Published Date:

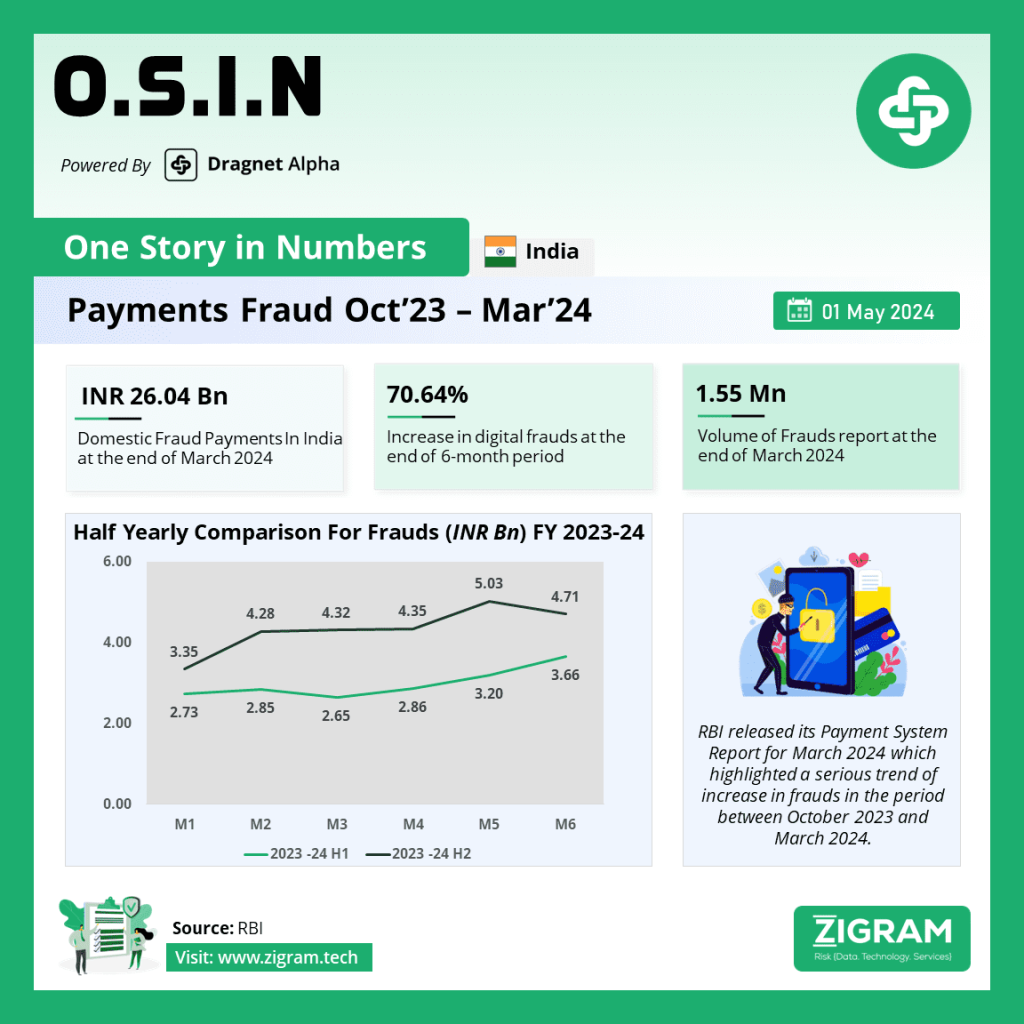

Recent data from the Reserve Bank of India (RBI) paints a concerning picture: payment frauds in India are on the rise, with domestic payment frauds witnessing a staggering increase of 70.64% to INR 26.04 billion during the six months ending March 2024, up from Rs 15.26 billion in the corresponding period of the previous year.

The volume of such fraudulent activities has also surged, reaching 1.551 million cases during March 2024 compared to 1.15 million cases in the preceding six months. This escalation is particularly alarming, as it signifies not just a monetary loss but also undermines trust in the banking system and poses significant operational and reputational risks for financial institutions.

It’s noteworthy that the data provided by the RBI encompasses various facets of financial transactions, including e-commerce transactions, FASTag usage, digital bill payments, and card-to-card transfers through ATMs. However, it excludes certain categories like failed transactions, chargebacks, reversals, and expired cards/wallets. This expanded scope underscores the evolving landscape of financial transactions, where digitalization has opened new avenues for both legitimate transactions and fraudulent activities.

The RBI’s acknowledgement of this concerning trend is evident in its recent reports, where it emphasizes the importance of leveraging new technologies to enhance banking operations while simultaneously addressing the heightened risks of fraud and data breaches. The regulatory body has proactively updated regulations to safeguard customers’ interests without stifling innovation, recognizing the delicate balance between fostering technological advancements and ensuring robust security measures.

Despite stringent regulations and technological advancements aimed at combatting fraud, perpetrators continue to devise sophisticated schemes to exploit vulnerabilities in the system. This is evident from the sudden surge in frauds reported in the credit and debit card, as well as internet segments, with the number of fraud cases skyrocketing by 624% during April-September of 2023-24 compared to the same period a year ago.

One contributing factor to this surge in frauds is the rapid expansion of credit card usage, with banks and non-banking financial institutions (NBFCs) adding 16.5 million credit card users during the fiscal year 2023-24. This increased adoption, coupled with attractive incentives such as reward points and EMI facilities, has made credit cards an appealing target for fraudsters.

Moreover, the proliferation of digital transactions, especially amidst the COVID-19 pandemic, has provided fraudsters with a broader attack surface, enabling them to exploit loopholes in online payment systems and compromise sensitive financial information.

In light of these developments, it is imperative for all stakeholders, including regulators, financial institutions, and customers, to collaborate in mitigating the risks associated with payment frauds. This entails implementing robust security protocols, enhancing fraud detection mechanisms, and fostering greater awareness among consumers about safe banking practices.

Furthermore, while technological innovations offer numerous benefits, they also necessitate constant vigilance and adaptation to emerging threats. By staying abreast of evolving trends and leveraging cutting-edge technologies like artificial intelligence and machine learning, the financial industry can stay one step ahead of fraudsters and safeguard the integrity of the banking ecosystem.

In conclusion, the escalating trend of payment frauds in India underscores the critical need for proactive measures to bolster cybersecurity and protect consumers’ financial interests. Only through concerted efforts and collaboration can we effectively combat fraud and ensure the resilience of our financial systems in an increasingly digital world.

Read the full report here.

Read about the news article here.

- #PaymentFrauds

- #FraudTrends

- #RBI

- #FinancialSecurity

- #DigitalTransactions

- #FraudPrevention

- #Cybersecurity

- #BankingTrends

- #CustomerProtection

- #RegulatoryUpdates

- #TechInnovation