Published Date:

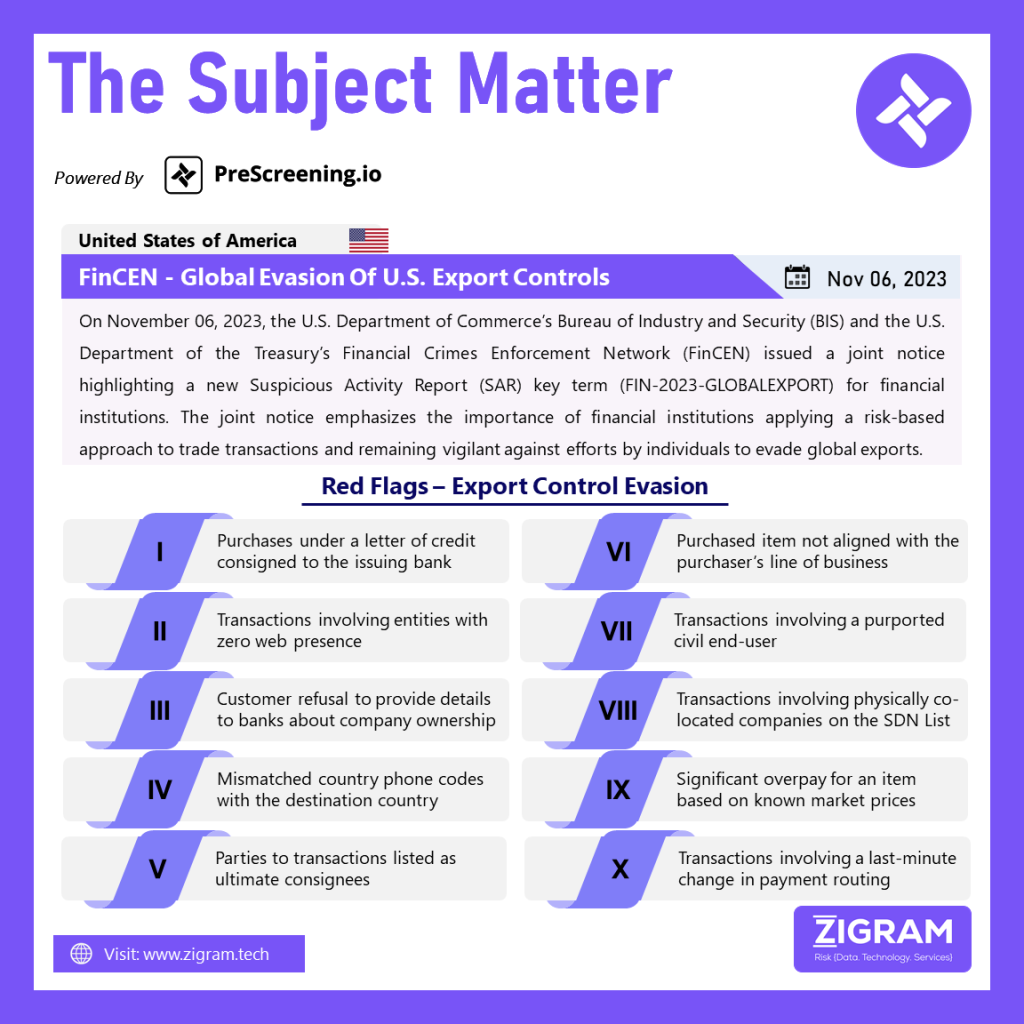

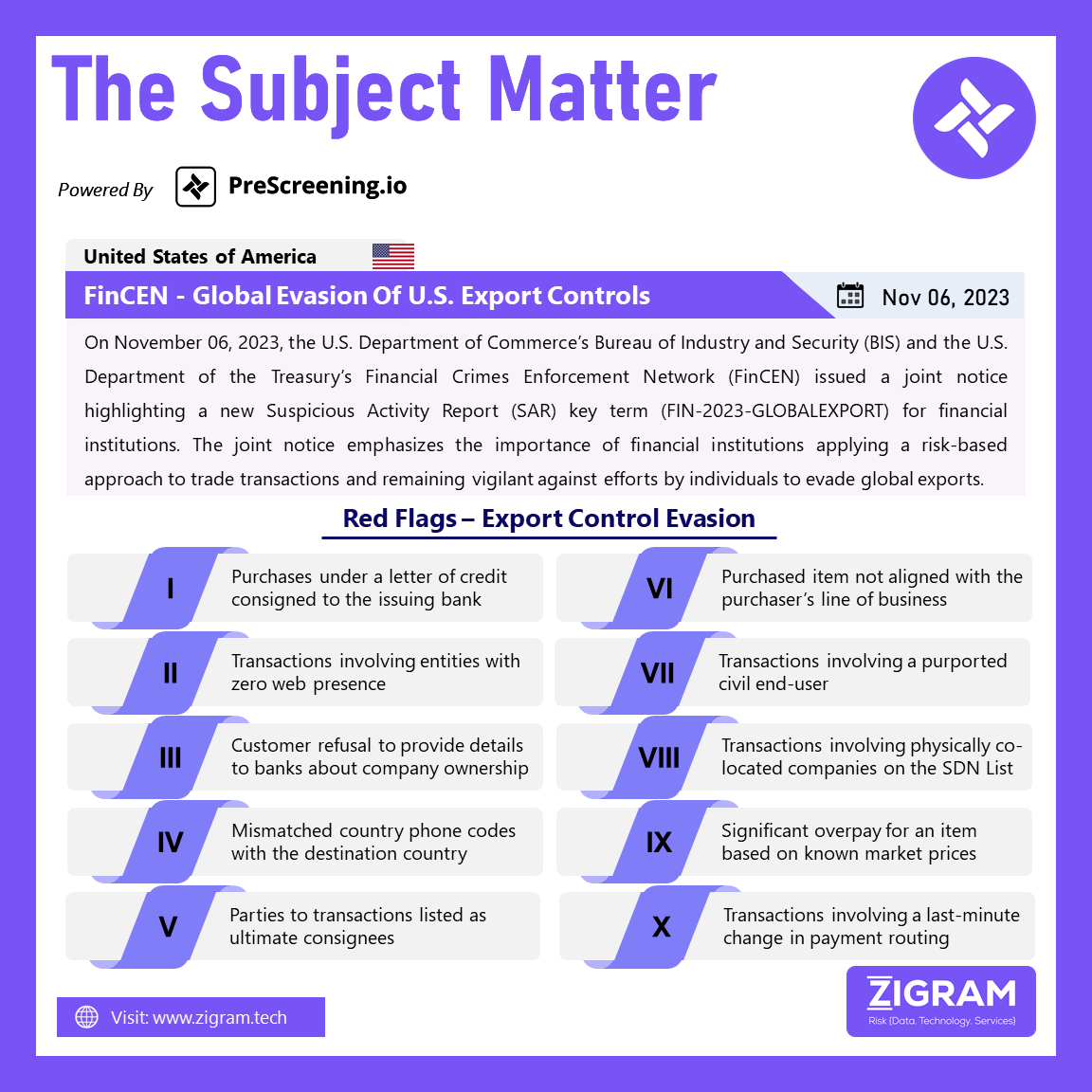

On November 06, 2023, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) and the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a joint notice highlighting a new Suspicious Activity Report (SAR) key term (FIN-2023-GLOBALEXPORT) for financial institutions. The joint notice emphasizes the importance of financial institutions applying a risk-based approach to trade transactions and remain vigilant against efforts by individuals to evade global exports.

The red flags to assist financial institutions in identifying transactions potentially tied to evasion of U.S. export controls are:-

1- Purchases under a letter of credit consigned to the issuing bank

2- Transactions involving entities with zero web presence

3- Customer refusal to provide details to banks about company ownership

4- Mismatched country phone codes with the destination country

5- Parties to transactions listed as ultimate consignees

6- Purchased item not aligned with the purchaser’s line of business

7- Transactions involving a purported civil end-user

8- Transactions involving physically co-located companies on the SDN List

9- Significant overpay for an item based on known market prices

10- Transactions involving a last-minute change in payment routing

- #moneylaundering

- #compliance

- #antimoneylaundering

- #prescreening

- #subjectmatter

- #amlcft

- #riskbasedapproach

- #suspicioustransactions

- #bis

- #fincen

- #usa