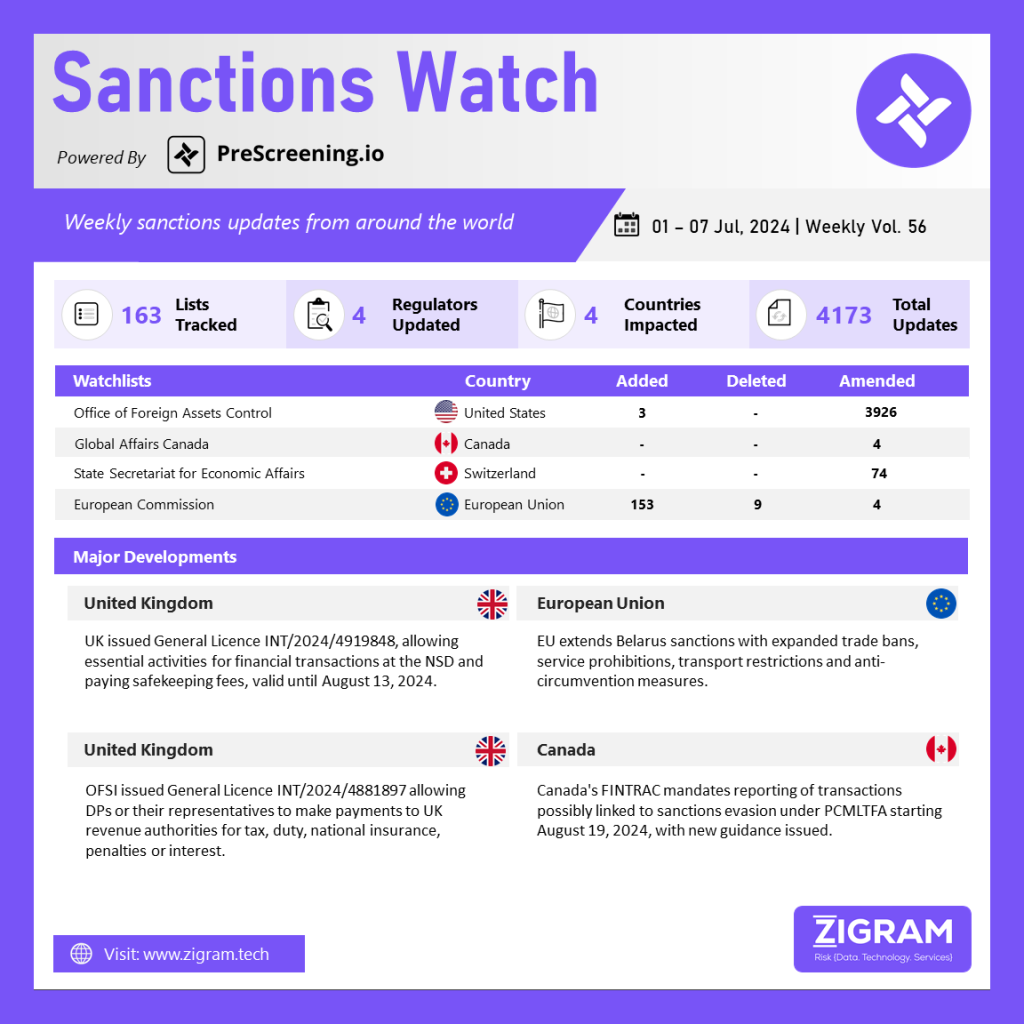

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

On July 3, 2024, the UK issued General Licence INT/2024/4919848 under Regulation 64 of the Russia (Sanctions) (EU Exit) Regulations 2019. This licence allows for the sale, divestment or transfer of financial instruments held at the National Settlement Depository (NSD), including the payment of safekeeping fees, subject to specified conditions. The authorised activities are exempt from certain prohibitions outlined in Regulations 11 to 15 of the Russia Regulations. Under the licence, “DP Held Financial Instruments” refer to debt and equity securities, including global depository receipts, held by the NSD. The licence also defines record-keeping requirements, mandates compliance with data protection regulations and specifies that HM Treasury retains the right to vary, revoke or suspend the licence at any time. Effective from July 3, 2024, this General Licence remains valid until August 13, 2024, allowing relevant institutions and persons to conduct necessary financial transactions within the defined parameters.

