- 7 minutes read

The Power Of RegTech In Automating KYC And AML Compliance

As financial institutions strive to comply with ever-increasing regulatory requirements, the need for efficient and effective solutions has become paramount. This is where RegTech, or regulatory technology, steps in. RegTech has emerged as a game-changer in the fintech industry, providing innovative and automated solutions to address the challenges of Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. By leveraging advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics, RegTech solutions offer a streamlined approach to regulatory compliance, ensuring accuracy, reducing costs, and improving operational efficiency.

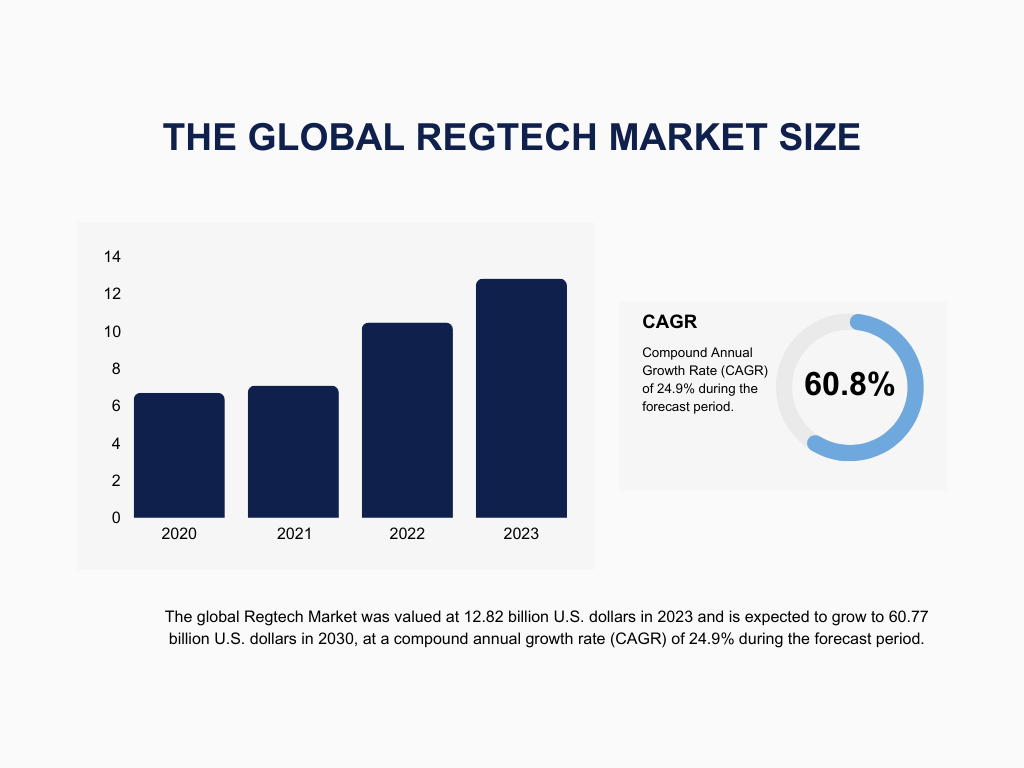

The Rise of RegTech in the Global Market

The RegTech industry has experienced significant growth since 2015, driven by the increasing number of regulations and legislation related to information systems. According to Fortune Business Insights, the global Regtech Market was valued at 12.82 billion U.S. dollars in 2023 and is expected to grow to 60.77 billion U.S. dollars in 2030, at a compound annual growth rate (CAGR) of 24.9% during the forecast period. This growth can be attributed to the rising demand for efficient compliance solutions and the need for financial institutions to navigate the complex regulatory landscape.

The Importance of KYC and AML Compliance

KYC and AML compliance are critical for financial institutions to mitigate the risks associated with money laundering, terrorist financing, and other financial crimes. KYC processes involve verifying the identities of customers, assessing their risk profiles, and ensuring that they comply with regulatory requirements. AML compliance, on the other hand, focuses on detecting and preventing money laundering activities by monitoring and analyzing financial transactions. Non-compliance with KYC and AML regulations can result in severe penalties, reputational damage, and loss of business opportunities.

The Benefits of RegTech in KYC and AML Compliance

RegTech solutions offer numerous benefits for financial institutions seeking to automate and optimize their KYC and AML compliance processes

1. Enhanced Accuracy and Efficiency

One of the primary benefits of RegTech in KYC and AML compliance is improved accuracy and efficiency. By leveraging advanced analytics and automation, RegTech solutions reduce the potential for human error and ensure that compliance processes are followed consistently and accurately. This is especially important given the high risk of regulatory penalties and reputational damage for financial institutions that do not comply. With RegTech, financial institutions can improve the accuracy and completeness of customer data, reduce false positives, and increase the effectiveness of their compliance efforts.

2. Cost Reductions

RegTech solutions also offer cost-saving opportunities for financial institutions Manual compliance procedures take a lot of time and resources, necessitating a high level of human interaction and specialized knowledge Financial institutions can accelerate the onboarding process, lessen the need for manual interventions, and offer a quicker and more seamless customer experience by utilizing RegTech solutions. By automating KYC and AML compliance processes, financial institutions can reduce the need for manual interventions, optimize their compliance workflows, and minimize the time and resources required to meet regulatory requirements. This can result in significant cost savings, particularly for institutions with large customer bases or complex compliance needs.

