The Financial Crimes Enforcement Network (FinCEN) has released its Year in Review for Fiscal Year 2023, a five-page infographic-packed report aimed at providing stakeholders with insights into the collection and use of Bank Secrecy Act (BSA) data. This report highlights FinCEN’s efforts to support law enforcement and national security agencies through BSA reporting, offering a snapshot of the statistics from FY 2023 on BSA reporting, its queries, and its use by law enforcement.

Overview of BSA Reporting in FY 2023

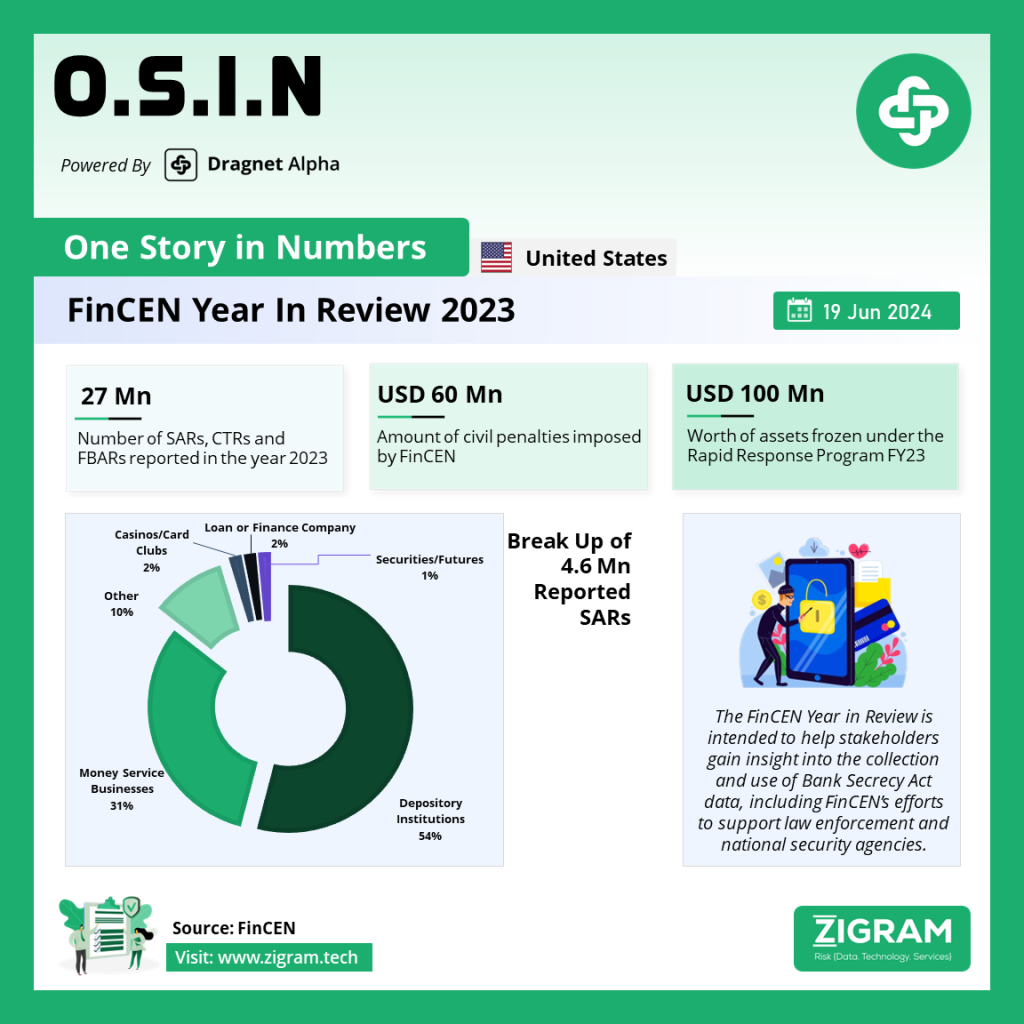

FinCEN’s Year in Review (YIR) reveals that approximately 294,000 financial institutions and other e-filers are registered to submit BSA reports. In FY 2023, these entities collectively filed:

– 4.6 million Suspicious Activity Reports (SARs)

– 20.8 million Currency Transaction Reports (CTRs)

– 1.6 million Reports of Foreign Bank and Financial Accounts (FBARs)

– 421,500 Forms 8300 concerning cash payments over USD 10,000 received in a trade or business

– 143,200 Reports of International Transportation of Currency or Monetary Instruments (CMIRs) for cross-border transactions exceeding USD 10,000

This massive volume of SARs and CTRs highlights the ongoing challenge of ensuring their effectiveness and usefulness, particularly given the phenomenon of “defensive filing” by financial institutions to avoid regulatory scrutiny.

Use of SARs and CTRs by Law Enforcement

The YIR underscores that the primary consumer of SARs within law enforcement is the Internal Revenue Service – Criminal Investigation (IRS-CI). According to the IRS-CI Report for 2023:

– 85.7% of investigations recommended for prosecution during FYs 2021 to 2023 had a primary subject with a related BSA filing.

– IRS-CI recommended 1,838 matters for prosecution in FY 2023, suggesting that approximately 1,575 cases involved BSA filings.

– 13.9% of all investigations opened in FY 2023 originated from BSA data, translating to roughly 372 investigations.

The FBI also made significant use of BSA data. In FY 2023:

– 11,367 FBI investigative subjects were also subjects of SARs.

– Approximately 15.42% of active FBI investigations were directly linked to SARs and CTRs.

Despite the significant number of SARs filed, the combined IRS-CI and FBI cases involving SARs represented less than 0.3% of all SARs filed in FY 2023, indicating a relatively small portion of filings become relevant to federal criminal investigations.

Section 314 Information Sharing

The YIR provides insights into the utilization of Section 314 information sharing, a tool designed to enhance collaboration between the government and financial institutions, as well as among financial institutions themselves, to combat illicit finance:

Section 314(a)

– Approximately 14,000 financial institutions participate.

– In FY 2023, there were 588 requests from 71 law enforcement agencies regarding 4,606 subjects, eliciting 55,400 responses.

Section 314(b)

– 7,790 financial institutions have registered to participate.

– This number is a small fraction of the 294,000 registered to file BSA reports.

– Most registrants are banks or credit unions (4,458), followed by investment advisers or other securities/futures entities (1,770).

– Over 26,400 SARs referenced Section 314(b), filed by over 1,300 financial institutions, indicating some level of engagement with this collaborative tool.

FinCEN’s Year in Review for FY 2023 illustrates the extensive scope of BSA reporting and its critical role in supporting law enforcement and national security. While the sheer volume of reports presents challenges in terms of their practical utility, the data underscores the importance of continued efforts to enhance the effectiveness of BSA filings. Moreover, the underutilization of Section 314 information sharing suggests there is significant potential for greater collaboration and impact in combating financial crimes. FinCEN’s commitment to transparency and ongoing improvements in the use of BSA data remains vital in the fight against illicit financial activities.

Read the full report here.

- #FinCEN

- #BSAData

- #FinancialCrimes

- #AML

- #SuspiciousActivityReports

- #CurrencyTransactionReports

- #IRS

- #FBI

- #LawEnforcement

- #FinancialInstitutions

- #Compliance

- #MoneyLaundering