The EU has expanded its sanctions against Belarus to align with existing measures targeting Russia. New sanctions include trade restrictions and bans on specific services and transport. These measures encompass an extended export/import ban covering dual-use goods, maritime navigation items and luxury goods, alongside a prohibition on importing gold, diamonds, helium, coal and crude oil from Belarus. Additionally, there’s a ban on exporting goods and technologies used in oil refining and natural gas liquefaction. Services such as accounting, auditing, business consultancy, architecture, engineering, advertising and market research are also prohibited. Transport restrictions prohibit the use of Belarusian-registered trailers for road transport within the EU and restrict EU-owned entities with Belarusian ownership of 25% or more from transporting goods by road in the EU. Anti-circumvention measures mandate EU operators to include a ‘no-Belarus clause’ in contracts to prevent re-exportation of sensitive goods and technology to Belarus and prohibit transit through Belarus of dual-use goods, technologies and industrial goods. EU operators affected by sanctions may seek compensation for damages caused by Belarusian entities due to sanctions implementation and expropriation.

Office of Financial Sanctions Implementation, under the Sanctions and Anti-Money Laundering Act 2018 (“the Sanctions Act”), has the authority to issue General Licences for country sanctions regimes. On 1 July 2024, OFSI issued General Licence INT/2024/4881897 encompassing all UK Autonomous Sanctions Regulations (listed in Annex 1 of the General Licence). This licence specifically permits payments to be made to Revenue Authorities by UK Designated Persons (DPs) or on their behalf. Those intending to utilize General Licence INT/2024/4881897 are advised to refer to the complete Licence for comprehensive definitions, permissions and usage criteria. UK DPs refer to individuals or entities designated for asset freezes under UK Autonomous Sanctions Regulations, excluding those designated for UN obligations compliance. Revenue Authorities include His Majesty’s Revenue & Customs, the Welsh Revenue Authority and Revenue Scotland. Permitted Payments cover obligations owed by or to UK DPs, including taxes, duties, national insurance, penalties or interest, either pre or post-designation. The Licence also outlines reporting and record-keeping obligations for UK DPs or their representatives. It’s crucial to note that General Licence INT/2024/4881897 does not sanction any actions knowingly facilitating funds or economic resources in breach of relevant Autonomous Sanctions Regulations, except as authorized under those Regulations. This Licence came into effect at 00:01 on 1 July 2024.

Financial Transactions and Reports Analysis Centre of Canada has issued new guidelines effective August 19, 2024, under Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), mandating businesses to report transactions suspected of sanctions evasion to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This development follows Canada’s 2023 Fall Economic Statement, which outlined legislative measures to combat sanctions evasion under laws like the United Nations Act, the Special Economic Measures Act and the Justice for Victims of Corrupt Foreign Officials Act. FINTRAC’s recent guidance clarifies reporting requirements for entities obligated under PCMLTFA, emphasizing the need to report financial activities potentially linked to sanctions evasion by sanctioned individuals or entities. The guidance also includes a Special Bulletin detailing common evasion tactics, such as the use of shell companies in offshore financial centers, non-resident bank accounts in secrecy jurisdictions and the utilization of cryptocurrencies and emerging financial technologies to bypass sanctions.

- #UnitedKingdom

- #GeneralLicence

- #FinancialInstruments

- #DataProtectionRegulations

- #DesignatedPerson

- #Belarus

- #TradeRestrictionsandBans

- #Dual-UseGoods

- #AntiMoneyLaundering

- #OfficeofFinancialSanctionsImplementation

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #SanctionsRegimes

- #UnitedNations

- #Cryptocurrencies

- #Canada

- #TerroristFinancing

- #EuropeanUnion