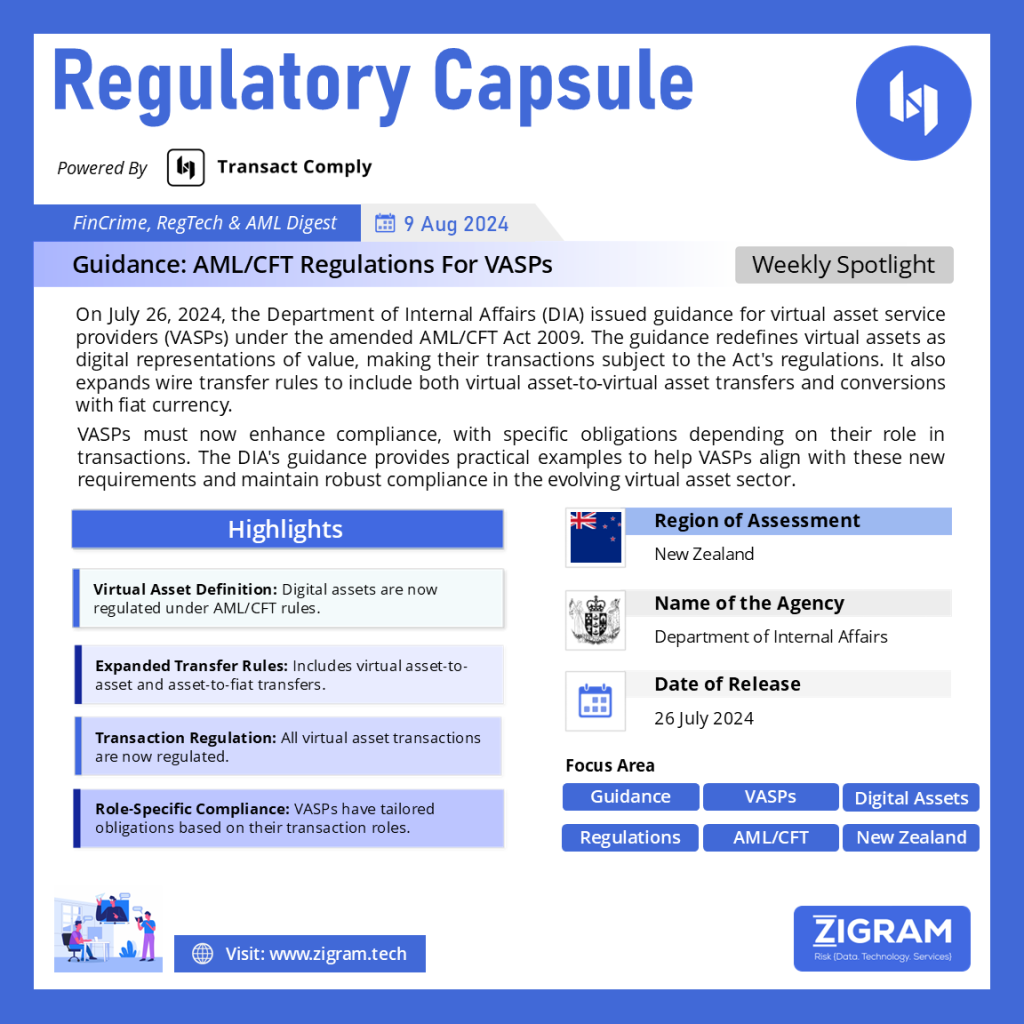

Regulation Name: Guidance On AML/CFT Regulations For VASPs

Publishing Date: 26 July 2024

Region: New Zealand

Agency: Deparment of Internal Affairs

On July 26, 2024, the Department of Internal Affairs (DIA) released critical guidance for virtual asset service providers (VASPs) regarding the stage 2 amendment regulations under the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Act 2009. This guidance marks a significant step in ensuring that VASPs align with the latest regulatory requirements, particularly in managing virtual assets and their associated transactions.

1. New Definitions and Requirements

The updated regulations, effective from June 1, 2024, introduce key changes for VASPs:

– Virtual Asset Definition: Effective from July 31, 2023, virtual assets are defined as digital representations of value that can be digitally traded, transferred, or used for payment or investment purposes, excluding fiat currencies and financial products under the Financial Markets Conduct Act 2013.

– Transaction Definition: As of June 1, 2024, the regulations ensure that the deposit, withdrawal, exchange, or transfer of virtual assets is recognized as a transaction under the Act. This inclusion mandates that all dealings involving virtual assets are subject to the AML/CFT transaction requirements.

2. Impact on VASPs

VASPs, though not explicitly defined in the Act, are broadly understood as businesses involved in transactions or dealings with virtual assets. The new regulations apply to VASPs if they engage in activities such as:

– Accepting deposits or other repayable funds.

– Transferring money or value on behalf of a customer.

– Issuing or managing means of payment.

– Providing safekeeping or administration of virtual assets.

These changes mean that VASPs need to review their AML/CFT programs to ensure compliance with the updated requirements.

3. Wire Transfer Requirements

A notable change under the new regulations is the expansion of wire transfer rules, also known as the ‘travel rule’. Previously, VASPs were only required to comply with these rules for fiat currency transfers or conversions between fiat and virtual assets. However, effective June 1, 2024, the definition of wire transfers now includes:

– Virtual Asset to Virtual Asset Transfers: Any transfer where the value remains in virtual assets throughout the transaction, including transfers between wallets.

– Virtual Asset to Fiat Currency Transfers: Transactions involving conversions between virtual assets and fiat currencies.

VASPs must now comply with two sets of wire transfer requirements for transactions involving both virtual assets and fiat currencies.

4. Obligations for Different Institutions

The guidance outlines specific responsibilities for VASPs based on their role in a transaction—whether as an ordering institution, intermediary institution, or beneficiary institution. For instance, an ordering institution involved in a wire transfer exceeding NZD$1,000 must identify and verify the originator’s identity and collect certain beneficiary information.

5. Practical Examples

The guidance provides practical examples of how these regulations apply to VASPs in various scenarios, such as:

– Purchasing Virtual Assets: A VASP receives fiat currency from a customer to purchase virtual assets and transfer them to another wallet.

– Selling Virtual Assets: A VASP sells virtual assets for a customer and transfers the fiat currency to a bank account.

– Exchanging Virtual Assets: A VASP exchanges one type of virtual asset for another and transfers it to a wallet hosted by another VASP.

The DIA’s new guidance is a critical resource for VASPs, providing clarity on how to navigate the evolving regulatory landscape. VASPs must ensure their AML/CFT programs are updated in line with these regulations to avoid compliance risks. By understanding and implementing these changes, VASPs can better manage the complexities of virtual asset transactions while adhering to the AML/CFT Act.

This guidance is a vital tool for VASPs to align their operations with the latest regulatory expectations, ensuring robust compliance in the rapidly evolving virtual asset industry.

Read the guidance here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AML

- #CFT

- #VirtualAssets

- #Regulation

- #VASPs

- #Compliance

- #CryptoRegulation

- #FinancialSecurity