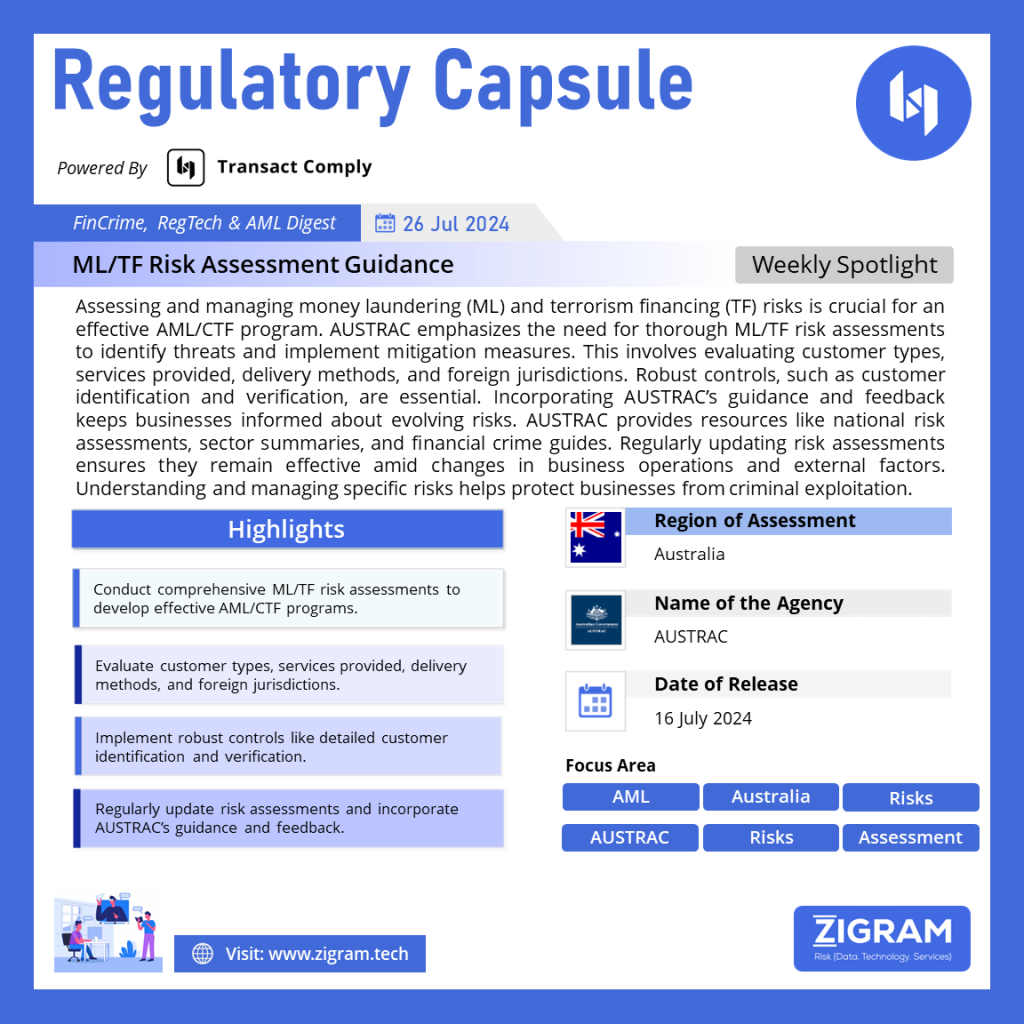

Regulation Name: ML/TF Risk Assessment Guidance

Publishing Date: 16 July 2024

Region: Australia

Agency: AUSTRAC

Assessing and managing money laundering (ML) and terrorism financing (TF) risks is a critical component of an Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) program. AUSTRAC, the Australian Transaction Reports and Analysis Centre, emphasizes that the first step in protecting a business from being exploited by criminals is to conduct a thorough ML/TF risk assessment. This process not only identifies potential threats but also determines the necessary measures to mitigate and manage these risks effectively.

Understanding Your Business’s ML/TF Risk

A comprehensive ML/TF risk assessment involves evaluating several key elements:

1. Customer Types:

Identifying the types of customers your business serves, especially those who are politically exposed persons (PEPs), can highlight potential risk areas.

2. Designated Services:

Assessing the services your business provides helps in understanding the specific risks associated with each service.

3. Service Delivery Methods:

Evaluating how services are delivered, whether face-to-face or online, can influence the level of risk.

4. Foreign Jurisdictions:

Considering the countries or regions you operate in can reveal jurisdiction-specific risks.

Implementing Control Measures

Once risks are identified, appropriate controls must be implemented to mitigate these risks. This includes developing detailed customer identification and verification procedures, which consider factors like the beneficial owners of customers, PEP status, sources of funds, and the control structures of non-individual customers such as companies and trusts.

Utilizing AUSTRAC Guidance

AUSTRAC provides extensive guidance and feedback on ML/TF risks. Incorporating AUSTRAC’s insights into your risk assessment is crucial for staying informed about evolving threats and vulnerabilities. AUSTRAC offers several resources, including:

– National Risk Assessments: Strategic overviews of threats and vulnerabilities in Australia.

– Sector-Based Risk Assessments: Summaries of risks faced by specific sectors.

– Financial Crime Guides and Threat Alerts: Information on specific crime types and indicators of suspicious activity.

– Typology and Case Studies Reports: Explanations of methods criminals use to conceal or move illicit funds.

Regular Review and Adaptation

Risk assessments must be flexible and regularly reviewed to adapt to changes in your business, customer circumstances, and external factors. This includes assessing risks for any new services, delivery methods, technologies, or jurisdictions. Regular monitoring of AUSTRAC updates and international guidance on ML/TF risks is essential to ensure your risk assessment remains current and effective.

Key Highlights

1. Critical First Step: Conducting a thorough ML/TF risk assessment is essential for developing an effective AML/CTF program.

2. Four Key Elements: Risk assessment involves evaluating customer types, services provided, delivery methods, and foreign jurisdictions.

3. AUSTRAC Guidance: Incorporating AUSTRAC’s extensive resources and feedback is vital for understanding and managing ML/TF risks.

4. Regular Review: Continuously updating risk assessments in response to business changes and external factors ensures ongoing protection against ML/TF threats.

Effectively identifying and managing ML/TF risks is paramount for any business’s AML/CTF program. By understanding the specific risks your business faces and implementing robust controls, you can safeguard your operations from criminal exploitation. Regularly incorporating AUSTRAC’s guidance and adapting to changes will help maintain a resilient and effective risk management strategy.

Read the guidance here.

Know more about the product: PreScreening.io

Click here to book a free demo.

- #AML

- #CTF

- #RiskAssessment

- #AUSTRAC

- #FinancialSecurity

- #Compliance

- #RiskManagement

- #AntiMoneyLaundering