Published Date:

Welcome to our weekly newsletter that provides the most recent updates and insights regarding AML, financial crime compliance, and emerging risks.

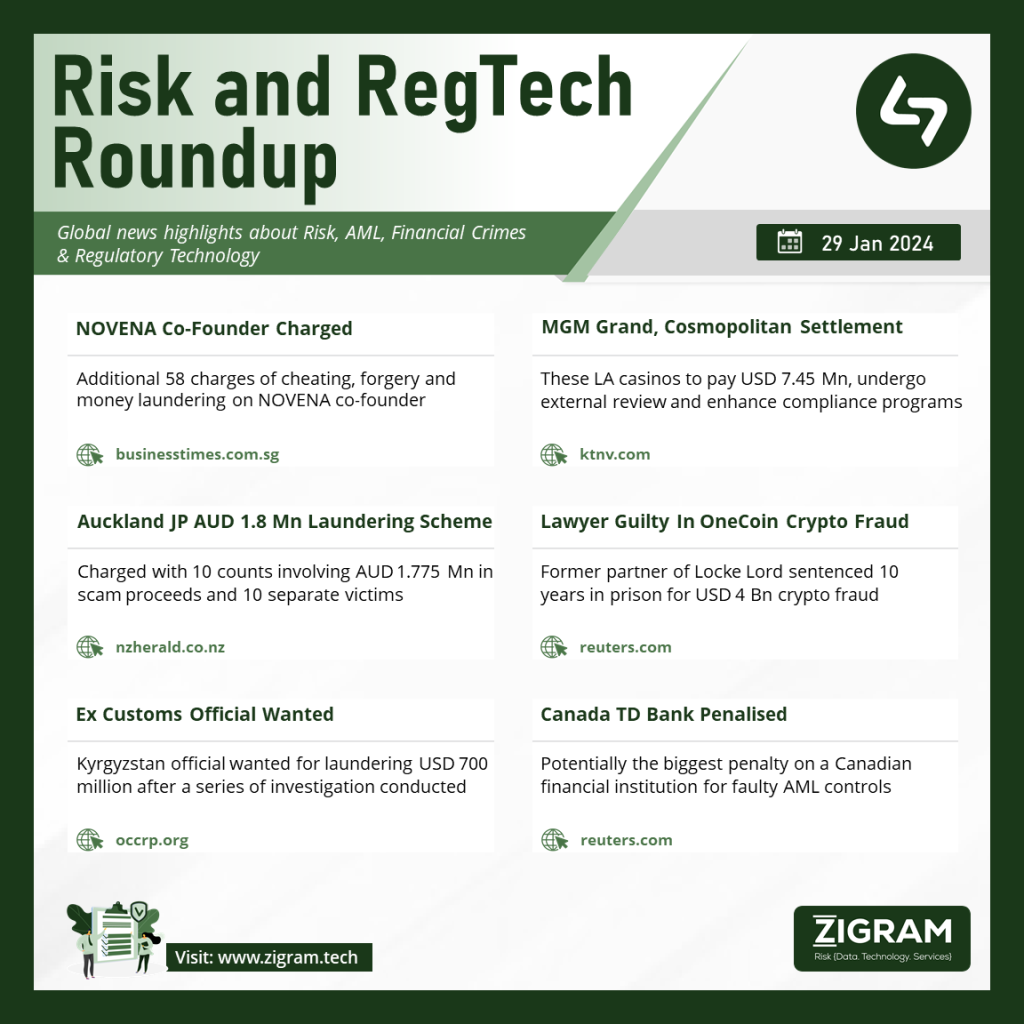

This week NOVENA Global Healthcare Group’s (NGHG) co-founder and former director Nelson Loh has been charged in court with 58 additional counts of cheating, forgery and money laundering offences. Furthermore, The former president of the MGM Grand casino has pleaded guilty to a federal charge for failing to file required reports of “suspicious transactions.” Following an investigation into alleged violations of money laundering laws and the Bank Secrecy Act, the MGM Grand and The Cosmopolitan of Las Vegas casinos have entered into settlements that require them to pay a combined $7.45 million, undergo external review, and enhance their anti-money laundering compliance program.

Moving on in New Zealand, an Auckland JP accused of being part of an elaborate international investment scam by allegedly laundering $1.8 million in stolen money has appeared in court and been granted suppression. The pensioner was arrested on Tuesday after a months-long police investigation. He was charged with 10 counts of money laundering, which allegedly involves USD 1.775m in scam proceeds and 10 separate victims. In another story, a former partner at U.S. law firm Locke Lord was sentenced to 10 years in prison on Thursday for his role in a nearly $400 million fraudulent cryptocurrency scheme. Mark Scott, 55, of Coral Gables, Florida, was found guilty of conspiracy to commit money laundering and conspiracy to commit bank fraud in November 2019 stemming from his role in the OneCoin cryptocurrency fraud.

Moving forth Kyrgyzstan has placed a corrupt former customs official, Raimbek Matraimov, believed to have siphoned millions out of the country, on a wanted list following temporary detentions, deals with the judiciary and money laundering charges. A series of investigations about the former deputy head of the State Customs Service described how he used his political connections to help funnel an estimated USD 700 million out of Kyrgyzstan to a dozen countries worldwide. Lastly, Canada’s TD Bank opens a new tab and faces a significant monetary penalty after an examination by the financial crimes watchdog found faulty anti-money laundering controls. It was reported the monetary penalty is expected to exceed CAD 10 million (USD 7.44 million), which could be the biggest ever penalty slapped on a Canadian financial institution by the country’s anti-money laundering agency.

- #NovenaGlobalHealthcare

- #JusticeofPeace

- #OneCoin

- #CustomsFraud

- #TDBank

- #MGMGrand

- #Cosmopolitan

- #US

- #Canada

- #Kyrgyzstan

- #NewZealand