- 7 minutes read

New Anti Money Laundering Regulation Package Adopted by European Council

As of May 30, 2024, in a big step forward in fighting financial crime, the European Council has adopted a new and comprehensive package of rules aimed at enhancing the European Union‘s ability to tackle money laundering and terrorist financing. The new rules aim to create a stricter and more consistent system for financial institutions, businesses, and authorities in all member states. The new regulatory package marks a critical development in the EU’s ongoing efforts to strengthen its financial system against illicit activities. Money laundering and terrorist financing have long been recognized as serious threats to economic stability and security. By adopting these new rules, the European Council aims to close existing loopholes, ensure better cooperation among member states, and enhance the overall integrity of the EU’s financial landscape.

“The new and stricter rules will strengthen our systems in the fight against money laundering and terrorist financing. A new agency based in Frankfurt will supervise the work of actors involved. This will ensure that fraudsters, organized crime and terrorists will have no space left for legitimizing their proceeds through the financial system” Stated Vincent Van Peteghem, Belgian minister for finance.

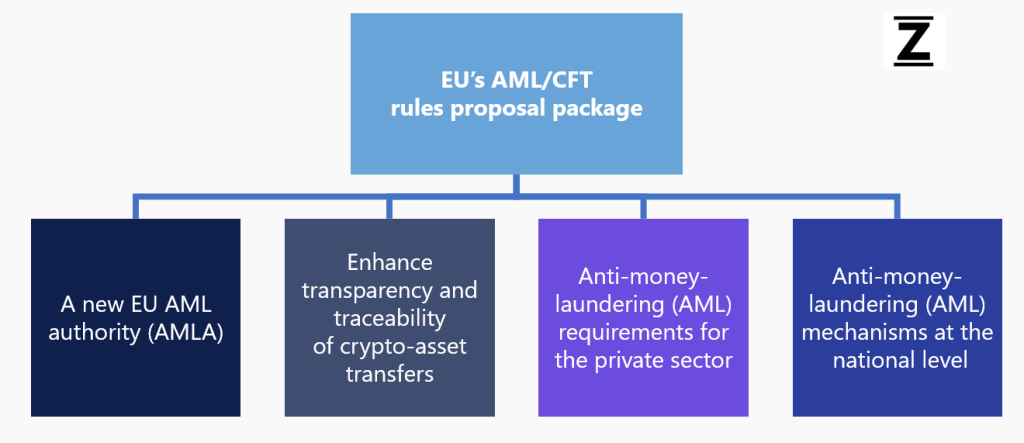

With the new package, all rules for the private sector will be moved to a new regulation that applies directly. A separate directive will handle how national authorities organize their efforts to fight money laundering and terrorism financing (AML/CFT). This regulation will standardize anti-money laundering rules across the EU for the first time, closing any gaps that fraudsters might exploit.

- The new regulation expands anti-money laundering rules to include new groups, such as most of the crypto sector, traders of luxury goods, and football clubs and agents. It also imposes stricter due diligence requirements, regulates beneficial ownership, and sets a limit of €10,000 for cash payments, among other measures.

- The directive will enhance national anti-money laundering systems by establishing clear rules on how Financial Intelligence Units (FIUs) - the national bodies that gather information on suspicious or unusual financial activities - and supervisors should work together.

- A new European Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA) is in process of being set that will have direct and indirect supervisory powers over high-risk obliged entities in the financial sector.

- Given that financial crime is cross-border, the new authority will make the AML/CFT framework more effective by working closely with national supervisors to ensure entities in the financial sector follow AML/CFT rules. AMLA will also assist the non-financial sector and support and coordinate the work of FIUs.

- The new anti-money laundering directive requires EU member states to make information from central bank account registers - showing who has which bank account and where - accessible through a single access point. Only FIUs will have access to this under the AML directive. To ensure national law enforcement authorities can also access these registers, the Council adopted a separate directive. This directive also standardizes bank statement formats. This direct access and standardized format are crucial tools for fighting crime and tracing and confiscating criminal proceeds.

Implementation And Next Steps

The adopted package of rules will now be implemented across all EU member states. Each country will be responsible for incorporating the new regulations into their national legal frameworks. The European Commission will oversee the implementation process to ensure consistency and effectiveness across the Union. To support businesses and financial institutions in complying with the new rules, the European Council has also announced plans for a series of guidelines and best practice recommendations. These resources will provide practical advice on how to meet the enhanced due diligence requirements, establish beneficial ownership registers, and enhance cooperation with authorities.

The adoption of this comprehensive anti-money laundering regulation package by the European Council represents a decisive step forward in the fight against financial crime in the European Union. By strengthening due diligence requirements, increasing transparency, enhancing cooperation, and imposing stricter sanctions, the new rules aim to create a more robust and secure financial system. As these regulations come into effect, they will play a crucial role in safeguarding the EU's economy and security from the pervasive threats of money laundering and terrorist financing.

Why Are AML Regulations Necessary?

Money laundering and terrorist financing are major threats to the integrity and stability of financial systems worldwide. These illicit activities undermine economic stability, facilitate organized crime, and compromise national security. Effective AML regulations are necessary to prevent criminals from using financial institutions to legitimize their proceeds and to disrupt the financial networks that support terrorist activities. By closing regulatory loopholes, enhancing transparency, and promoting cooperation among financial institutions and authorities, AML regulations help to safeguard the financial system and protect the broader economy from the adverse impacts of financial crime. They also build public trust in financial institutions by ensuring that these entities operate with integrity and accountability.

ZIGRAM helps financial institutions and businesses comply with the new AML regulations. ZIGRAM specializes in providing data asset solutions that enable organizations to manage compliance, risk, and governance more effectively. With its advanced technology and expertise in regulatory compliance, ZIGRAM can assist institutions in implementing robust due diligence processes, establishing comprehensive beneficial ownership registers, and enhancing cooperation with regulatory authorities. By leveraging ZIGRAM's solutions, businesses can ensure they meet the stringent requirements of the new AML framework, thereby reducing their risk of exposure to financial crime and contributing to the overall integrity of the EU's financial system.

- #AMLPackage

- #AML

- #Compliance

- #RegTech

- #EuropeanUnion

- #GlobalRegulations

- #FinancialSecurity