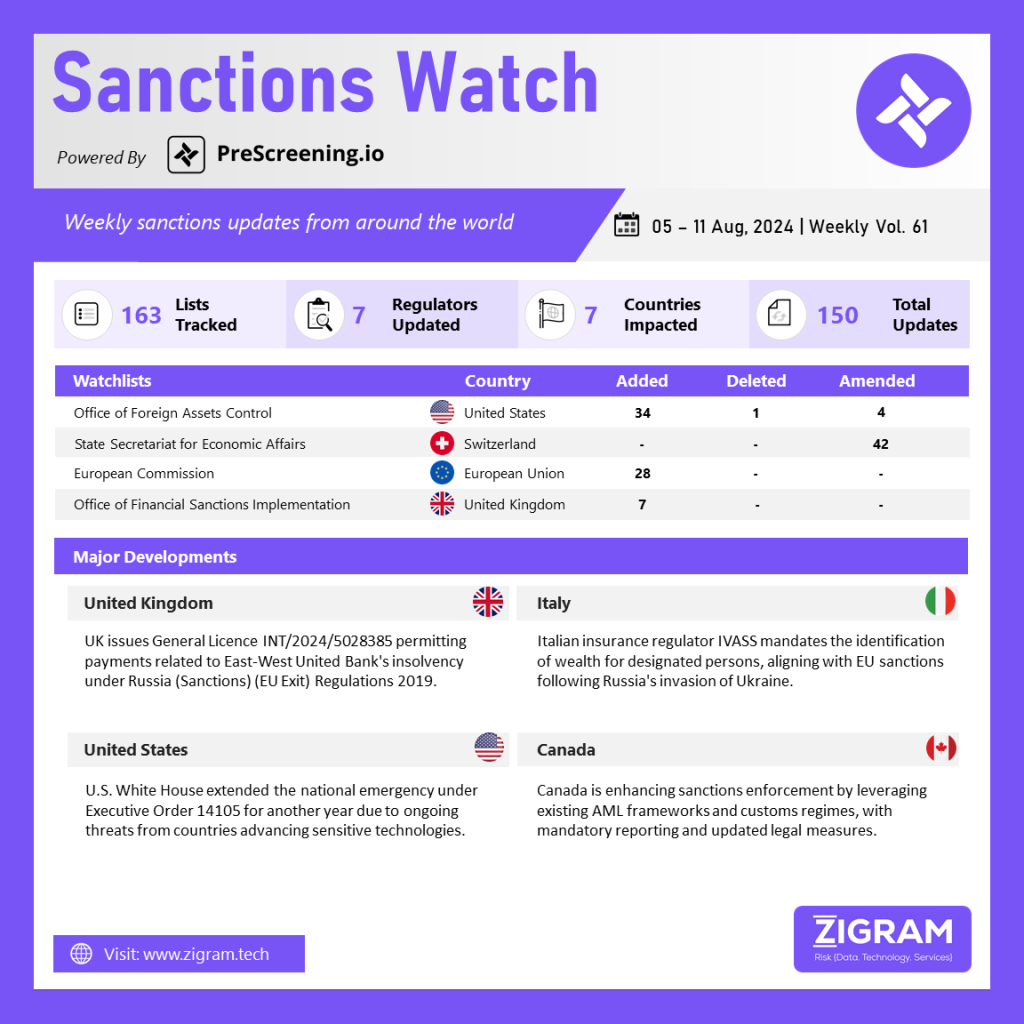

Sanctions Watch Vol 61

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

UK Issues General Licence for EWUB Insolvency Amid Russia Sanctions Compliance

The UK has issued General Licence INT/2024/5028385 under regulation 64 of the Russia (Sanctions) (EU Exit) Regulations 2019, permitting payments and other activities related to East-West United Bank’s (EWUB) insolvency proceedings. This licence allows any person, including EWUB and Insolvency Practitioners, to engage in transactions connected to the insolvency process, but restricts funds and resources from benefiting designated persons under the Russia Regulations, except for EWUB itself.

Relevant Institutions may process these payments, and notifications must be sent to HM Treasury within 14 days of the first payment. Record-keeping is required for at least six years. The licence, effective from August 9, 2024, until August 8, 2029, allows activities as long as they comply with the Russia Regulations and accurate information is maintained. HM Treasury reserves the right to modify, revoke, or suspend the licence at any time.

Italy’s Insurance Regulator IVASS Tightens Sanctions Compliance for Russian Oligarch Assets

Italy’s insurance regulator, IVASS, has issued new guidelines emphasizing the need for insurance firms to identify and report the assets of designated individuals. As of July 26, local and foreign insurance entities must establish procedures to detect and monitor funds and resources that are subject to sanctions.

They are prohibited from engaging in transactions with these individuals, unless authorized by the Financial Security Committee. Additionally, any assets linked to designated persons must be reported to Italy’s Financial Intelligence Unit (FIU) using the designated online form. This directive follows the EU’s decision to freeze assets owned by Russian oligarchs and others in response to the 2022 invasion of Ukraine.

White House Extends National Emergency on Sensitive Technologies Citing Security Threats

On August 6, 2024, the White House announced the continuation of the national emergency declared on August 9, 2023, by Executive Order 14105 under the International Emergency Economic Powers Act, due to the ongoing and significant threat to U.S. national security posed by countries of concern advancing in sensitive technologies and products critical for military, intelligence, surveillance, or cyber capabilities, which exploit U.S. investments and intangible benefits, necessitating the extension of the emergency for an additional year to address these threats and will be published in the Federal Register and communicated to Congress.

Canada Strengthens Sanctions Enforcement Using AML and Customs Frameworks

Canada is enhancing its sanctions enforcement by leveraging its existing anti-money laundering (AML) and customs frameworks. The government is using the Proceeds of Crime, Money Laundering and Terrorist Financing Act (PCMLTFA) and its administrative agencies, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and the Canada Border Services Agency (CBSA), to create a civil enforcement regime for sanctions. This includes mandatory reporting of suspected sanctions evasion by prescribed entities, importers, exporters, and those financing transactions.

Additionally, amendments to the Criminal Code have lowered the evidentiary burden for prosecuting money laundering cases related to sanctions evasion. Proposed changes also aim to broaden the PCMLTFA’s terrorist property reporting requirements to cover property owned or controlled by designated persons.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #UnitedKingdom

- #GeneralLicence

- #Russia

- #RestrictedFunds

- #DesignatedPersons

- #Italy

- #InsuranceRegulator

- #Guidelines

- #FinancialIntelligenceUnit

- #EuropeanUnion

- #InvasionofUkraine

- #UnitedStates

- #NationalEmergency

- #ExecutiveOrder

- #SanctionsWatch

- #InternationalSanctions

- #EconomicSanctions

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsViolations

- #SensitiveTechnologies

- #Canada

- #AntiMoneyLaundering

- #TerroristFinancing

- #CivilEnforcementRegime