- 7 minutes read

ESG Due Diligence: A Comprehensive Approach For Responsible Business Practices

In today’s business landscape, responsible practices go beyond profitability. Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, strategic approaches, and overall reputation. ESG due diligence, the process of identifying and mitigating risks associated with a company’s environmental impact, social responsibility, and governance practices, has become a vital tool for organizations of all sizes. This article explores the various applications, benefits, and best practices of ESG due diligence, empowering businesses to navigate this evolving landscape and contribute to a more sustainable future.

What is ESG Due Diligence?

ESG due diligence involves a comprehensive assessment of a company’s sustainability practices and potential risks across three key areas:

Environmental:

This includes evaluating the company's impact on the environment, such as carbon emissions, waste management, resource use, and pollution control.

Social:

This examines the company's relationships with its stakeholders, including employees, communities, and suppliers. Factors like labor practices, diversity and inclusion, human rights, and social impact initiatives are considered.

Governance:

This assesses the company's internal structures, policies, and procedures, focusing on transparency, accountability, board composition, and risk management practices.

By conducting thorough ESG due diligence, organizations can gain valuable insights into potential risks and opportunities, enabling them to make informed decisions and manage their operations responsibly.

This is particularly relevant in:

Investment Decisions:

Investors increasingly consider ESG factors when evaluating a company's long-term viability and potential returns. ESG due diligence helps them assess the company's sustainability practices, identify potential risks, and make informed investment decisions.

Mergers and Acquisitions (M&A):

Failing to consider ESG factors during M&A activities can lead to reputational damage, regulatory issues, and financial losses. ESG due diligence helps identify potential risks associated with the target company and ensure alignment with the acquiring company's ESG values.

Supply Chain Management:

Ethical and sustainable practices throughout the supply chain are crucial for responsible businesses. ESG due diligence helps vet suppliers and ensure their practices align with the company's values and commitment to sustainability.

Why is ESG Due Diligence Important?

Several factors contribute to the growing importance of ESG due diligence:

Investor and Customer Expectations:

Investors increasingly prioritize companies with strong ESG performance, seeking sustainable investments that align with their values. Additionally, customers are more likely to support businesses that share their commitment to environmental and social responsibility.

Managing Risks:

Mitigating potential risks associated with poor ESG performance is crucial. Non-compliance with environmental regulations, labor issues, or unethical sourcing practices can lead to fines, reputational damage, and operational disruptions.

Building Positive Reputation:

Demonstrating strong ESG performance builds trust with stakeholders, strengthens brand value, and attracts top talent and investors.

Identifying Cost-Saving Opportunities:

Implementing sustainable practices can lead to cost savings through reduced energy consumption, waste management, and resource optimization.

Driving Sustainable Growth:

Integrating ESG considerations into operations contributes to a more sustainable future, ensuring responsible growth and long-term business resilience.

Challenges of ESG Due Diligence:

Implementing effective ESG due diligence presents several challenges. Data collection remains a significant hurdle, with inconsistencies in reporting standards and lack of transparency from companies posing difficulties in acquiring accurate and comparable information. Verifying data further complicates the process, requiring expertise and resources to validate the authenticity and completeness of reported measures. Additionally, greenwashing, where companies overstate or mislead about their ESG performance, necessitates scrutiny and analysis to separate genuine efforts from mere branding exercises.

The Role of Technology in Facilitating ESG Due Diligence:

Emerging technologies offer promising solutions to these challenges. Data analytics tools can streamline data collection and analysis, enabling faster and more comprehensive assessments. Artificial intelligence (AI) can be used to identify patterns and trends in ESG data, uncovering potential risks and opportunities that might be missed by manual analysis. Machine learning algorithms can assist in verifying data integrity and detecting anomalies, reducing the risk of greenwashing. Blockchain technology can create secure and transparent data ecosystems, enhancing trust and confidence in ESG reporting.

The Potential Impact of ESG Due Diligence on Developing Countries:

While ESG due diligence holds immense potential for promoting responsible business practices, its impact on developing countries requires careful consideration. Stringent ESG requirements could pose challenges for companies in these regions, potentially hindering their access to investment and markets. It’s crucial to establish frameworks that are sensitive to the specific contexts and capacities of developing countries, ensuring equitable participation and avoiding unintended consequences that hinder their economic development.

