The recently unveiled the Basel AML Index 2023 examines the escalating risks associated with money laundering and terrorist financing. Its comprehensive assessment emphasizes critical areas that demand immediate attention and underlines the urgency for collaborative efforts to fortify Anti-Money Laundering/Counter Financing of Terrorism (AML/CFT) systems worldwide.

The Basel AML Index serves as an independent ranking, meticulously evaluating countries’ risks pertaining to money laundering (ML) and terrorist financing (TF). Drawing upon 18 indicators grouped into five domains, it measures various factors contributing to heightened ML/TF risks:

- Quality of AML/CFT Framework

- Bribery and Corruption

- Financial Transparency and Standards

- Public Transparency and Accountability

- Legal and Political Risks

Key Highlights Of Basel AML Index

Surge In Global Risks

This year, there has been a noticeable surge in the average global risk level, escalating from 5.25 to 5.31 out of a maximum of 10 Indicating a worrisome trend in the realm of financial crimes.

Escalating Risks And Diminishing Effectiveness

The analysis underscores heightened risks across four out of five measured domains: corruption, financial transparency and standards, public accountability, and political/legal risks. However, amidst these concerns, the quality of AML/CFT frameworks has remained stagnant.

FATF Assesment

The Board of the RE or a Committee of the Board is empowered to determine the periodicity of ML/TF risk assessment, allowing for flexibility in adapting to changing risk profiles.

Regional Insights And Critical Debates

Impact Of New Technologies

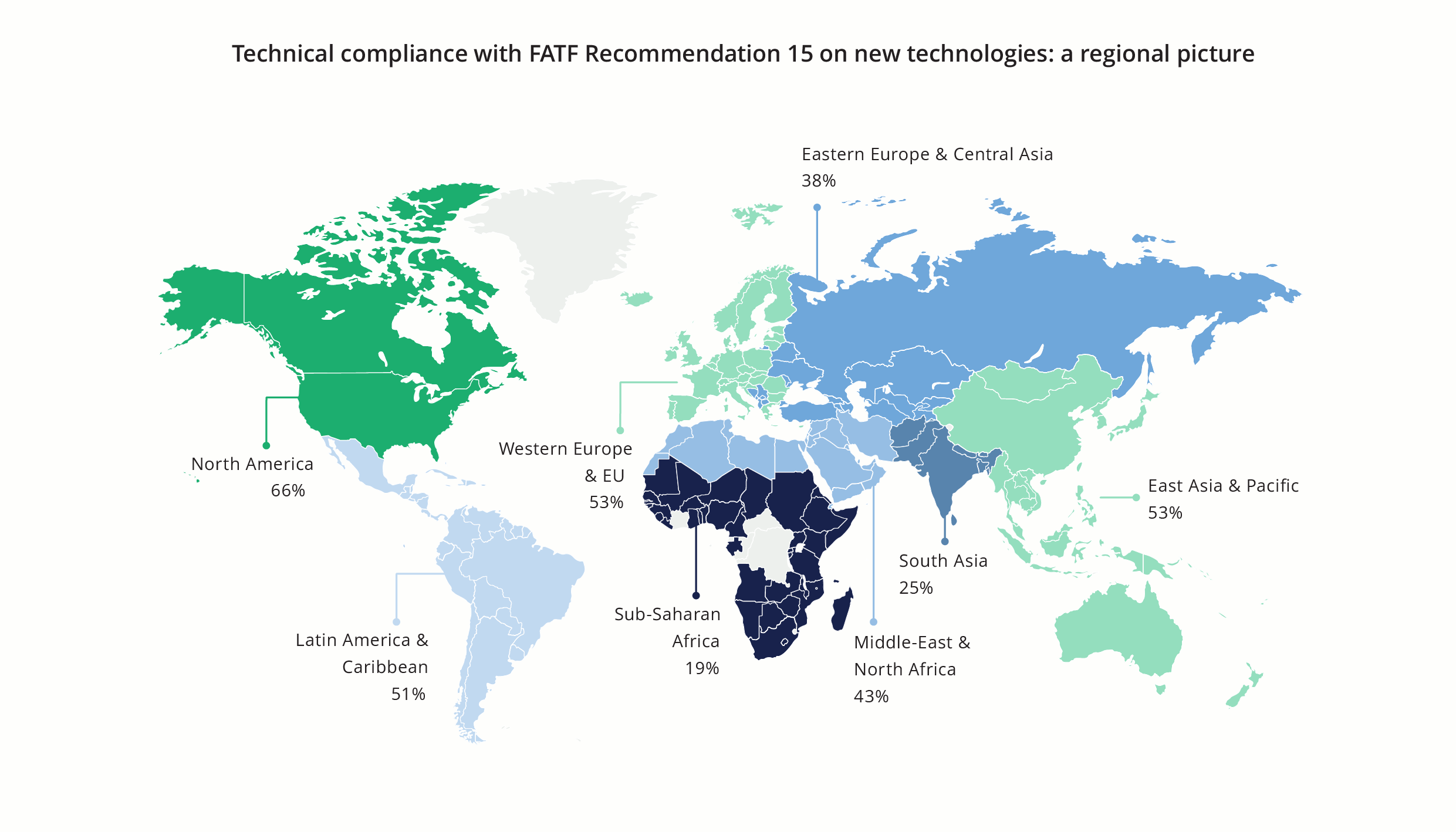

A crucial debate revolves around understanding the evolving risks posed by new technologies, particularly cryptocurrencies and virtual assets. The need for precise regulation, diligent supervision, and effective enforcement is paramount to fostering a robust FinTech sector while ensuring the integrity of financial systems, protecting consumers, and preserving investors’ interests. FATF Recommendation 15 states countries should identify new technologies, businesses and assets (including cryptocurrencies, virtual assets service providers, etc) to assess the risks of money laundering and terrorist financing.

The assessments state that cryptocurrencies and virtual assets have become significant concerns within the financial crime landscape due to substantial scandals, high volatility, and the apparent use of these digital currencies by organized crime for concealing and laundering illicit funds. Regionally, various African, South American and Asian countries are one of the least compliant regions whereas Australian, European and North American countries are the most compliant regions.

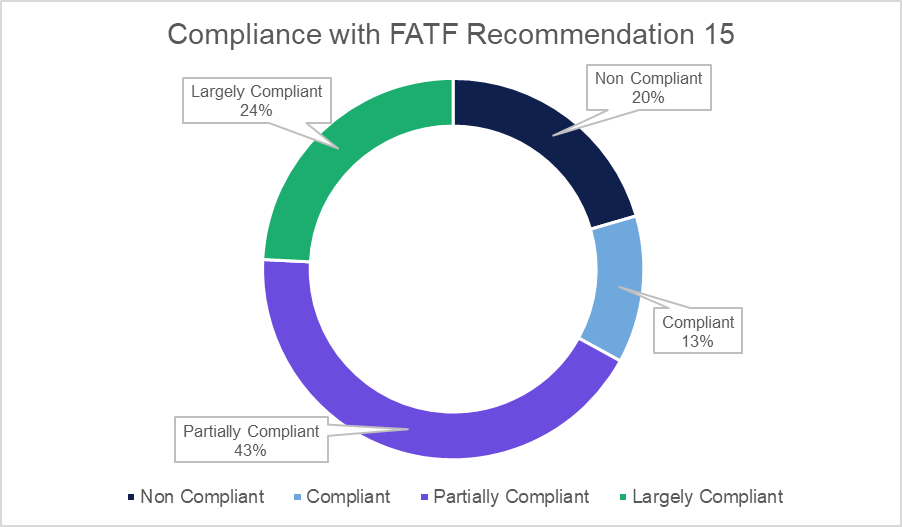

The performance regarding FATF Recommendation 15 is alarming. Out of 161 assessed countries, only 12.5% are deemed “compliant,” while a significant 20.5% fall under the category of “non-compliant.” The global average technical compliance is a mere 43%, substantially lower than the overall average compliance across all 40 Recommendations (65%), positioning it as the second lowest after the non-profit sector.

The performance regarding FATF Recommendation 15 is alarming. Out of 161 assessed countries, only 12.5% are deemed “compliant,” while a significant 20.5% fall under the category of “non-compliant.” The global average technical compliance is a mere 43%, substantially lower than the overall average compliance across all 40 Recommendations (65%), positioning it as the second lowest after the non-profit sector.

Terrorist Financing And Non Profit Organizations

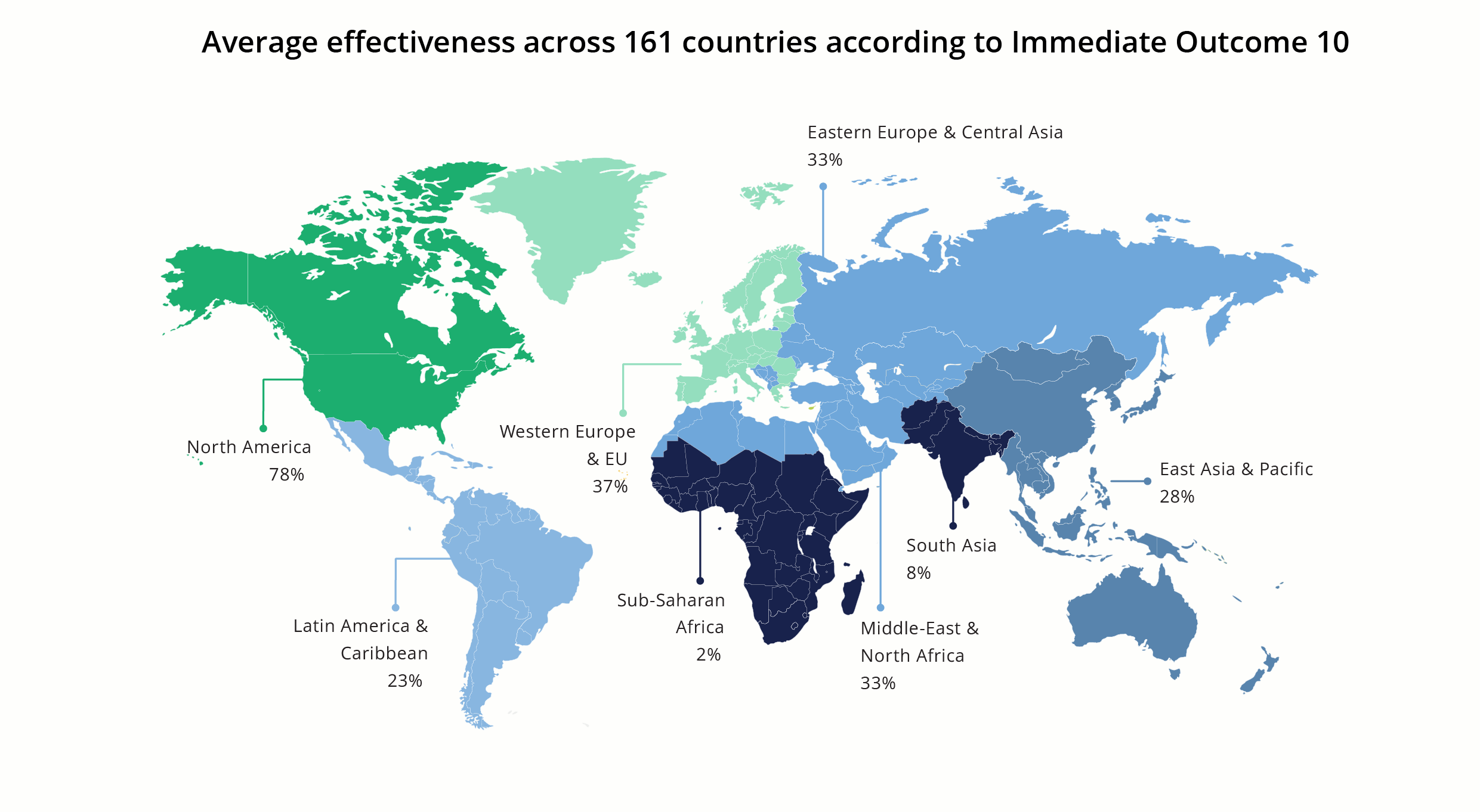

Addressing the increased efforts required to prevent terrorist financing through non-profit organizations is crucial. Highlighting the necessity of averting harm to legitimate humanitarian efforts and human rights organizations, this area remains a significant global challenge concerning compliance with FATF standards. In the FATF assessment for effectiveness, Immediate Outcome 10 (IO10) assesses the country’s preventive measures and financial sanctions taken against terrorist funding.

