Published Date:

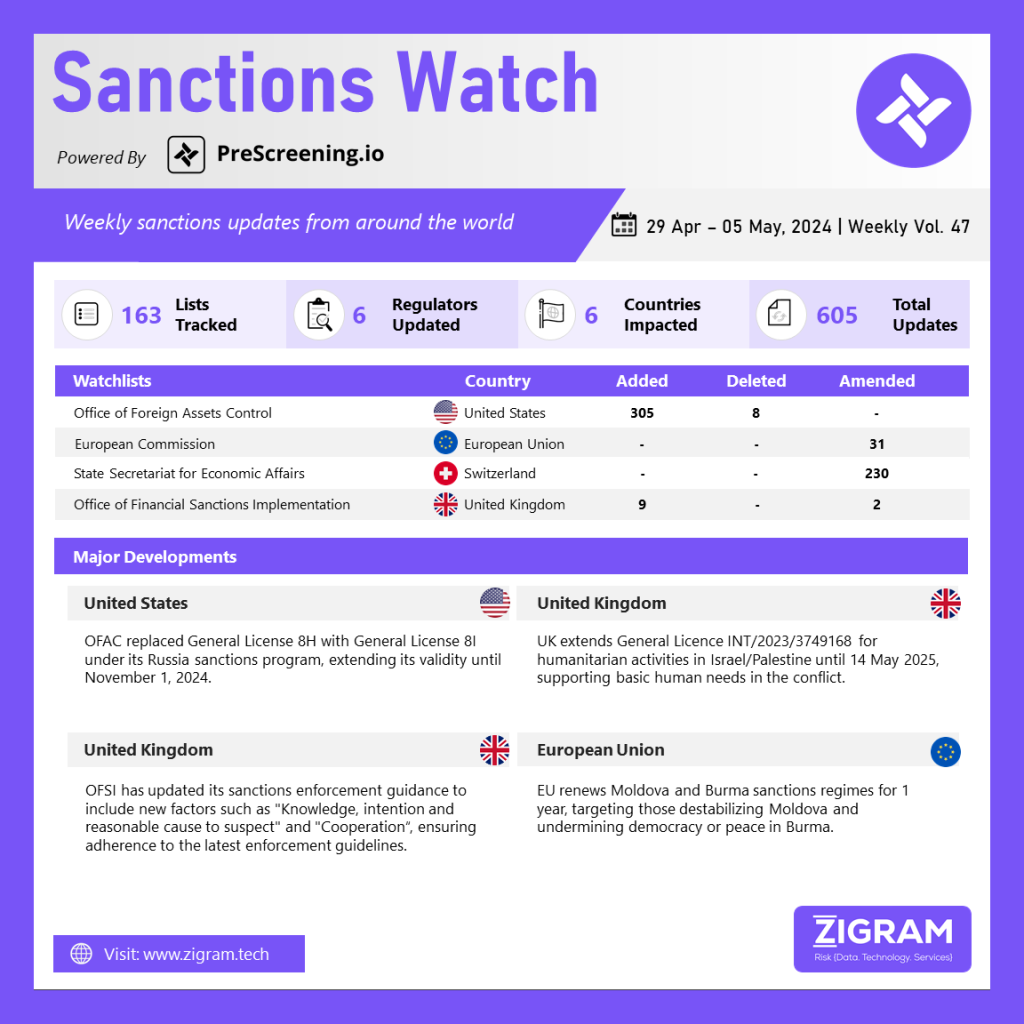

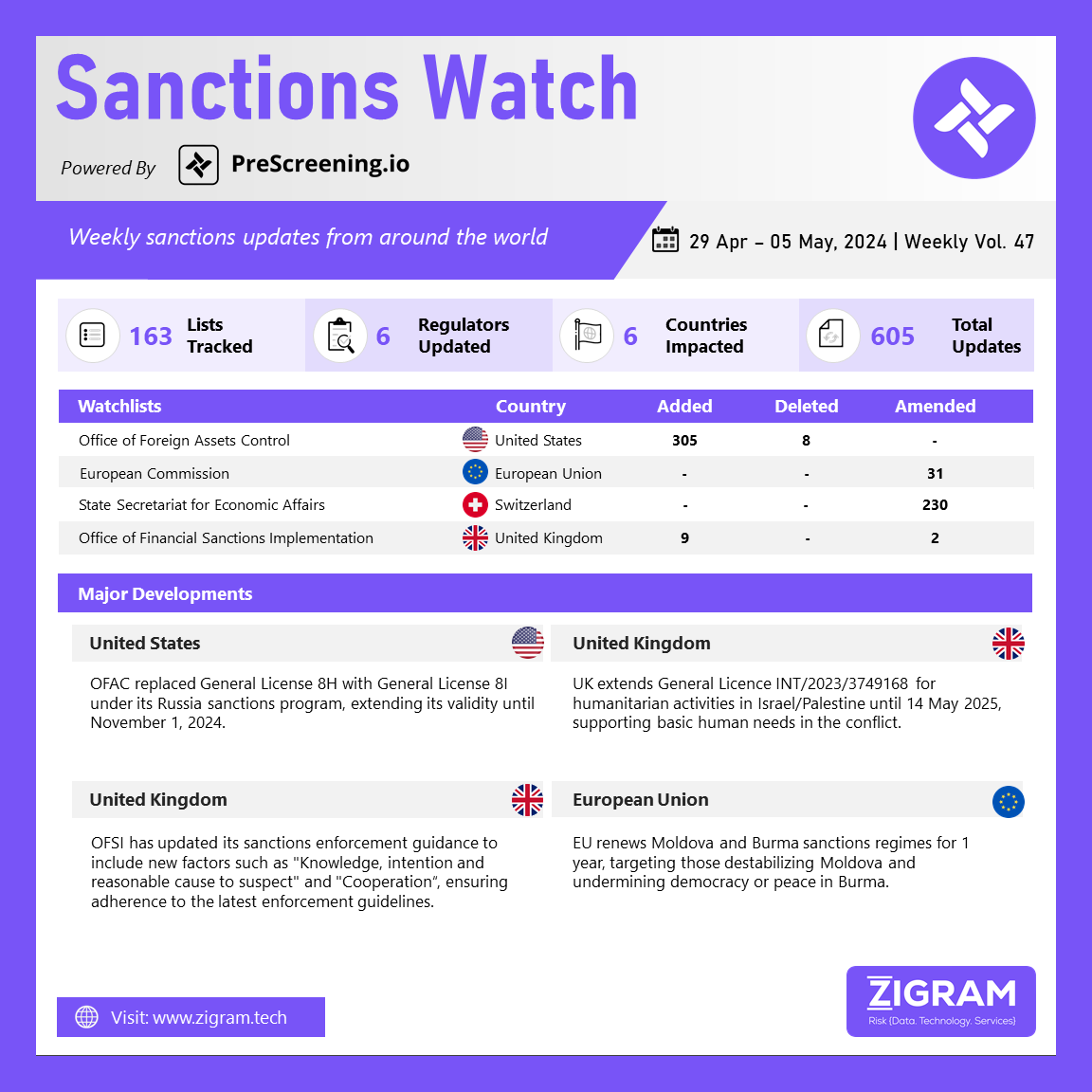

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The Office of Foreign Assets Control (OFAC) issues General License No. 8I, under the Russian Harmful Foreign Activities Sanctions Regulations, authorizing transactions linked to energy until November 1, 2024. This license permits transactions involving specified Russian entities, including major banks and the Central Bank of the Russian Federation, pertaining to energy activities such as petroleum extraction, production and power generation. Transactions are allowed unless otherwise prohibited by specific directives or the Russian Harmful Foreign Activities Sanctions Regulations. Notably, the license does not authorize certain activities, such as transactions blocked by Directive 1A or opening correspondent accounts for designated entities. General License No. 8I replaces its predecessor, General License No. 8H, effective April 29, 2024. This authorization remains in effect until November 1, 2024, unless renewed.

The United Kingdom has extended General Licence – INT/2023/3749168, which pertains to humanitarian activities in Israel and the Occupied Palestinian Territories, for an additional year until 14 May 2025. Originally set to expire on 15 May 2024, this licence allows for specific activities aimed at providing humanitarian assistance and supporting basic human needs in the context of the conflict in the region. The extension underscores the UK’s ongoing commitment to facilitating timely aid delivery and addressing the critical needs of individuals affected by the situation. This decision reflects the importance placed on maintaining continuity in humanitarian efforts and ensuring that essential support reaches those in need amidst the challenging circumstances in Israel and the Occupied Palestinian Territories.

