Regulation Name: Crypto Assets Risk Indicators

Publishing Date: 23 May 2024

Region: United States

Agency: Joint Chiefs of Global Tax Enforcement (J5)

J5 Identifies Key Risk Indicators For Crypto Asset Transactions

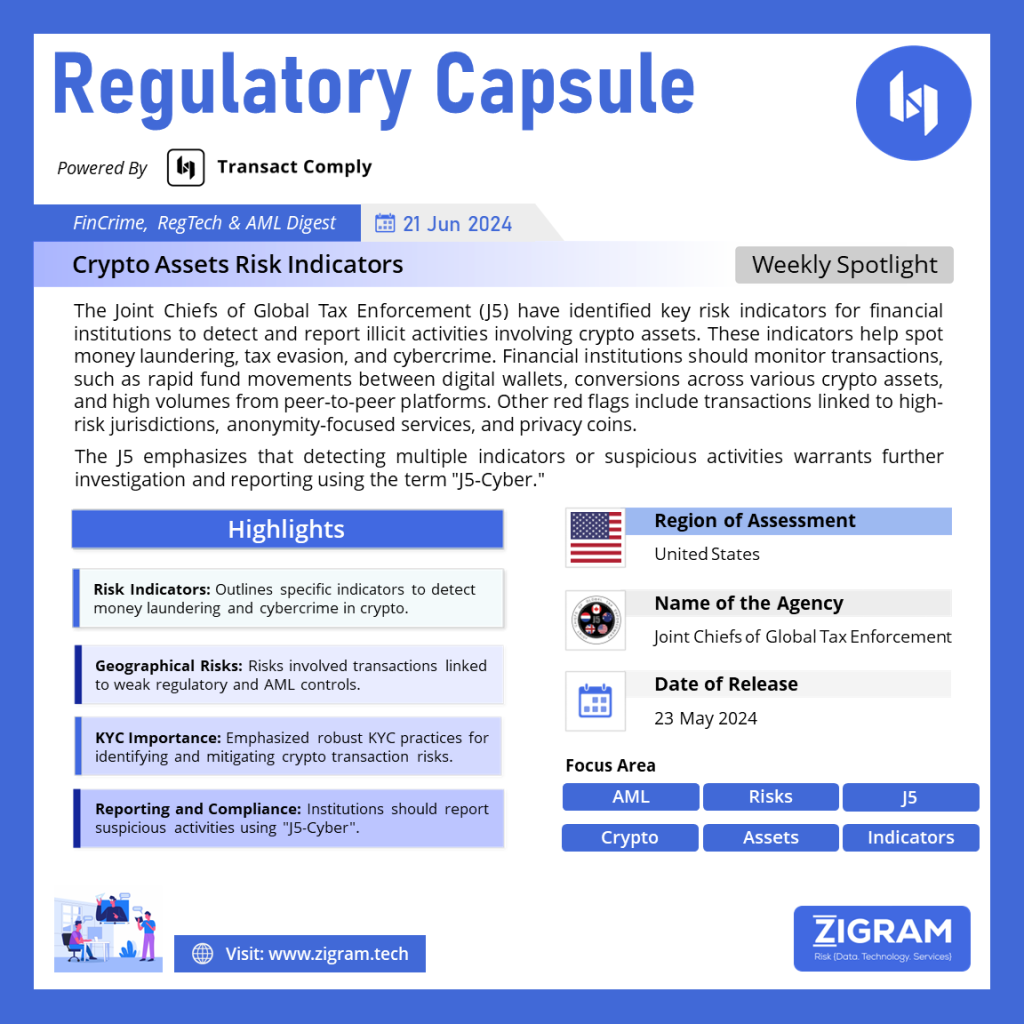

The Joint Chiefs of Global Tax Enforcement (J5) have released a comprehensive advisory on identifying risk indicators associated with crypto assets to help financial institutions detect and report illicit activities such as money laundering, tax evasion, and cybercrime. This collaborative partnership among tax authorities and law enforcement from five countries aims to enhance the integrity of the financial system and ensure compliance with anti-money laundering (AML) regulations.

Risk Indicators for Financial Institutions

The J5 has outlined several key risk indicators that financial institutions should prioritize to detect suspicious activities involving crypto assets. These indicators include:

1. Rapid movement of funds between digital wallets, especially across multiple jurisdictions, indicating potential layering.

2. High-volume transactions from peer-to-peer platforms, bypassing traditional financial institutions.

3. Conversion across different crypto assets to complicate the tracing of funds.

4. Transactions linked to high-risk jurisdictions with weak regulatory frameworks and inadequate AML controls.

Geographical and Counterparty Risks

Geographical risk indicators are critical for financial institutions to consider. Transactions involving high-risk jurisdictions identified as non-cooperative for AML purposes can signal potential illicit activities. Additionally, monitoring interactions with high-risk counterparties, such as entities with obscure ownership structures or links to suspicious sources like darknet marketplaces and mixing services, is crucial.

Importance of Robust KYC Practices

Robust Know Your Customer (KYC) practices are essential for identifying potential risks associated with crypto asset transactions. Financial institutions and crypto exchanges must verify customer identities and understand their transaction patterns to establish a baseline understanding of their clients’ crypto exposure and activities. Indicators such as incomplete identification information, difficulty in establishing beneficial ownership, and inconsistent transactional activity should raise red flags.

Reporting and Compliance

To counteract the risks associated with crypto assets, financial institutions are encouraged to report suspicious activities using the term “J5-Cyber.” This helps in the proactive detection and response to financial crimes, reinforcing the integrity of the financial system. Observing a combination of risk indicators or other suspicious activities warrants further investigation and reporting to the relevant authorities.

As the financial landscape continues to evolve, the J5’s efforts in developing and sharing these risk indicators underscore the collective commitment to mitigating the risks associated with crypto assets. By disseminating valuable insights to the financial sector, the J5 enhances the ability of reporting entities to detect and report suspicious activities, thereby disrupting illicit financial flows and maintaining the overall integrity of the financial system.

Read the full notice here.

- #CryptoRisk

- #FinancialSecurity

- #MoneyLaundering

- #AML

- #J5Cyber

- #CryptoCompliance

- #FinancialCrime

- #BlockchainSecurity

- #TaxEvasion

- #CybercrimeDetection

- #KYC

- #CryptoRegulation