Published Date:

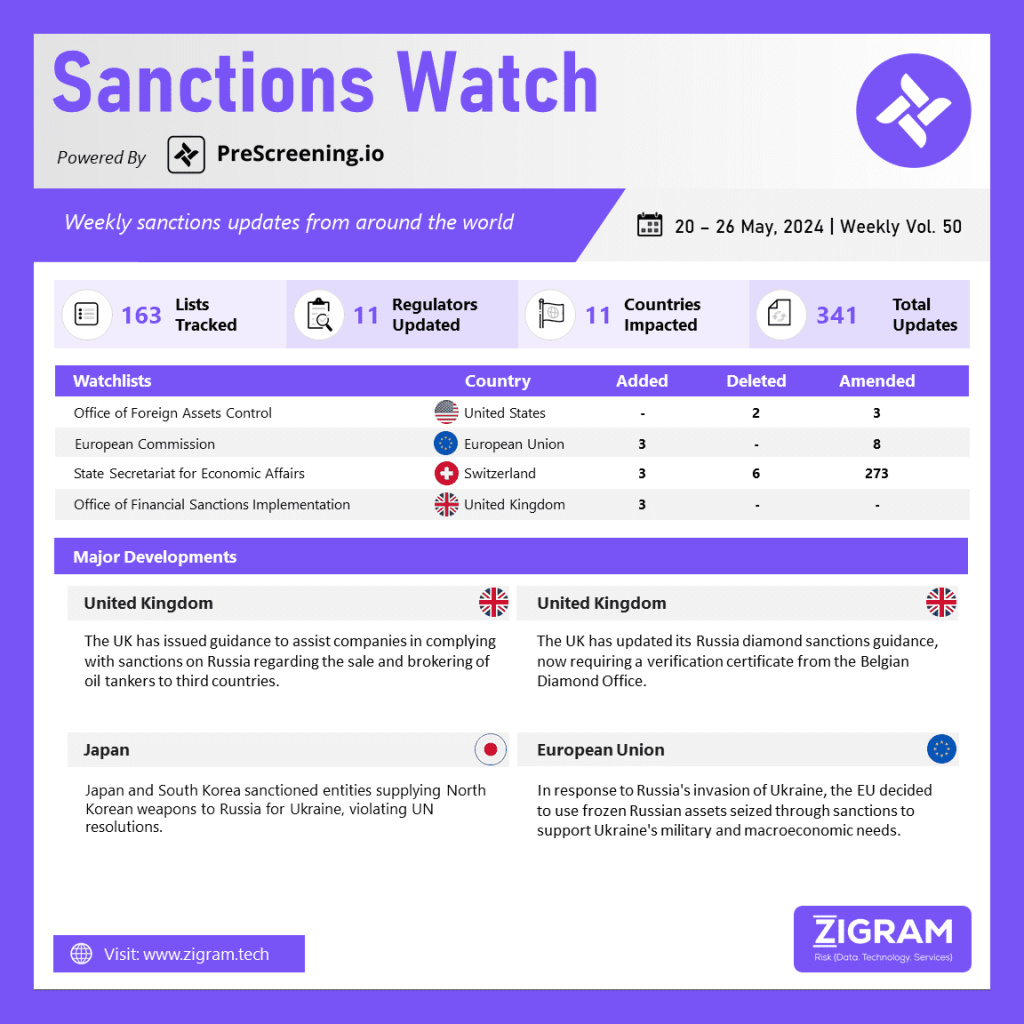

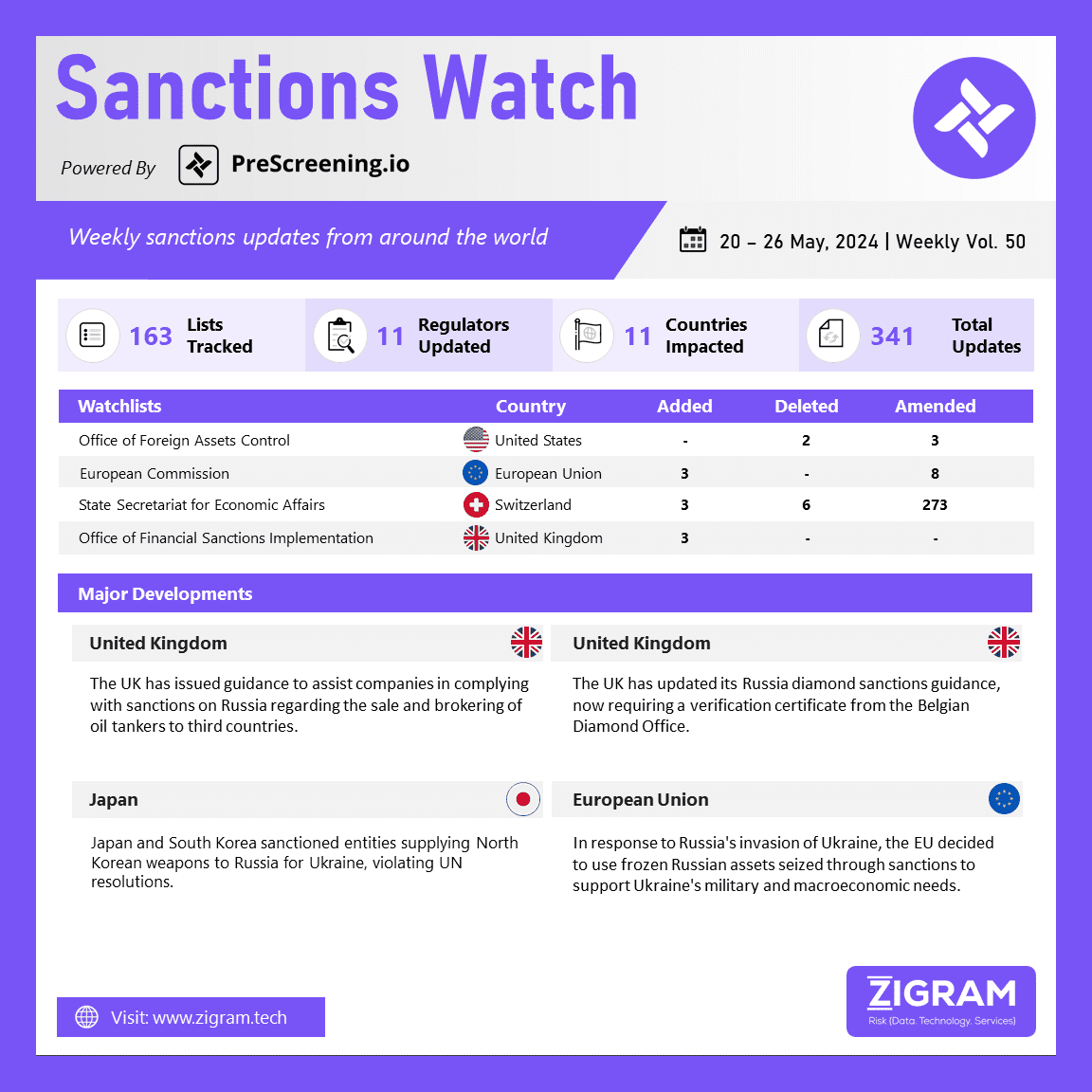

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The United Kingdom has released guidance aimed at aiding companies in their compliance efforts regarding sanctions on Russia related to the sale and brokering of oil tankers to third countries. The guidance elaborates on several key points: Regulation 29 of the Russian Sanctions Regulations prohibits intermediation services in agreements that make specific vessels listed in Part 7 of Schedule 2A available in a third country for delivery to Russia. To conduct appropriate due diligence, companies should gather contact details, source of funds, and copies of the buyer’s beneficial ownership identification, which can be verified against third-party databases, media, and market intelligence to confirm the true end user or beneficial owner. Shipbrokers are advised to implement a “red flag” system in their due diligence, and the guidance outlines 19 potential red flags, such as transactions involving vessels over 15 years old, purchase prices substantially above market value, buyers linked to sales in high-risk destinations, or shipping routes inconsistent with typical business patterns.

In response to Russia’s invasion of Ukraine, the UK government has imposed various sanctions under The Russia (Sanctions) (EU Exit) Regulations 2019 (“the Russia Regulations”) to encourage Russia to cease actions destabilizing Ukraine. The Russia (Sanctions (EU Exit) (Amendment) Regulations 2024 (“the 2024 Regulations”) have further amended the Russia Regulations, introducing a prohibition on importing certain Russian diamonds processed in third countries. This measure, building on previous bans, aims to curb the circumvention of sanctions on Russian diamonds. The prohibition, effective from 1 March 2024 for diamonds equal to or larger than 1 carat, and from 1 September 2024 for diamonds equal to or larger than 0.5 carats, applies to diamonds meeting specific criteria outlined in regulation 46Z16Q of Chapter 4JC of the Russia Regulations. Traders should be prepared to provide documentation demonstrating a diamond’s supply chain history to ensure compliance with these regulations. Importers can apply for an individual licence for banned diamonds processed in third countries, and there is also a General Trade Licence for certain diamonds processed and located outside Russia before 1 March 2024. Traders should ensure compliance to avoid potential criminal offences.