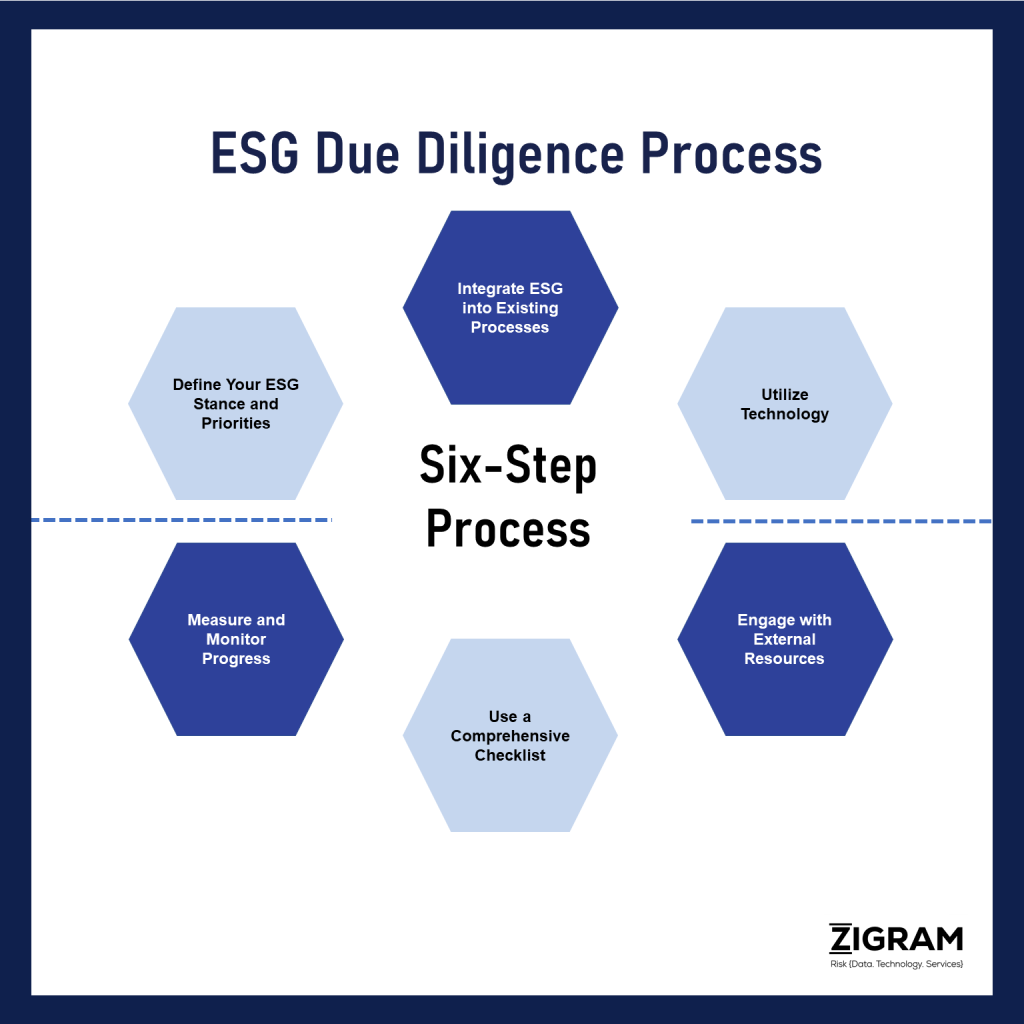

Building an Effective ESG Due Diligence Process:

Despite the challenges, implementing a robust ESG due diligence process offers numerous benefits. Here’s a step-by-step guide:

Define Your ESG Stance and Priorities:

- Identify the ESG elements most relevant to your organization and potential risks. Consider your industry, location, and stakeholder expectations.

- Develop a customized checklist reflecting your values and long-term goals. Define clear expectations and desired outcomes for your ESG performance.

Integrate ESG into Existing Processes:

- Incorporate ESG considerations into existing due diligence procedures for transactions, supplier onboarding, and investment decisions.

- Train relevant personnel on identifying and assessing ESG risks and opportunities. Foster a culture of responsible decision-making within your organization.

Utilize Technology:

- Explore technology solutions like ESG governance software, data analysis tools, and satellite imagery to enhance data collection, analysis, and verification.

- Leverage AI and machine learning to identify trends, predict risks, and detect anomalies in ESG data.

Engage with External Resources:

- Stay informed about industry best practices, regulatory developments, and emerging standards. Partner with organizations like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

- Collaborate with peers, regulators, and policymakers to ensure your approach aligns with evolving requirements. Seek expert guidance from ESG consultants when needed.

