Published Date:

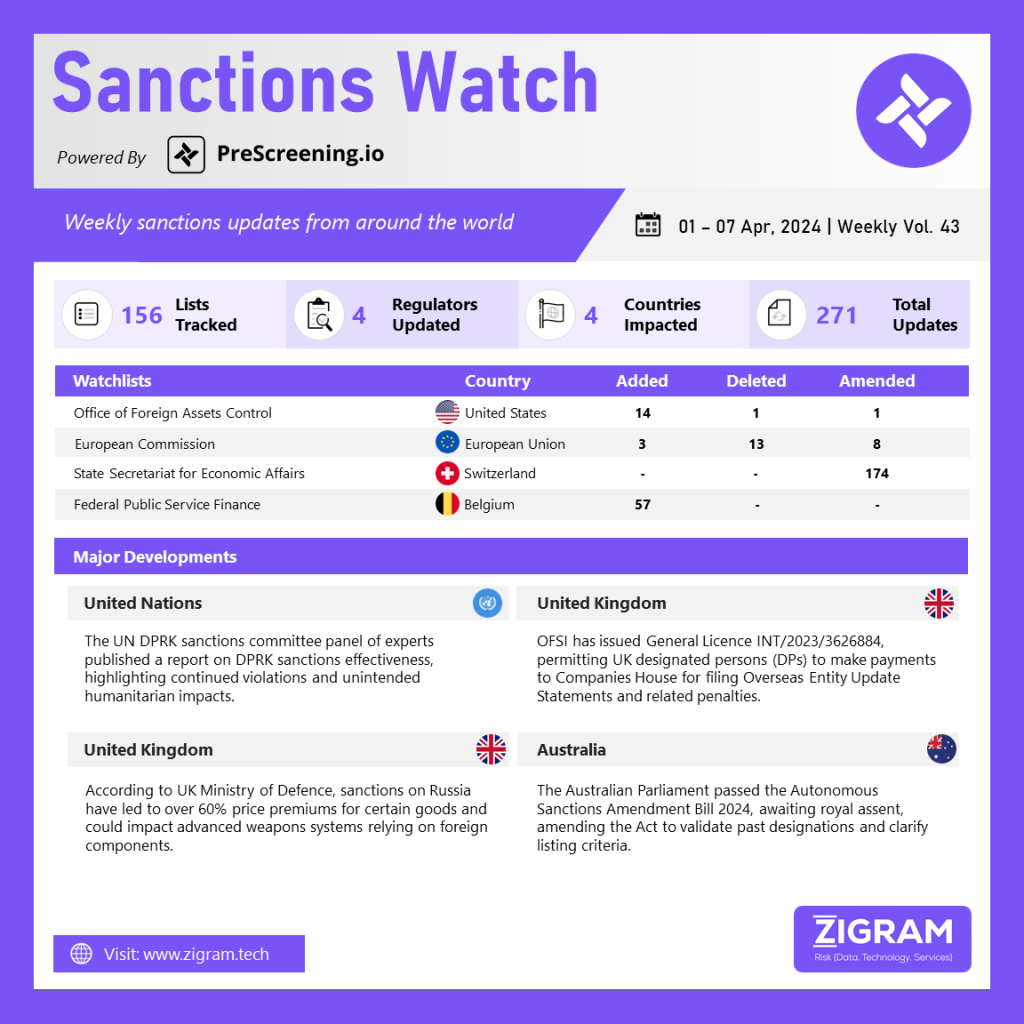

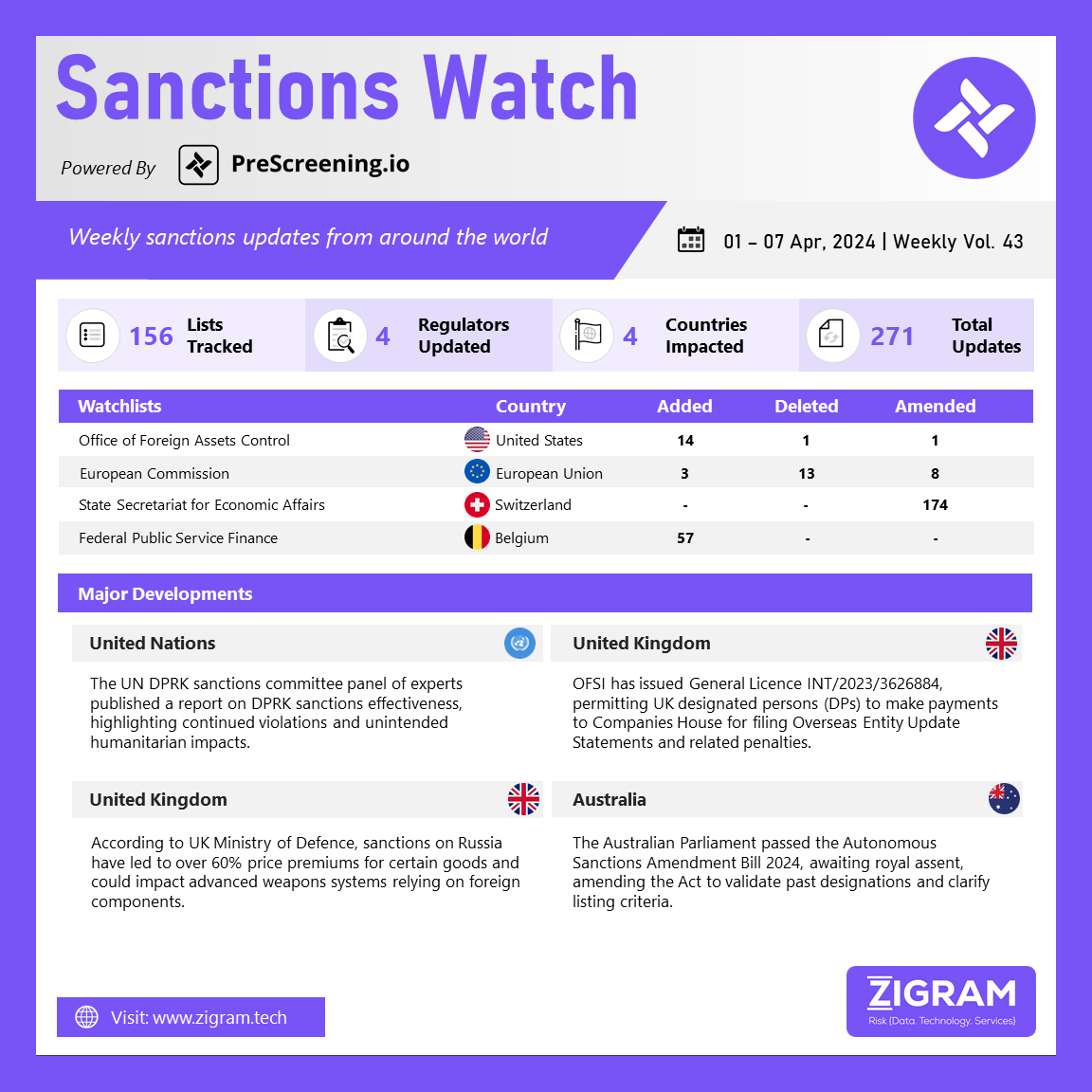

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The UN DPRK sanctions committee panel of experts, whose renewal Russia recently vetoed, released a report on sanctions’ effectiveness in the DPRK. The report highlights ongoing violations, such as nuclear weapons development, importing petroleum products, and accessing the international financial system. To evade maritime sanctions, DPRK vessels use false destinations, inconsistent identifiers on AIS, and ship-to-ship transfers under darkness. Imports, exports, and trade with Russia are increasing, with luxury goods entering the country. The Panel is investigating reports of weapons supplies to the DPRK. Additionally, UN sanctions unintentionally impact the humanitarian situation due to overcompliance and procurement delays.

OFSI has expanded the list of permitted payments under General Licence by adding two permissions. The first permission allows the payment of fees by or due from UK Designated Persons (DPs) to Companies House for filing an Overseas Entity Update Statement concerning entities on the Register of Overseas Entities. The second permission permits the payment of penalties by or due from UK DPs to Companies House. These penalties are incurred due to failure to register as an entity on the Register of Overseas Entities or failure to provide an Overseas Entity Update Statement for entities listed on the Register of Overseas Entities.

The UK Ministry of Defence released a defence intelligence update regarding sanctions on Russia. The update cites research from the Bank of Finland Institute for Emerging Economies, revealing that third-party countries are imposing price premiums exceeding 60% on exports of certain