Published Date:

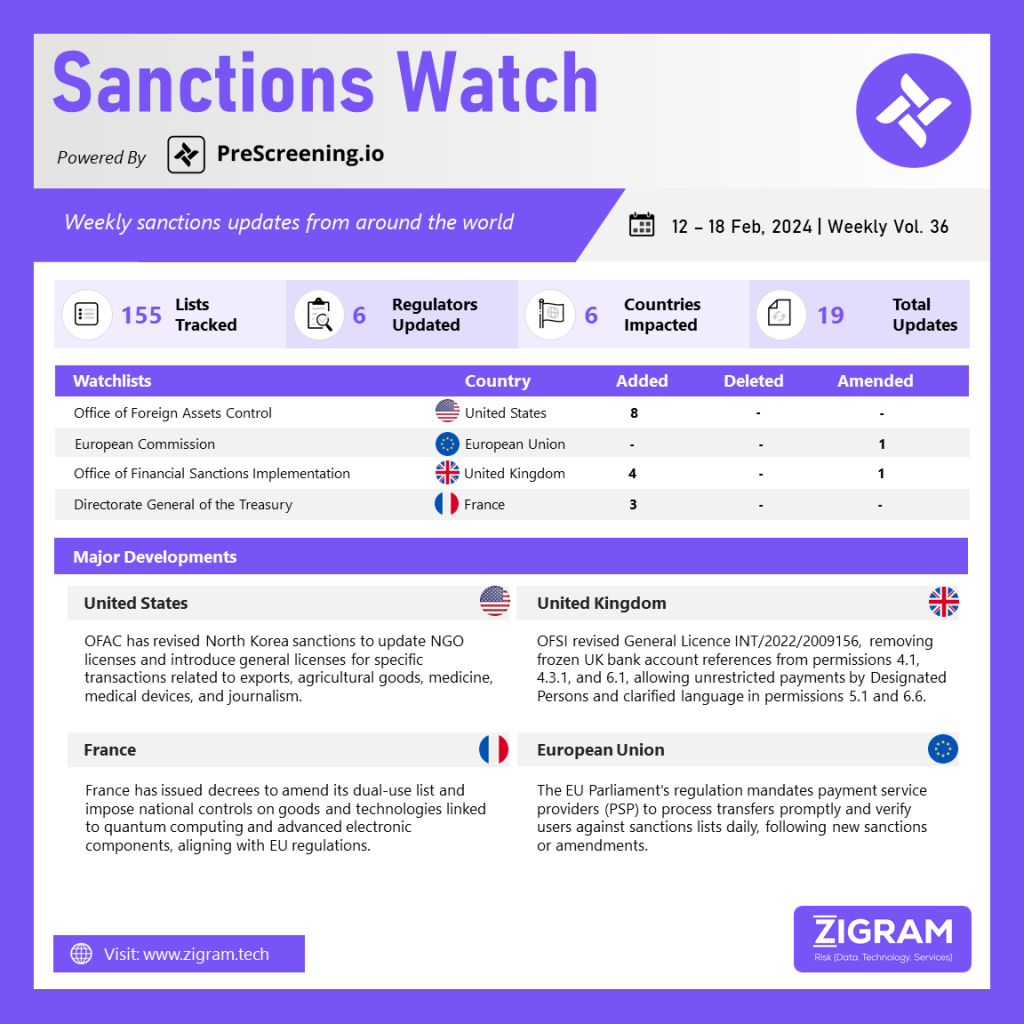

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The Office of Foreign Assets Control (OFAC) recently updated its North Korea sanctions regulations, specifically amending a general license for non-governmental organizations and introducing new general licenses. These licenses now allow specific transactions related to the export and re-export of items authorized by the US Department of Commerce, the provision of certain agricultural commodities, medicine, and medical devices, as well as certain journalistic activities in North Korea. In conjunction with these regulatory changes, OFAC has also published several new FAQs (1160, 1161, 1162, 1163) and revised existing ones (459, 463, 558) to provide clarity and guidance on these updates.

The Office of Financial Sanctions Implementation (OFSI) has revised General Licence INT/2022/2009156, making notable changes. In this update, references to frozen UK bank accounts have been eliminated from permissions 4.1, 4.3.1, and 6.1. This adjustment clarifies that designated persons (DPs) are not limited to making payments solely from frozen funds. Additionally, the language in permissions 5.1 and 6.6 has been refined for better clarity and understanding. These amendments aim to streamline the licensing process, ensuring that DPs have a clearer understanding of the permissions granted and their obligations. The revisions seek to enhance compliance with financial sanctions regulations by providing clearer guidelines for individuals and entities affected by the General Licence INT/2022/2009156.

France has recently updated its dual-use list and implemented national controls on items related to quantum computing and advanced electronic components. An 8 February decree aligned French control lists with those of the European Union, focusing on exports, imports, and transfers of dual-use goods and technologies. This was followed by a 2 February decree imposing national controls on exports to third countries of goods and technologies linked to quantum computers and their enabling technologies, along with equipment for designing, developing, producing, testing, and inspecting advanced electronic components.

The European Parliament has passed a regulation aimed at ensuring prompt processing of money transfers by payment service providers (PSPs). This regulation mandates PSPs to promptly verify whether any of their users are individuals or entities subject to sanctions. The verification must be done immediately after the implementation of any new sanctions measures and after the enactment of any amendments, and at least once every calendar day thereafter. The regulation emphasizes the urgency of these verification processes to prevent sanctioned individuals or entities from accessing or using payment services in violation of sanctions. Compliance with this regulation is crucial for PSPs to uphold the integrity of the financial system and to prevent the misuse of payment services for illicit activities.

- #OFAC

- #NorthKorea

- #GeneralLicense

- #DesignatedPersons

- #OFSI

- #France

- #EuropeanUnion

- #DualUseGoods

- #EuropeanParliament

- #PaymentServiceProviders

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #RegulatoryObligations

- #SanctionsBreaches

- #Compliance