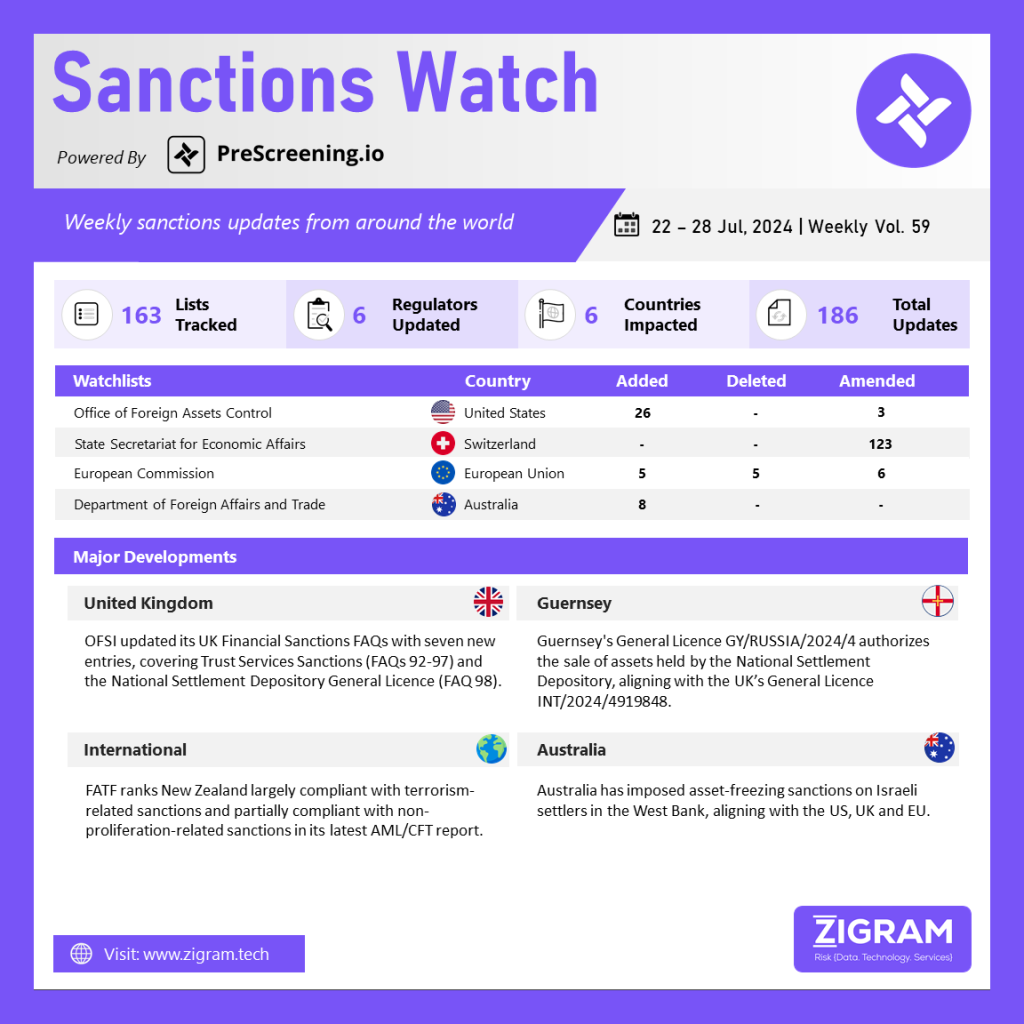

Sanctions Watch Vol 59

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

OFSI has expanded its UK Financial Sanctions FAQs with the addition of seven new entries, offering updated guidance on specific sanctions issues. These updates include detailed information on Trust Services Sanctions, which can be found in FAQs 92–97 under the “Russia” section. These FAQs provide clarity on several key points: what activities are prohibited under the trust services sanctions, the provisions of the General Licence for trust services, the entities to which the sanctions apply, and the implications of these sanctions when an asset freeze is imposed.

Furthermore, the update includes FAQ 98 in the “General Licensing” section, which introduces the National Settlement Depository General Licence (INT/2024/4919848). This licence confirms that the conversion of depositary receipts into local line is considered a sale or transfer, thus clarifying the regulatory framework for these transactions.

Guernsey has issued a General Licence (GY/RUSSIA/2024/4) authorizing the sale of assets held by the National Settlement Depository under the Sanctions (Implementation of UK Regimes) (Bailiwick of Guernsey) (Brexit) Regulations, 2020. This licence, issued by the Policy & Resources Committee under regulation 64 of the Russia (Sanctions) (EU Exit) Regulations 2019, aligns with the UK’s General Licence INT/2024/4919848, issued on 3/7/24 by the Office of Financial Sanctions Implementation (OFSI). The licence permits activities under the same terms, conditions, and duration as the UK licence, with specific modifications detailed in the Table of Modifications. The Policy & Resources Committee can vary, revoke, or suspend this licence at any time.

The Financial Action Task Force (FATF) recently published an Anti-Money Laundering and Counter-Terrorism Financing (AML/CFT) report on New Zealand, assessing its compliance with terrorism and proliferation sanctions recommendations. The report rates New Zealand as “largely compliant” with terrorism-related sanctions but notes areas for improvement, such as expanding designation criteria, extending freezing obligations, enhancing the judicial review process for de-listing refusals, and providing more information in the de-listing procedure.

For non-proliferation-related sanctions, New Zealand is deemed “partially compliant,” with the FATF highlighting the lack of a mechanism to communicate changes in Iran and DPRK designations beyond a UN website link, no obligation to report assets frozen under these sanctions, and insufficient guidance on applying for de-listing. The FATF ranks countries on their compliance with AML/CFT recommendations across four levels: compliant, largely compliant, partially compliant, and non-compliant.

The Australian Government has enacted Magnitsky-style sanctions against seven Israeli individuals and one entity, targeting them for their role in settler violence against Palestinians in the West Bank. These individuals have been implicated in violent assaults, including beatings, sexual assault, and torture, resulting in severe injury or death. The sanctioned entity, a youth group, is responsible for inciting and carrying out violence against Palestinians.

Australia urges Israel to hold these perpetrators accountable and halt settlement activities, which exacerbate tensions and hinder the prospects for a two-state solution. The Albanese Government maintains that Israeli settlements in the Occupied Palestinian Territories are illegal under international law and obstruct peace efforts. Australia remains committed to working towards a just and lasting peace between Israelis and Palestinians.

Know more about the product: PreScreening.io

Click here to book a free demo.

- #OFSI

- #UK

- #FAQs

- #ProhibitedActivities

- #GeneralLicence

- #AssetFreeze

- #Guernsey

- #FinancialActionTaskForce

- #FATF

- #AntiMoneyLaundering

- #CounterTerrorismFinancing

- #NewZealand

- #Terrorism

- #DPRK

- #Australian

- #Israel

- #Palestinians

- #InternationalLaw

- #SanctionsWatch

- #InternationalSanctions

- #EconomicSanctions

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsViolations