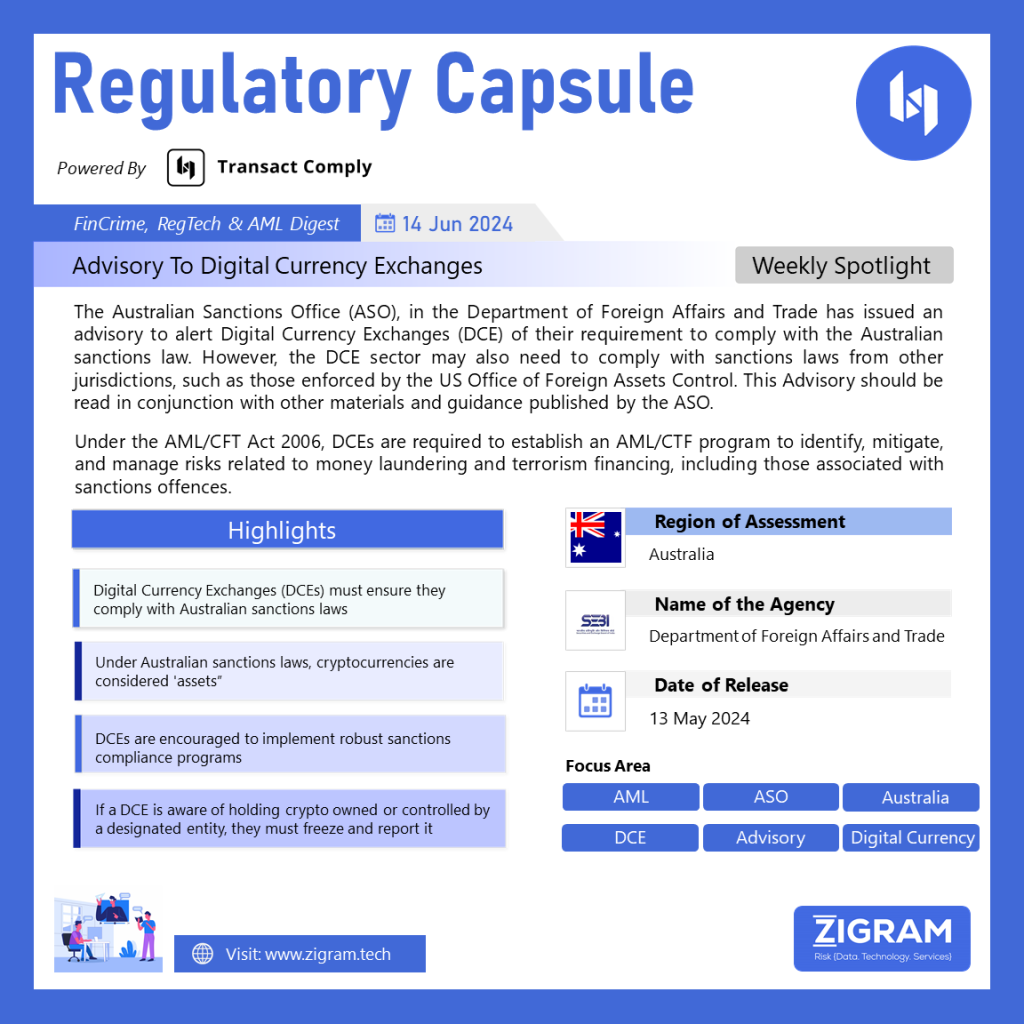

Regulation Name: Advisory To Digital Currency Exchanges

Publishing Date: 13 May 2024

Region: Australia

Agency: Department of Foreign Affairs and Trade

The Australian Sanctions Office (ASO), in the Department of Foreign Affairs and Trade has issued an advisory to alert Digital Currency Exchanges (DCE) of their requirement to comply with the Australian sanctions law. However, the DCE sector may also need to comply with sanctions laws from other jurisdictions, such as those enforced by the US Office of Foreign Assets Control. This Advisory should be read in conjunction with other materials and guidance published by the ASO.

Who must comply with Australian sanctions laws?

Australian sanction laws apply to activities conducted:

– Within Australia,

– By Australian citizens and Australian-registered corporate bodies overseas,

– On board Australian-flagged vessels and aircraft.

The individual is responsible for ensuring compliance with these laws. It is essential to seek one’s own legal advice and perform due diligence to stay fully informed about the business partners and transactions.

How do sanctions obligations apply to the DCE sector?

Under Australian sanctions laws, cryptocurrencies and other funds or economic resources are classified as ‘assets.’ Due to their anonymity and the ease with which they can be transferred across borders, cryptocurrencies are particularly attractive to those attempting to evade sanctions. Therefore, the Digital Currency Exchange (DCE) sector must be vigilant about potential sanctions exposure risks.

It is illegal to provide cryptocurrency to, or for the benefit of, a designated person or entity. Additionally, asset holders such as banks or crypto exchanges are prohibited from using, dealing with, or facilitating the use or dealing of cryptocurrency owned or controlled by a designated person or entity.

DCEs must take reasonable precautions and perform due diligence to avoid facilitating cryptocurrency payments to or from designated entities or their associates. If you discover that you hold cryptocurrency owned or controlled by a designated entity, you are required to freeze the cryptocurrency and report it to the Australian Federal Police (AFP).

AML/CFT Program

Digital Currency Exchanges (DCEs) must comply with numerous ongoing legal and reporting requirements to prevent the criminal misuse of digital currencies, including ensuring compliance with sanctions.

Developing a sanctions compliance program to address the risks associated with cryptocurrencies is complex. This involves screening counterparties and beneficiaries, tracing the sources of funds, and freezing digital assets when necessary.

Under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, DCEs are mandated to create an AML/CTF program. This program must identify, mitigate, and manage risks related to money laundering and terrorism financing, including those stemming from sanctions offences. It should include measures to monitor transactions that might indicate a sanctions offence and report any suspicious activities to AUSTRAC.

How can you prevent a sanctions contravention?

As Digital Currency Exchanges (DCEs), it is recommended that you:

– Assess your exposure to Australian sanctions laws.

– Seek legal advice.

– Implement due diligence measures to manage any identified or anticipated risks of breaching financial sanctions.

You should also consider screening all parties involved in a transaction against the Consolidated List as part of your ongoing reasonable precautions and due diligence. This includes parties who are not your direct customers, such as the payee in an electronic funds transfer or remittance when your customer is the payer.

What should you do if you identify a possible sanctions contravention?

An individual should deny or refuse to process transactions unless they are confident that the transactions are lawful. Any attempted transactions should be reported through the Sanctions Portal Pax or by email to sanctions@DFAT.gov.au.

If transactions have already occurred, steps should be taken to prevent any future payments from being processed, and the incident should be reported to the Australian Sanctions Office through the Sanctions Portal Pax or via email. Additionally, the cryptocurrency involved should be frozen and reported to the AFP.

Consideration should also be given to AML/CTF obligations, including whether to submit a suspicious matter report to AUSTRAC, conduct enhanced customer due diligence, or strengthen the AML/CTF program.

Read the advisory released by the Department of Foreign Affairs and Trade here.

- #ASO

- #AML

- #CFT

- #FinancialSecurity

- #Compliance

- #MoneyLaundering

- #TerroristFinancing

- #FinancialRegulations

- #DigitalCurrency

- #Cryptocurrency

- #DepartmentofForeignAffairsandTrade

- #Australia