3. Operational Efficiency

In addition to cost savings, RegTech solutions improve operational efficiency in KYC and AML compliance. By streamlining compliance processes and reducing manual interventions, financial institutions can expedite customer onboarding, decrease the time and resources needed for due diligence, and enhance the overall efficiency of their compliance procedures. RegTech solutions enable seamless integration with existing systems, ensuring a smooth workflow and eliminating redundant tasks. This allows compliance teams to focus on higher-value activities and strategic initiatives.

4. Real-time Monitoring and Alerts

RegTech solutions provide real-time monitoring and alerts, enabling financial institutions to promptly detect and respond to potential regulatory violations. By leveraging AI and ML algorithms, RegTech solutions continuously analyze customer data and transaction patterns, flagging any suspicious activities or patterns that may indicate money laundering or other illicit activities. This proactive approach helps financial institutions avoid emerging risks, minimize losses, and protect their reputation.

5. Streamlined Customer Experience

RegTech solutions also contribute to an enhanced customer experience. Manual compliance processes can be cumbersome and time-consuming for customers, requiring them to provide multiple forms of identification and documentation. Financial institutions can offer a faster and more seamless customer experience, minimize the need for manual interventions, and streamline the onboarding process by utilizing RegTech solutions. This improves customer satisfaction, fosters loyalty, and helps financial institutions attract and retain customers in a competitive market.

RegTech Solutions for KYC and AML Compliance

RegTech solutions for KYC and AML compliance encompass a range of innovative technologies and capabilities. Here are some key features and use cases of RegTech solutions in the context of KYC and AML compliance:

Identity Verification

RegTech solutions automate identity verification processes through advanced technologies such as document verification. Document verification checks the authenticity of identity documents, such as passports or driver's licenses, using optical character recognition (OCR) and other verification techniques. These solutions improve accuracy, reduce manual errors, and enhance the efficiency of the identity verification process.

Risk Assessment and Scoring

RegTech solutions leverage AI and ML algorithms to automate risk assessment and scoring. By analyzing customer data, transaction history, and other relevant factors, these solutions calculate risk scores for each customer. Risk scores help financial institutions determine the level of due diligence required and allocate resources efficiently. RegTech solutions continuously monitor customer behavior and adjust risk scores in real time, ensuring ongoing compliance and proactive risk management.

Transaction Monitoring and Analysis

RegTech solutions automate transaction monitoring and analysis, enabling financial institutions to detect suspicious activities and patterns. By leveraging AI and ML algorithms, these solutions analyze transaction data, identify anomalies, and generate alerts for further investigation. Transaction monitoring tools help financial institutions identify potential money laundering, terrorist financing, or other illicit activities in real time. These solutions can also generate comprehensive reports and provide audit trails for regulatory compliance purposes.

Data Analytics and Reporting

RegTech solutions utilize big data analytics to analyze large volumes of customer and transaction data, enabling financial institutions to identify trends, patterns, and potential risks. These solutions generate comprehensive reports and provide actionable insights for compliance teams. RegTech solutions can also automate reporting processes, ensuring timely and accurate submission of regulatory reports. By leveraging data analytics, financial institutions can gain valuable insights into their compliance efforts, optimize processes, and make informed decisions.

RegTech Solutions for KYC and AML Compliance

In 2023, the cumulative fines and penalties for AML compliance breaches reached a staggering USD 44 billion globally. This highlights the critical importance of implementing effective RegTech solutions to mitigate the risks associated with money laundering and ensure regulatory compliance. ZIGRAM, a RegTech solutions provider, offers a comprehensive suite of products and services designed to help financial institutions automate KYC and AML compliance processes. As regulatory requirements continue to evolve and become more complex, the role of RegTech in KYC and AML compliance will become increasingly crucial. RegTech solutions will continue to leverage advanced technologies such as AI, ML, and big data analytics to enhance compliance processes, improve accuracy, and reduce costs. The integration of emerging technologies like blockchain and digital identity management will further revolutionize the way financial institutions approach KYC and AML compliance.

RegTech has emerged as a powerful tool for financial institutions seeking to automate and optimize their KYC and AML compliance processes. By leveraging advanced technologies, RegTech solutions enhance accuracy, reduce costs, improve operational efficiency, and provide real-time monitoring capabilities. The future of RegTech in KYC and AML compliance looks promising, with ongoing advancements and innovations expected to further streamline regulatory compliance and strengthen the fight against financial crimes. As financial institutions navigate the complex regulatory landscape, embracing RegTech solutions will be crucial to maintaining a competitive edge, ensuring compliance, and safeguarding their reputation in an ever-changing industry.

ZIGRAM with its advanced technologies and industry expertise, empowers organizations to stay ahead of regulatory requirements, enhance accuracy, and improve operational efficiency. Contact ZIGRAM today to learn more about our innovative RegTech solutions and how we can support your compliance efforts.

- #KYC

- #AML

- #RegTech

- #Automation