sanctioned goods to Russia. Despite Russia’s increased production of key munitions, the sanctions are expected to have the greatest impact on its more advanced weapons systems, which likely heavily rely on foreign components. Additionally, the Stockholm International Peace Research Institute reports that Russia’s global arms trade share has decreased to 11% for the period 2019-2023, down from 21% in the period 2014-2018.

The Australian Autonomous Sanctions Amendment Bill 2024, as outlined in the explanatory memorandum, has passed both Houses of the Australian Parliament and awaits royal assent from the Governor-General for enactment. The bill amends the Autonomous Sanctions Act 2011 in response to recent de-listing judgments, specifically Deripaska and Abramov, by inserting section 10A to allow valid designation of individuals and entities based on past actions or positions held, regardless of the time elapsed. It also retrospectively validates past designations and affirms the validity of designation decisions even if the Minister did not consider their discretion. The amendments are described in the memorandum as clarifications rather than substantive changes. The Australian Senate Standing Committee for the Scrutiny of Bills has expressed concern about the retrospective validation of designations, particularly regarding individuals who have structured their activities assuming these designations would be invalidated by the court, and how this would affect current de-listing cases.

- #OFSI

- #GeneralLicence

- #UnitedNations

- #DPRK

- #Russia

- #NuclearWeapons

- #DesignatedPersons

- #UnitedKingdom

- #Australian

- #Bill

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #RegulatoryObligations

- #SanctionsBreaches

- #Compliance

- #Designated

- #RegulatoryFramework