Japan and South Korea have announced sanctions targeting entities involved in the North Korea-Russia arms trade, which violates UN resolutions. These measures come ahead of a trilateral summit in Seoul, the first in five years. Pyongyang has allegedly sent thousands of munitions containers to Russia, with experts suggesting recent North Korean weapons tests may be for use in Ukraine. Japan’s spokesperson, Yoshimasa Hayashi, condemned these deals, stating Japan, with US cooperation, has frozen assets of 11 groups and one individual linked to Russia-North Korea military assistance supporting Russia’s invasion of Ukraine. These actions breach UN resolutions banning weapons transfers with North Korea. Japan’s Asahi newspaper reported that nine sanctioned groups and the individual are in Russia, while two Cyprus-based organizations allegedly facilitated weapons transport. In August, the US Treasury imposed similar sanctions due to Russia’s munitions depletion in Ukraine, leading Moscow to seek support from allies like Pyongyang.

In response to Russia’s full-scale invasion of Ukraine, the EU decided to freeze the assets of the Central Bank of the Russian Federation within the EU. The EU Working Group, established during Sweden’s Presidency of the Council, explored using these frozen assets to aid Ukraine. This effort led to the EU’s recent decision to utilize the net extraordinary revenues generated by these frozen assets to provide military and macroeconomic assistance to Ukraine. Minister for Foreign Affairs Tobias Billström emphasized the decision’s importance in compensating Ukraine for the destruction caused by Russia’s aggression, highlighting Sweden’s initiative during its Presidency. Extraordinary revenues, estimated at EUR 3 billion in 2024, have accrued to central securities depositories in the EU managing the immobilised assets. Ninety percent of these funds will be allocated for military support through the European Peace Facility, with the remaining 10 percent for macroeconomic support through the Ukraine Facility, subject to annual review.

- #UnitedKingdom

- #RedFlag

- #BeneficialOwnership

- #OilTankers

- #DueDiligence

- #Bans

- #RussianDiamond

- #Ukraine

- #Japan

- #NorthKoreanWeapons

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #RegulatoryObligations

- #SanctionsBreaches

- #AssetFreeze

- #Regulations