Published Date:

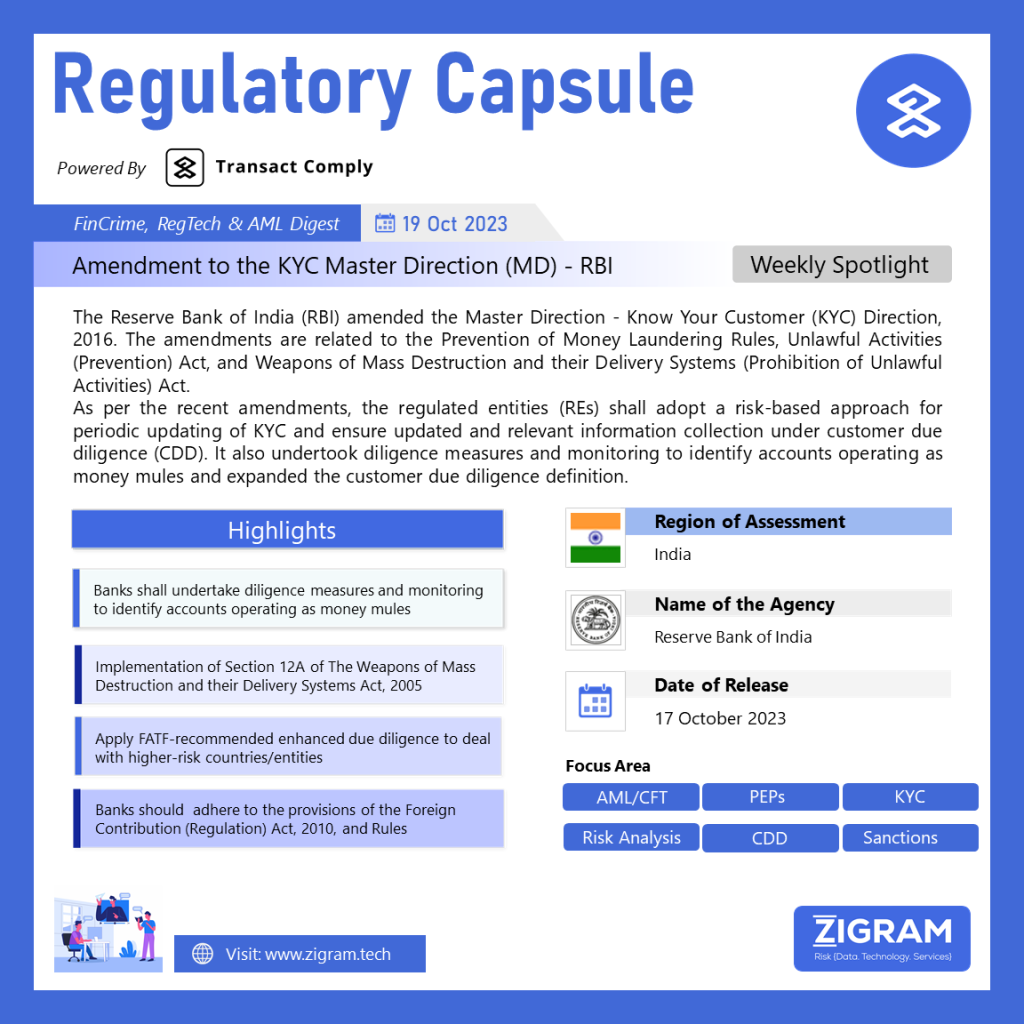

The Reserve Bank of India (RBI) amended the Master Direction – Know Your Customer (KYC) Direction, 2016. The amendments are related to the Prevention of Money Laundering Rules, Unlawful Activities (Prevention) Act, and Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act.

As per the amendments Regulated entities (REs) must follow a risk-based approach for periodic KYC updates and gather relevant customer information. They are also required to monitor accounts for potential money mule activity and expand the definition of customer due diligence.

In compliance with the Prevention of Money Laundering Rules, REs within a group must implement group-wide policies for sharing information and managing money laundering and terror financing risks. They should adopt a Risk-Based Approach for risk mitigation and have board-approved policies. REs must monitor and enhance controls as needed. Banks must adhere to the Foreign Contribution (Regulation) Act, 2010, and follow RBI instructions based on advice from the Ministry of Home Affairs.

- #KYC

- #AML

- #RBI

- #MoneyMule

- #TerrorFinancing

- #RiskBasedApproach

- #PMLA

- #GroupWidePolicies

- #FinancialRegulation

- #Compliance

- #India