Published Date:

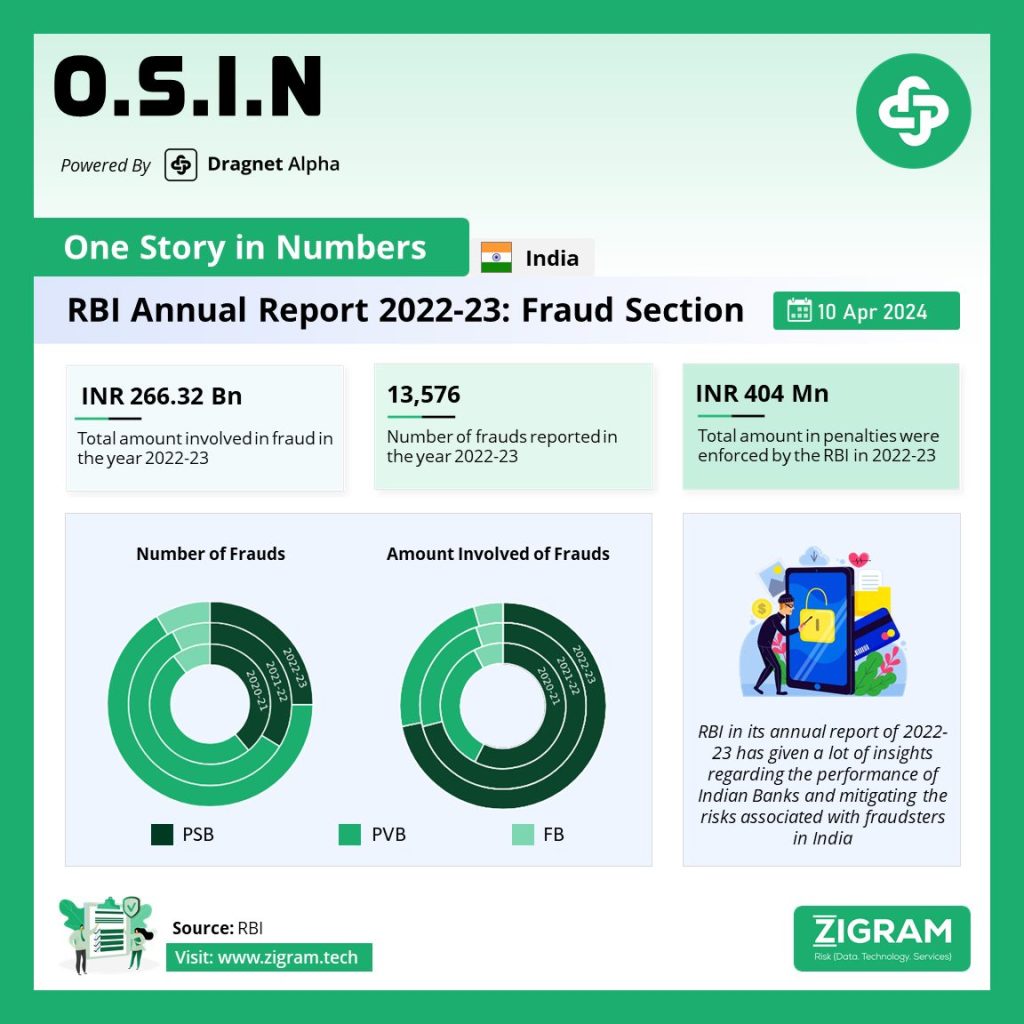

The fraud section of the Indian banking sector during 2022-23 witnessed several notable trends and developments. According to the data provided by the Reserve Bank of India (RBI), the number of reported fraud cases declined to a six-year low during this period. The average amount involved in frauds also decreased, with a concentration of cases in card or internet-related frauds. The majority of frauds in public sector banks (PSBs) were related to advances, while private sector banks (PVBs) accounted for a majority of card/internet and cash-related cases.

A detailed breakdown of frauds in various banking operations based on the date of reporting shows the number of frauds and the amount involved in different areas of operation for each financial year. The data reveals that advances given by the banks pose the highest frauds in terms of amount (INR 251.77 Bn) and card/internet frauds in terms of numbers (6,699).

Additionally, the document highlights the enforcement actions taken against regulated entities, including instances of imposition of penalties and the total penalty amount. It notes that the increase in instances of penalties imposed on regulated entities during 2022-23 was led by co-operative banks while penalties imposed on PSBs and PVBs declined during the year.

Furthermore, the report emphasizes the impact of frauds on the banking sector, noting that they lead to reputational, operational, and business risks for banks and undermine the stability of the financial system. It also discusses the importance of building resilience through good governance and robust risk management practices to address the evolving nature of risks faced by the banking system.

In conclusion, the fraud section of the Indian banking sector during 2022-23 reflects a decline in the number of reported fraud cases and the average amount involved, with a focus on advances, card/internet, and cash-related frauds. The report also underscores the need for effective enforcement actions and risk management practices to mitigate the impact of frauds on the banking sector.

Report in Detail : Reserve Bank of India – Trend and Progress of Banking in India

- #IndianBankingSector

- #FraudTrends

- #RBI

- #PublicSectorBanks

- #PrivateSectorBanks

- #EnforcementActions

- #Penalties

- #RiskManagement

- #FinancialStability

- #Governance

- #CooperativeBanks