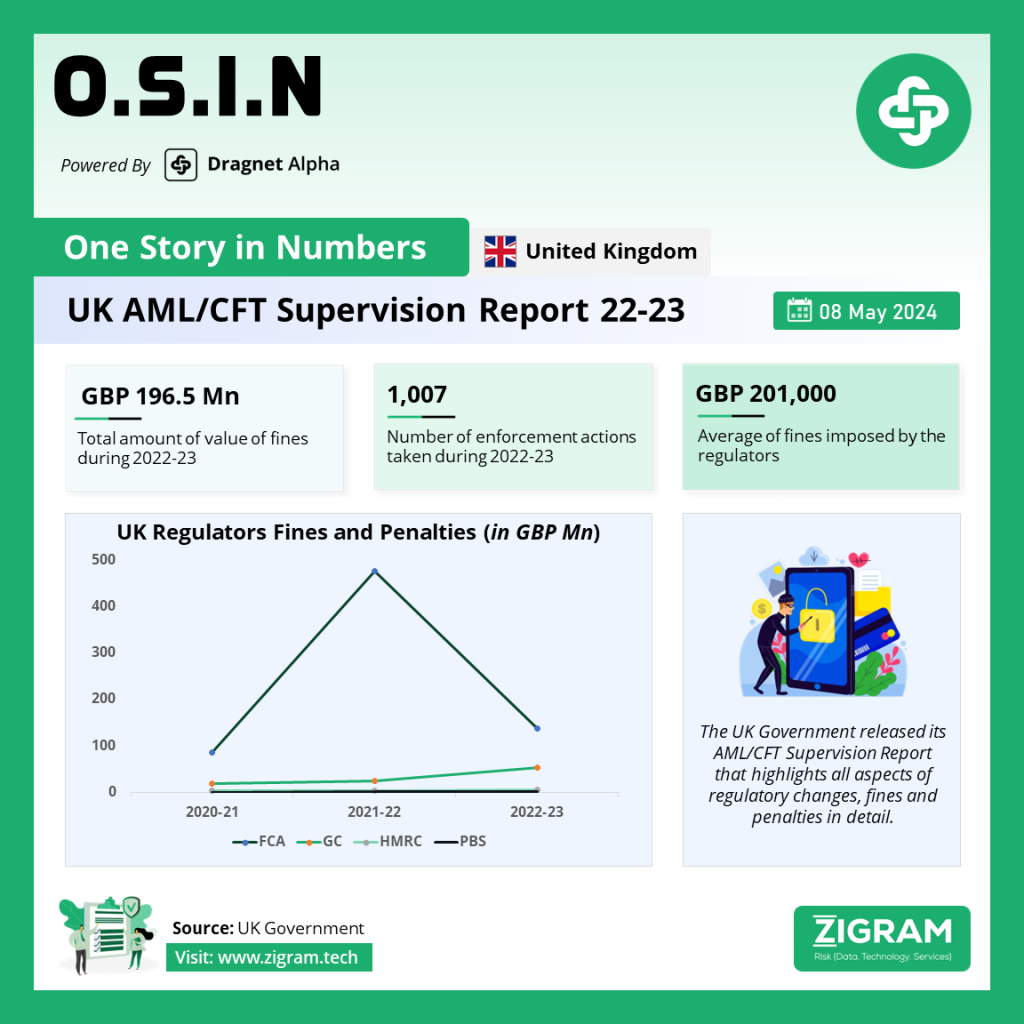

In 2022-23, the total fines across all 25 supervisors amounted to GBP 197 million, a decrease from the previous year’s GBP 504 million. This decrease is primarily due to fewer large fines imposed by the Financial Conduct Authority (FCA) in 2021-22. The average fine in 2022-23 was approximately GBP 201,000, with significant variation between supervisors, with the FCA and the Gambling Commission (GC) imposing higher average fines compared to HM Revenue & Customs (HMRC) and Professional Body Supervisors (PBSs).

In conclusion, robust enforcement of AML/CTF regulations is imperative for maintaining integrity in financial systems. Supervisors play a pivotal role in promoting compliance through varied measures tailored to the specific risks and requirements of each sector. The collaborative effort between regulators, industry experts, and firms is essential in combating financial crimes effectively.

Read the report here.

- #Supervision Report

- #AML

- #CTF

- #RegulatoryCompliance

- #UnitedKigdom

- #FraudPrevention

- #RegulatoryUpdates