Published Date:

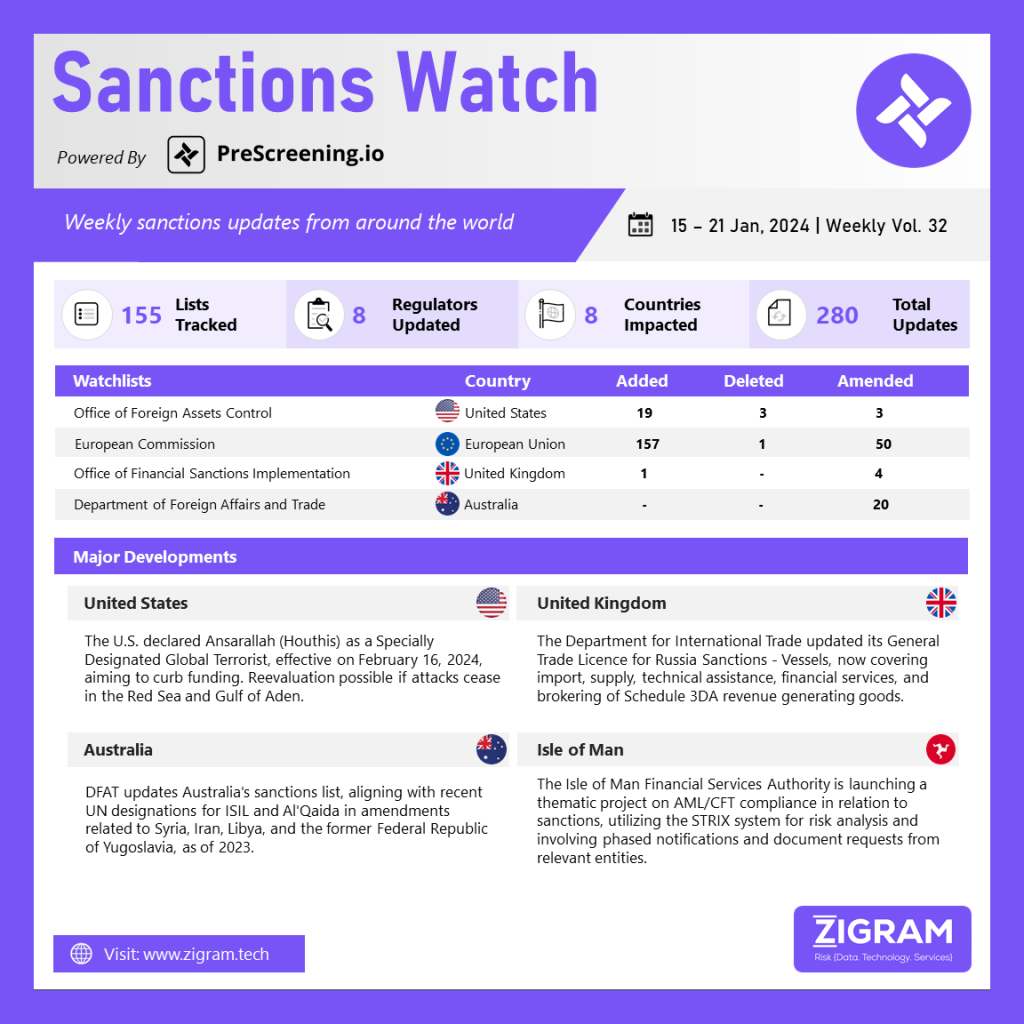

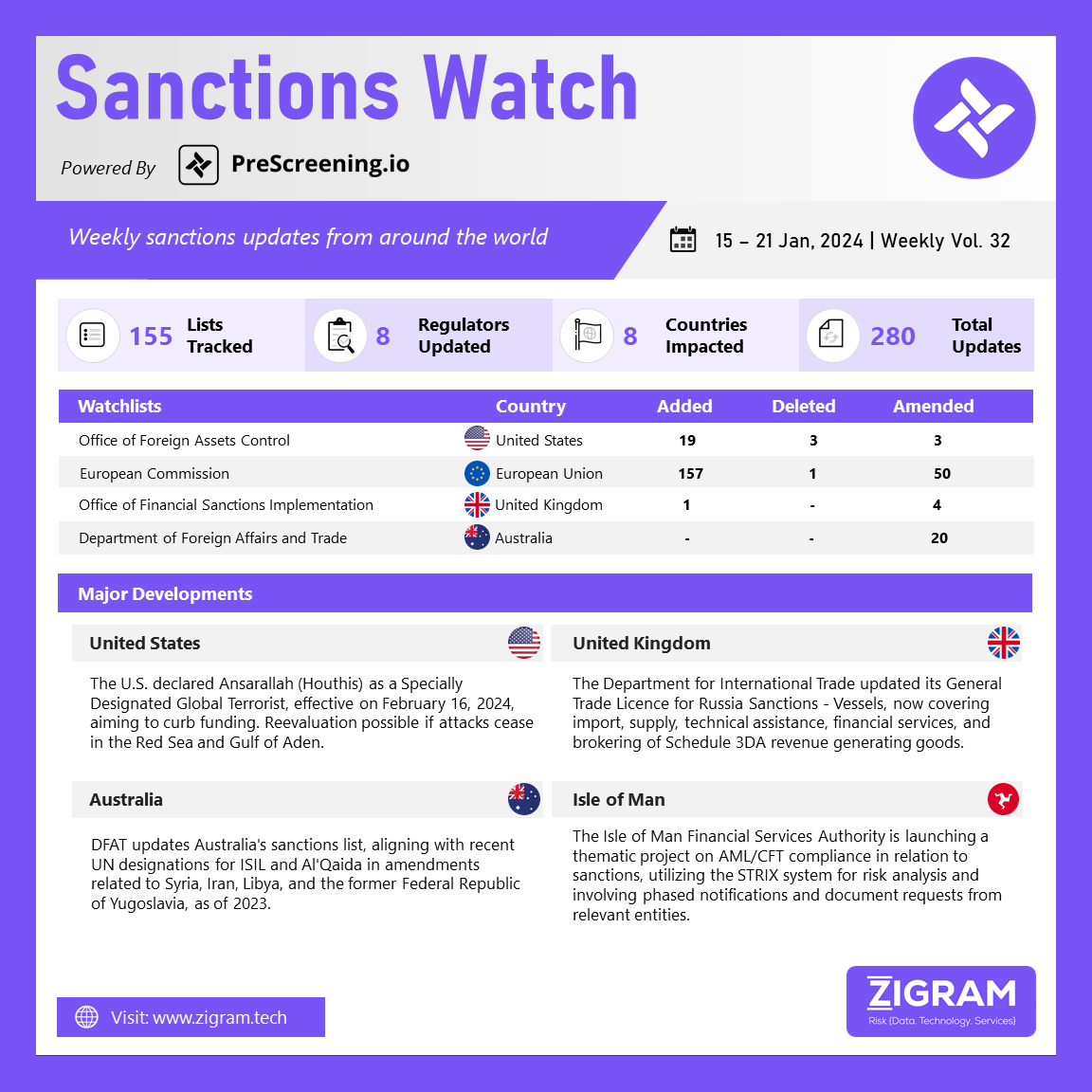

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

In recent months, Houthi militants based in Yemen have launched unprecedented attacks on United States military forces and international vessels in the Red Sea and Gulf of Aden, constituting clear acts of terrorism. These assaults have not only put U.S. personnel, civilian mariners, and global trade at risk but have also posed a threat to freedom of navigation. Responding to these ongoing threats, the United States has officially designated Ansarallah, or the Houthis, as a Specially Designated Global Terrorist. This strategic move aims to hinder terrorist funding, restrict financial market access, and hold the Houthis accountable for their actions. The designation will be implemented after 30 days, allowing for the establishment of humanitarian carve-outs to avoid negatively impacting the people of Yemen. Emphasizing the importance of preventing adverse effects on Yemenis, the U.S. assures that sanctions will not impede the flow of essential goods like food, medicine, and fuel into Yemeni ports. President Biden underscores the commitment to take further actions to safeguard U.S. citizens and maintain the smooth flow of international commerce.

