Published Date:

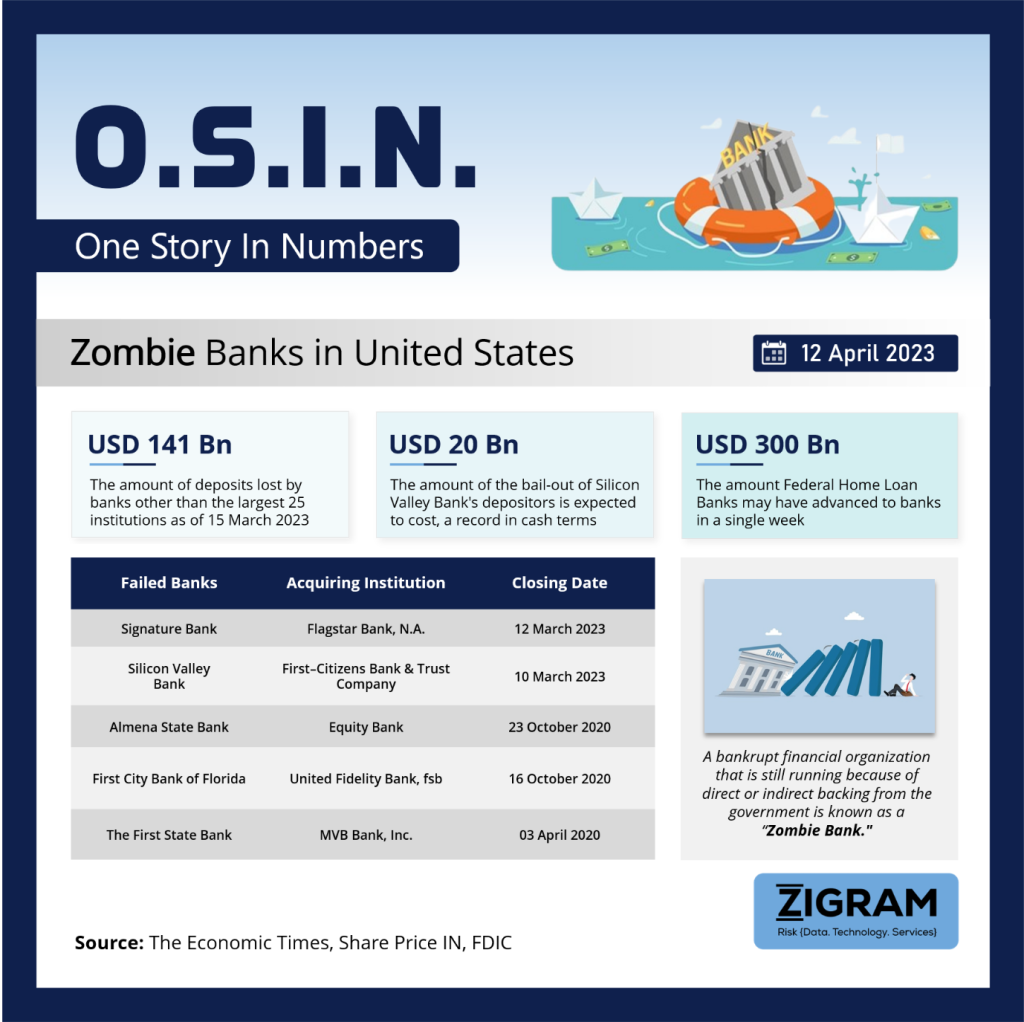

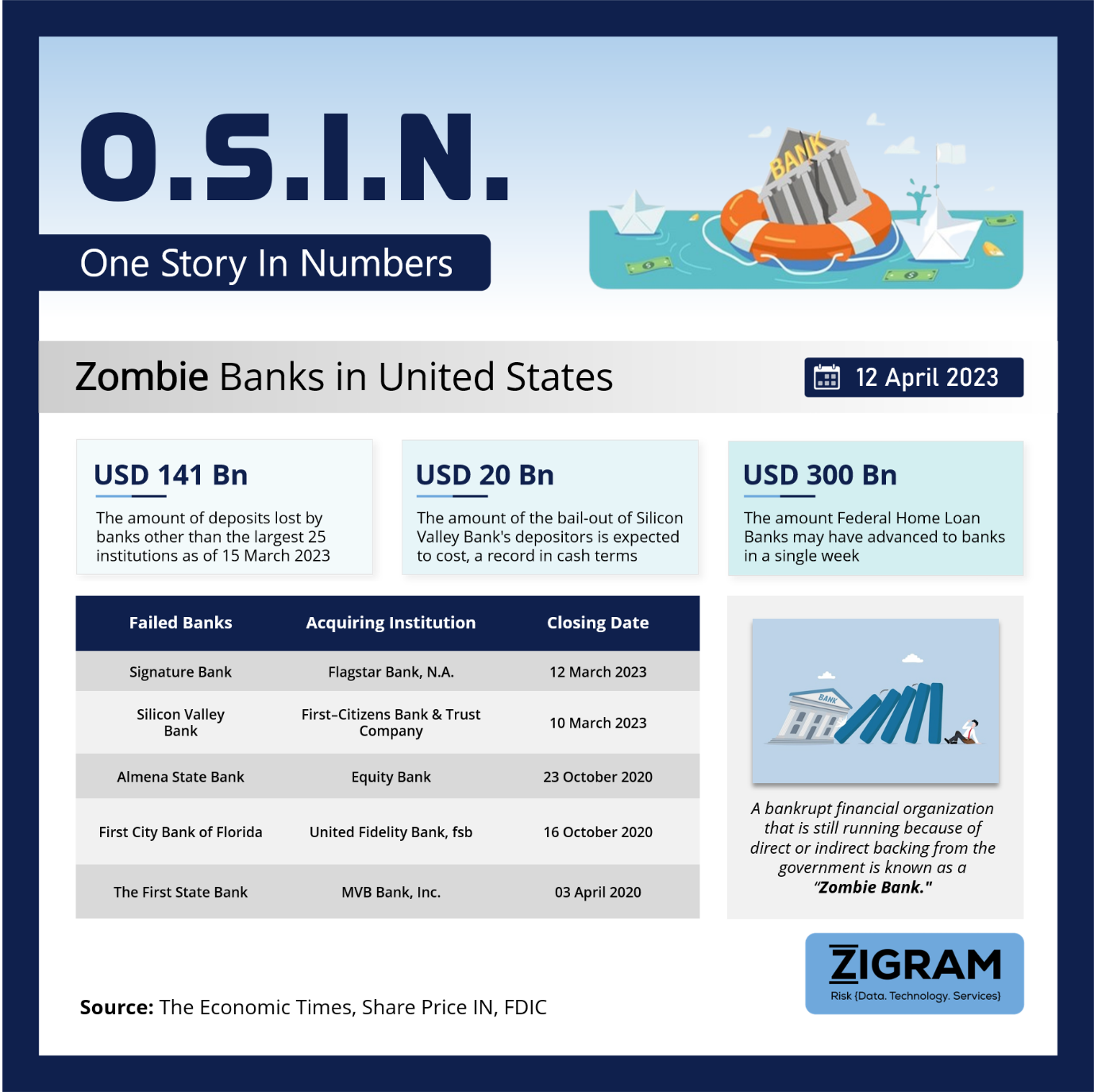

This week’s episode of OSIN talks about the Zombie Banks in the United States. A Zombie Bank is a financially troubled institution that is kept alive through government or central bank intervention. This happens when a bank has taken on excessive risk, made bad investments, or suffered losses that have eroded its capital base. Instead of letting the bank fail and potentially causing wider economic problems, financial support is provided to keep it operating. While the financial markets may appear calm, United States’ small and midsize banks continue to face problems.

A series of banks such as Silicon Valley Bank and Signature Bank failed in April 2023, putting the world’s confidence in the financial industry to a test. Silicon Valley Bank had USD 167 billion in total assets as on March 10 2023. First Citizens is expected to purchase USD 72 billion of those assets at a discount of USD 16.5 billion, while the FDIC will keep around USD 90 billion. In a USD 2.7 billion agreement, New York Community Bank had agreed to purchase a sizeable portion of Signature Bank.

Many people have lost their deposits and unrealized losses could wipe out their core equity safety cushions. The federal government’s generous and indiscriminate support for banks has slowed deposit flight, but it could also result in zombie banks with capital tied up in unproductive legacy assets.

Policymakers need to recognize losses quickly, infuse banks with fresh capital and discourage banks from improving capital ratios by lending less. Failure in doing so could lead to a prolonged crisis.

- #zombiebank

- #unitedstates

- #financialcrisis

- #bankfailure

- #FDIC

- #governmentintervention

- #depositinsurance

- #bankingindustry

- #NewYorkCommunityBank

- #investors

- #FederalReserve

- #OSIN