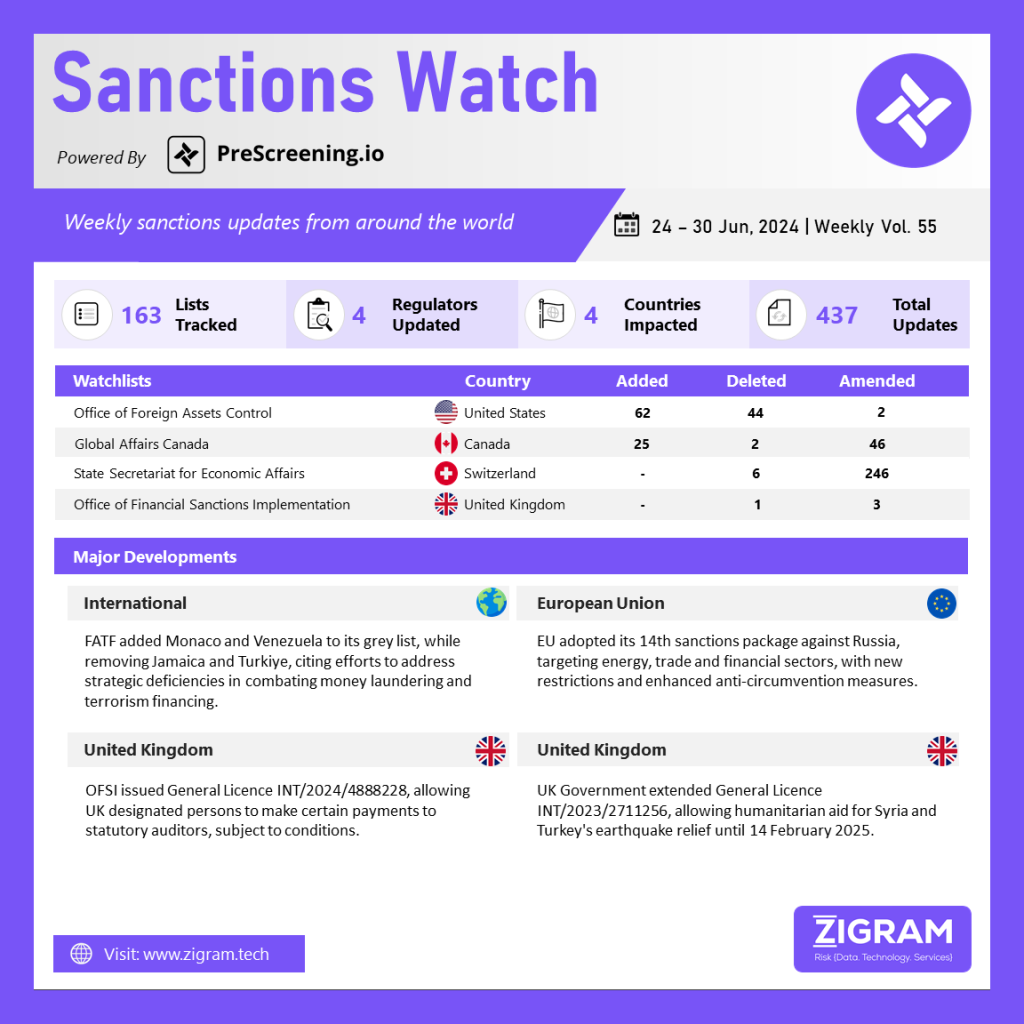

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The Financial Action Task Force (FATF) announced on June 28 that Monaco and Venezuela have been added to its “grey list” of countries under heightened scrutiny for deficiencies in combating money laundering and terrorist financing. This decision follows Monaco’s previous efforts to address concerns raised by the Council of Europe’s anti-money laundering body, despite unverified allegations involving individuals close to Prince Albert II. The FATF, headquartered in Paris, oversees compliance efforts across over 200 jurisdictions worldwide. Grey-listed nations, which also include Mali, Vietnam and Yemen among others, are acknowledged for cooperating with FATF but are deemed to have strategic shortcomings in their financial integrity frameworks. Monaco, renowned for its tax-friendly environment, expressed commitment to meeting FATF recommendations to facilitate its removal from the grey list, affirming its resolve to implement necessary reforms within specified timelines. Additionally, the FATF delisted Jamaica and Turkey from the grey list after these countries successfully rectified identified deficiencies, underscoring their compliance progress.

On June 24, 2024, the European Union enacted its 14th sanctions package against Russia, marking a significant escalation in economic and individual restrictive measures. These measures, implemented through Council Regulation (EU) 2024/1739 and Council Regulation (EU) 2024/1745, target a wide spectrum of entities and individuals, totaling 116 new designations. These include freezes on assets and travel bans for 69 individuals and 47 entities across various sectors critical to Russia’s economy such as defense, space engineering and energy. Notably, the package introduces sanctions on the liquefied natural gas (LNG) sector for the first time, restricting investments and transshipment activities related to major projects like Arctic LNG 2 and Murmansk LNG. The EU has also strengthened anti-circumvention measures and due diligence requirements, emphasizing compliance across EU subsidiaries and third-country operations. Additionally, financial sector restrictions have been expanded to prohibit transactions using Russia’s Financial Messaging System and engage with specified banks supporting Russia’s defense-industrial complex.

On June 27, 2024, OFSI issued General Licence INT/2024/4888228, allowing UK designated persons or their representatives to make payments to statutory auditors upon their appointment by a company, subject to specific conditions. This licence, applicable under all UK Autonomous Sanctions Regulations listed in Annex I, exempts such payments from prohibitions that would otherwise apply. Defined terms include “UK DPs” as entities subject to UK asset freeze sanctions and “Statutory Auditors” as defined in the Companies Act 2006 for auditing accounts. Permitted Payments refer to remuneration for these audits and the licence also outlines reporting and record-keeping obligations. Effective from 00:01 on June 27, 2024, the licence empowers HM Treasury to amend, cancel, or suspend it as needed, ensuring compliance with sanctions regulations while facilitating statutory audit processes.

The UK Government has extended General Licence INT/2023/2711256, allowing humanitarian assistance activities for earthquake relief efforts in Syria and Turkey until 14 February 2025. This licence, under regulation 61 of The Syria (Sanctions) (EU Exit) Regulations 2019, exempts certain activities from prohibitions in the Syria Regulations, facilitating the provision of funds, goods and services needed for timely delivery of humanitarian aid. The licence applies to designated persons and institutions involved in relief activities, provided that the funds used are not controlled by designated individuals unless exchanged through relevant institutions. This extension ensures that humanitarian organizations, including the United Nations and other international bodies, can continue their critical work in the affected regions without breaching sanctions regulations. HM Treasury retains the authority to modify or revoke the licence as necessary.

- #FATF

- #UnitedStates

- #GreyList

- #MoneyLaundering

- #TerroristFinancing

- #Monaco

- #Venezuela

- #Jamaica

- #Turkiye

- #EuropeanUnion

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #EU

- #14thSanctionsPackage

- #Russia

- #AssetsFreeze

- #TravelBans

- #OFSI

- #GeneralLicence

- #DesignatedPersons

- #Syria

- #Turkey

- #UnitedKingdom

- #HumanitarianAid

- #UnitedNations