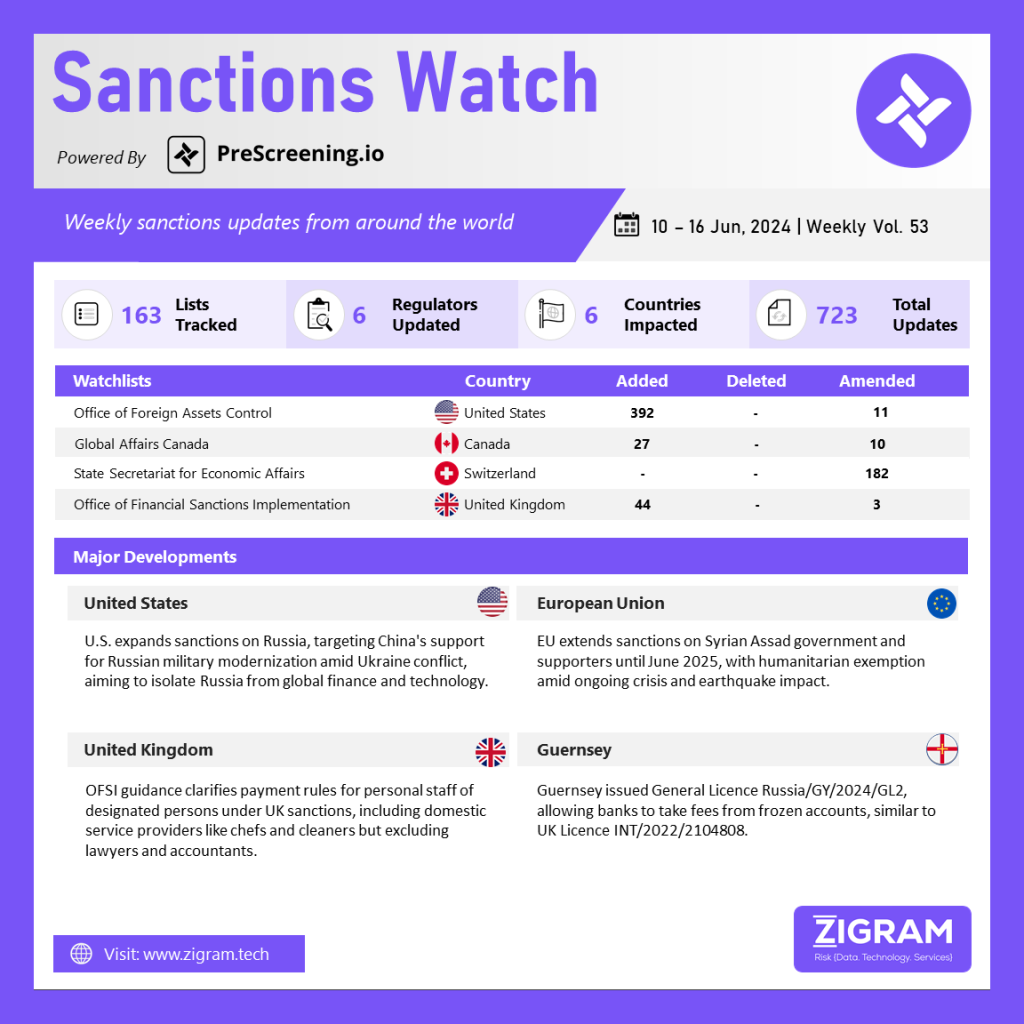

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The Biden administration, amidst gathering of G7 leaders, has expanded sanctions on Russia to curb China’s support for Russia in its war against Ukraine. The new measures, announced as President Biden headed to a G7 meeting in Italy, focus on disrupting the growing technological collaboration between China and Russia, seen as crucial for Russia’s military advancement during the conflict. Coordinated by the Treasury, State, and Commerce Departments, the sanctions aim to further isolate Russia from the global financial system and impede its access to military technology. Despite China’s increased support to Russia in recent months, including shipments of crucial components, it has refrained from sending weapons, aligning with Biden’s warnings. Notably, the sanctions do not target Chinese or European banks aiding Russia, nor do they restrict Russia’s energy exports to avoid inflation risks. The measures also expand “secondary” sanctions to deter banks worldwide from financing Russia’s war efforts, alongside restrictions on Moscow’s stock exchange and sanctions on Chinese firms aiding Russian military access to critical technologies.

The European Union has prolonged its sanctions against the Syrian Assad government and its affiliates, including economic sectors benefiting them, until June 1, 2025, citing ongoing repression and human rights violations in Syria. Despite removing one individual and five deceased persons from the sanctions list, the measures now impact a total of 316 individuals and 86 entities. Alongside this renewal, the EU has extended the humanitarian exemption, initially introduced in February 2023 due to the severe humanitarian crisis in Syria exacerbated by a recent earthquake affecting both Syria and Turkey. This extension aims to ensure the uninterrupted provision of humanitarian aid and support for Syrian civilians’ basic needs while aligning EU measures with those of the United Nations.

The UK’s Office of Financial Sanctions Implementation (OFSI) has issued guidance clarifying the circumstances under which payments can be made to personal staff of designated persons (DPs) under the UK’s sanctions regime. OFSI defines personal staff as those providing domestic or non-professional services directly employed by the DP, a DP-owned company, or provided by a third party. Examples include chefs, cleaners, and drivers, but not lawyers or accountants. OFSI acknowledges that high-net-worth DPs may use property management companies for personal property, considering their staff as personal staff. OFSI’s policy states that personal staff payments are generally not covered under basic needs or routine holding and maintenance licensing grounds, except in specific circumstances. The prior obligations licensing ground is not intended for continuous service but rather for settling existing contracts or winding down arrangements post-designation. OFSI expects DPs to terminate contracts with UK employees upon designation and discourages staff from continuing services post-designation.

Guernsey has released General Licence Russia/GY/2024/GL2, allowing banks to withdraw fees from accounts frozen under the Russia Regulations for routine maintenance or holding. This new licence mirrors the UK General Licence Bank Fees INT/2022/2104808, with slight modifications to suit Guernsey’s regulations. The initiative aims to ensure that banks can manage administrative costs associated with these accounts, maintaining their operational viability while complying with the sanctions imposed on Russia.

- #UnitedStates

- #G7

- #Russia

- #MilitaryTechnology

- #EnergyExports

- #China

- #Ukraine

- #EuropeanUnion

- #Syria

- #HumanRightsViolations

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #HumanitarianAid

- #OfficeofFinancialSanctionsImplementation

- #DesignatedPersons

- #Guernsey

- #GeneralLicence

- #FrozenAccounts