Use a Comprehensive Checklist:

- Utilize a checklist encompassing relevant factors like:

- Geographical information and potential environmental risks

- Sector-specific ESG considerations and industry benchmarks

- Company structure and governance practices

- Financial considerations and ESG-related investments

- Regulatory compliance and potential risks

- ESG rankings, ratings, and disclosures

- Reputation and media coverage of ESG performance

- Supply chain practices and labor standards

- Social impact initiatives and community engagement

- Technology utilization for sustainability goals

- Legal and regulatory requirements, both domestic and international

Measure and Monitor Progress:

- Establish key performance indicators (KPIs) aligned with your ESG goals and priorities. Track metrics like carbon emissions, waste reduction, employee engagement, and community investment.

- Regularly assess progress against these KPIs and industry benchmarks. Identify areas for improvement and adapt your approach based on results.

- Communicate results to stakeholders and continuously improve your ESG due diligence process to ensure long-term effectiveness.

Benefits of a Robust Process:

Implementing a robust ESG due diligence process offers several benefits for organizations, including:

- Attracting Investors and Customers:

A strong ESG strategy sets organizations apart, attracting investors seeking sustainable companies and customers aligning with their values. - Mitigating Risks:

Proactive identification and mitigation of ESG-related risks helps avoid reputational damage, legal liabilities, and financial losses. - Building a Positive Reputation:

Strong ESG performance builds trust and credibility with stakeholders, enhancing brand value and attracting top talent, investors, and customers. - Identifying Cost-Saving Opportunities:

Increased energy efficiency, waste reduction, and sustainable practices can lead to cost savings. - Driving Sustainable Growth:

Integrating ESG considerations into operations contributes to a more sustainable future and long-term business resilience.

Best Practices and Strategies for Effective ESG Due Diligence:

- Tailor the approach:

Recognize that there's no one-size-fits-all solution. Different sectors have varying ESG priorities and risks. Tailor your process to align with your sector and geographic considerations. - Start early:

Integrate ESG due diligence early, ideally alongside other due diligence processes. Early engagement allows for thorough assessments and early identification of issues. - Prioritize key factors:

Identify the most critical ESG factors for your organization and prioritize them in your process. Consider the materiality of each factor and focus on those with the most significant impact. - Engage stakeholders:

Involve key stakeholders, including employees, board members, and executives, to gain insights and ensure alignment with ESG principles. Conduct interviews, on-site visits, and risk assessments to gather comprehensive information.. - Stay informed:

Continuously update your knowledge on industry best practices, regulations, and emerging standards. Engage with peers, regulators, and policymakers to exchange knowledge and ensure compliance with evolving ESG requirements.

- Measure and monitor progress:

Establish metrics and key performance indicators (KPIs) to track your organization's ESG performance over time. Regularly assess progress against these metrics and compare performance to industry benchmarks.

- Collaborate with external experts:

Consider engaging external experts like ESG consultants for specialized guidance, data analysis, and verification.

The Future of ESG Due Diligence:

ESG due diligence is still evolving, with several key trends shaping the future:

- Mandatory Reporting Standards:

Regulatory bodies worldwide are considering or implementing mandatory ESG reporting standards, leading to more standardized, comparable, and reliable data. - ESG-Linked Performance Metrics:

Increasingly, companies are developing ESG-linked performance metrics tied to executive compensation and bonuses, further aligning interests with sustainable practices. - Evolving Regulations:

Regulatory landscapes related to ESG are constantly evolving, necessitating continuous monitoring and adaptation of due diligence approaches. - Data Collection Advancements:

Technological advancements, like satellite imagery and artificial intelligence, will enhance data collection and analysis, providing deeper insights into companies' ESG performance. - Global Considerations:

As concerns about global issues like climate change and human rights grow, ESG due diligence will likely adopt a more global perspective, encompassing broader societal and environmental impacts.

ESG due diligence is no longer a peripheral activity, but a core component of responsible business practices. By integrating ESG considerations into their operations and decision-making processes, companies can attract investors, build trust with stakeholders, mitigate risks, and drive sustainable growth. Understanding the evolving legal and regulatory landscape, integrating ESG with risk management, engaging stakeholders effectively, and utilizing robust measurement and reporting frameworks are key to successful ESG due diligence. Additionally, embracing emerging technologies and adopting a globally aware and culturally sensitive approach are crucial for navigating the complexities of international business. By committing to continuous improvement and embracing innovation, companies can contribute to a more sustainable and equitable future for all.

- #ESG

- #Environment

- #Social

- #Governance

- #DueDiligence