Published Date:

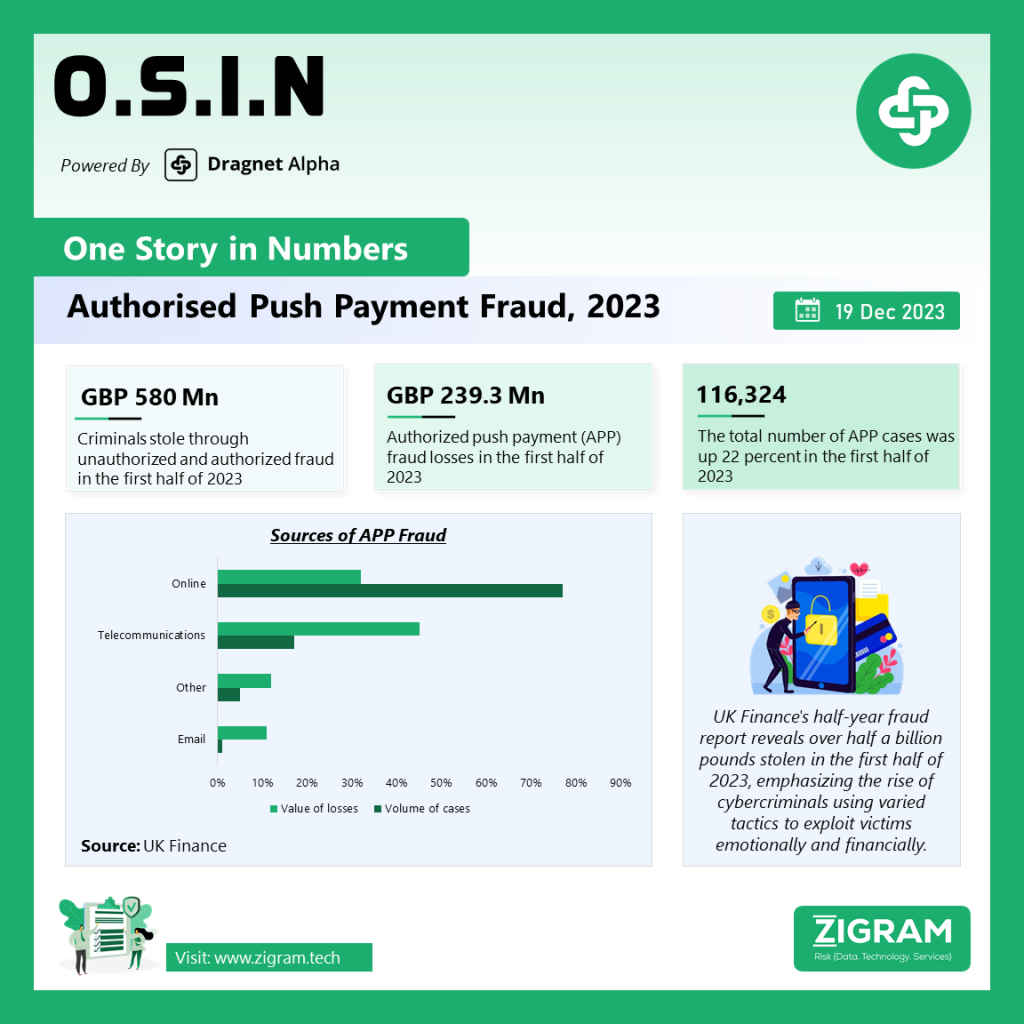

The UK Finance half-year fraud report for 2023 reveals a notable decrease of two percent in the amount stolen through unauthorized and authorized fraud compared to the same period in 2022. Criminals managed to pilfer GBP 580 million during the first half of the year, prompting an urgent call for increased collaboration across sectors to combat evolving fraud tactics.

Fraud Prevention Efforts:

Banks played a crucial role in mitigating fraud risks, preventing an additional GBP 651 million of unauthorized fraud through advanced security systems. The financial services sector emerges as a leader in the fight against fraud, actively collaborating with other sectors, government, and law enforcement to prevent and disrupt criminal activities.

Modus Operandi:

The report highlights that 77% of Authorized Push Payment (APP) fraud cases originated online, while another 17% were initiated through telecommunications networks. Criminals adeptly leverage social media, online platforms, texts, phone calls, and emails to deceive victims into divulging personal details and parting with their money.

Human Impact:

Beyond financial losses, the report underscores the callous manipulation of victims, resulting in psychological and emotional harm. Criminals increasingly exploit various digital channels, emphasizing the need for a holistic approach to prevent and address the multifaceted impact of fraud.

Sector Collaboration and Reimbursement:

While the financial services sector stands as the sole entity reimbursing victims, the report urges other sectors to contribute more actively in preventing fraud. Collaboration is deemed essential to address criminal activities increasingly taking place on platforms beyond traditional banking.

APP Fraud Landscape:

Authorized Push Payment (APP) fraud losses amounted to GBP 239.3 million, reflecting a one percent decrease compared to the previous year. This figure includes GBP 196.7 million in personal losses and GBP 42.6 million in business losses.

Increasing Cases and Purchase Scams:

The total number of APP cases surged by 22%, reaching 116,324, driven primarily by a 43% increase in purchase scams. These scams, where victims are tricked into paying for non-existent goods, accounted for two-thirds of all APP cases, with losses escalating by 31% to GBP 40.9 million.

Romance Scams on the Rise:

Romance scams witnessed a 29% increase in cases, accompanied by a 26% rise in losses, totalling GBP 18.5 million. Criminals exploit online dating platforms to deceive victims into believing they are in a relationship, emphasizing the need for heightened awareness in this digital age.

Decline in Impersonation Fraud:

Fraud cases involving impersonation of banks or the police, convincing victims to transfer money to a “safe account,” saw a substantial decline of 35%, with losses decreasing by 27%. Increased consumer awareness and warnings likely contributed to this positive trend.

Reimbursement and Victim Relief:

Despite the challenges, the report indicates a positive trend in victim reimbursement, with GBP 152.8 million of APP losses returned to victims in H1 2023, representing 64% of the total loss. This marks a 13% increase from GBP 135.6 million in H1 2022, showcasing ongoing efforts to provide relief to those affected by fraud.

The UK Finance half-year fraud report highlights the persistent threat of fraud, especially in the digital landscape. While the financial services sector remains committed to reimbursing victims, a collaborative, cross-sectoral approach is imperative to effectively prevent and address the evolving tactics employed by criminals. The report emphasizes the necessity for a comprehensive strategy to safeguard consumers, reduce financial losses, and alleviate the emotional toll inflicted by fraudulent activities.

- #FraudPrevention

- #FraudAwareness

- #DigitalFraud

- #APPFraud

- #CyberCrime

- #ScamPrevention

- #OnlineSafety

- #FraudTactics

- #RomanceScams

- #PurchaseScams

- #VictimReimbursement

- #FinancialLosses

- #FraudVictims