The General Trade Licence Russia Sanctions – Vessels, issued by the Department for International Trade, has undergone a significant update. The revision expands the license’s coverage to encompass various regulations, enhancing its regulatory framework. Notably, the revised license now includes Regulation 46XB, governing the import of Schedule 3DA revenue-generating goods. Additionally, it addresses Regulation 46XD, focusing on the supply and delivery of such goods to a third country. The scope further extends to Regulation 46XE, covering technical assistance related to Schedule 3DA revenue-generating goods, and Regulation 46XF, which pertains to financial services and funds associated with these goods. Lastly, Regulation 46XG is now part of the license, specifically dealing with brokering services related to Schedule 3DA revenue-generating goods. This comprehensive update aligns the General Trade Licence with the evolving landscape of international trade regulations, ensuring a more robust and inclusive framework.

The Australia Department of Foreign Affairs & Trade (DFAT) has recently updated its consolidated sanctions list, aligning with the latest UN designations related to ISIL (Da’esh) and Al’Qaida. This adjustment is reflected in several legislative instruments, including the Autonomous Sanctions (Designated Persons and Entities and Declared Persons – Syria) Amendment (No. 1) Instrument 2023, the Autonomous Sanctions (Designated Persons and Entities and Declared Persons – Iran) Amendment (No. 3) Instrument 2023, the Autonomous Sanctions (Designated and Declared Persons—Former Federal Republic of Yugoslavia) Amendment (No. 1) Instrument 2023, the Autonomous Sanctions (Designated Persons and Entities and Declared Persons – Libya) Amendment (No. 1) Instrument 2023, and the Autonomous Sanctions (Designated Persons and Entities and Declared Persons—Zimbabwe) Amendment (No. 1) Instrument 2023. These measures signify Australia’s commitment to international efforts in combating terrorism and ensuring compliance with sanctions across various regions.

The Isle of Man Financial Services Authority (“the Authority”) is gearing up for the implementation of a thematic project centered on Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) compliance regarding sanctions. Spearheaded by the AML/CFT Supervision Division, the initiative will collaborate with other supervisory divisions where applicable. Set to kick off later this week, the thematic project will specifically target aspects of the Anti-Money Laundering and Countering the Financing of Terrorism Code 2019 (“the Code”). Phase 1 involves issuing a questionnaire via the new AML CFT Risk Analysis system, STRIX, to all pertinent entities. Phase 2 will see requests for relevant documentation sent concurrently with notifications of inclusion in this project’s second phase to license holders and designated businesses. The project’s staggered nature allows for gradual notifications and involvement of individual entities over time. Additional support and information on the Code are accessible on the Authority’s AML/CFT webpage, including resources like the Anti-Money Laundering & Countering the Financing of Terrorism Handbook, IOM Customs & Excise Sanctions Guidance, and the latest IOM Financial Crime Strategy 2024-2026. Ian Spence, Head of the AML/CFT Supervision Division, emphasized the island’s commitment to fulfilling international obligations related to sanctions, counterterrorism, and controls on the proliferation of weapons.

- #UnitedStates

- #Houthi

- #Ansarallah

- #Yemen

- #Vessels

- #Terrorism

- #SpeciallyDesignatedGlobalTerrorist

- #SDGT

- #GeneralTradeLicence

- #Russia

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #Russia

- #TradeRegulations

- #Australia

- #DepartmentofForeignAffairsAndTrade

- #DFAT

- #UN

- #ISIL

- #Al’Qaida

- #Syria

- #Iran

- #Yugoslavia

- #Libya

- #Zimbabwe

- #IsleofMan

- #FinancialServicesAuthority