In its recent update, OFSI has revised its Financial Sanctions Enforcement and Monetary Penalties guidance to ensure consistent application of its Enforcement guidance across cases. This latest version emphasizes that OFSI will consistently employ the most recent iteration of its Enforcement guidance in all instances. The guidance delves deeper into OFSI’s approach to evaluating suspected breaches of financial sanctions, elucidating the criteria it employs and delineating them into distinct categories. Notably, the update introduces two novel case factors, namely “Knowledge, intention and reasonable cause to suspect” and “Cooperation,” which were previously addressed more broadly within the guidance. This refined framework aims to enhance clarity and precision in assessing potential violations, equipping stakeholders with a clearer understanding of OFSI’s expectations and criteria for compliance.

The European Union has extended its sanctions regime concerning Moldova for a duration of one year until April 29, 2025. These sanctions are directed towards individuals and entities deemed responsible for activities that aim to destabilize, undermine, or threaten the sovereignty and independence of Moldova. Presently, the sanctions apply to 11 individuals and one entity as outlined in the regulation and decision. Additionally, the EU has prolonged its sanctions regime regarding Myanmar/Burma for one year until April 30, 2025, alongside modifying the listings for 19 individuals on the sanctions list. The sanctions imposed on Burma are aimed at individuals who are involved in actions that undermine democracy or the rule of law in Myanmar or engage in activities that jeopardize the peace of the nation, as specified in the regulation and decision.

- #OFAC

- #GeneralLicense

- #Russia

- #UnitedKingdom

- #Israel

- #PalestinianTerritories

- #HumanitarianActivities

- #OFSI

- #Moldova

- #EnforcementGuidance

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #RegulatoryObligations

- #SanctionsBreaches

- #GeneralLicence

- #EuropeanUnion