Analysis of FATF data utilized in the Basel AML Index covering 161 jurisdictions reveals a substantial challenge in meeting FATF standards concerning non-profit organizations. The average technical compliance score for Recommendation 8 significantly lags at 41%, contrasting sharply with the 65% average across all Recommendations. Compliance with international standards concerning the misuse of non-profit organizations for terrorist financing ranks as the weakest among all 40 Recommendations outlined by the FATF.

Regionally, there is a stark disparity in the average effectiveness score for FATF IO10, ranging from as low as 2% in Sub-Saharan Africa and 8% in South Asia to a notably higher 78% in North America. Approximately 40% of evaluated nations display the lowest level of performance concerning both technical compliance and effectiveness. The United Kingdom stands out as the sole jurisdiction displaying the highest attainable scores for both technical compliance and effectiveness.

Confiscation As A Deterrent

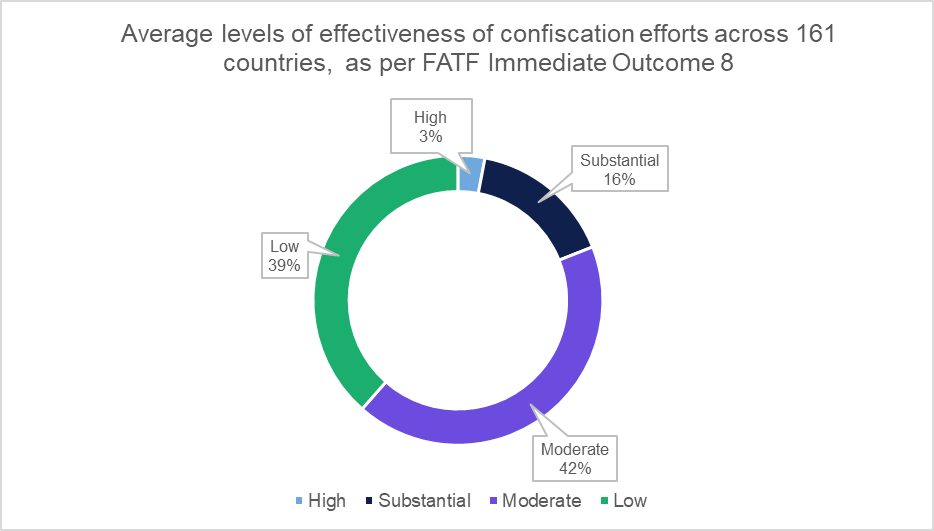

Among the 40 recommendations against money laundering and terrorist funding, Recommendations 4 deals with the confiscation and seizure of assets by countries ensuring a strong operational and regional framework and Recommendation 38 deals with collaboration between countries to trace, investigate, freeze, seize and confiscate criminal property and property of corresponding value in case of international affairs. Despite advancements in tracing and seizing illicit assets, the scarcity of permanent confiscations, especially across borders, underscores the need for stronger laws and international cooperation.

- While legal frameworks fulfil FATF recommendations 4 and 38, encompassing more than 80% compliance across countries, the aspect of confiscation remains lacking in many jurisdictions.

- In the FATF assessment for effectiveness, FATF's Immediate Outcome 8 assesses jurisdictions based on their effectiveness in confiscating illicit assets. The global average effectiveness remains stagnant at 28%, unchanged from the previous year. Only a small fraction, accounting for 3%, exhibit a high level of effectiveness. This discrepancy highlights the shortfall in implementing mechanisms to seize illicit assets, despite possessing necessary legal frameworks.

Scoring And Ranking

The Basel AML Index ranks jurisdictions based on overall scores, shedding light on areas requiring immediate attention to combat money laundering and terrorist financing effectively. The rankings reveal countries with the most pressing challenges in these domains. The scores are given out of 10 and the higher the score, more the risks. Countries such as Haiti, Chad, Myanmar and Democratic Republic of Congo are the top 4 countries with the most risks scores whereas Finland, Iceland, Estonia and Andorra are bottom 3 countries and are the most compliant and risk-free countries.

To get the full ranking please click here

To summarize, The Basel AML Index 2023 serves as a call for global cooperation and decisive action to fortify AML/CFT frameworks. It accentuates the urgent need for enhanced effectiveness, regional contextualisation, and the imperative to tackle emerging challenges, particularly new technologies and cross-border financial crimes. To combat money laundering and terrorist financing, comprehensive strategies must be embraced, safeguarding societies, economies, and fundamental values.

ZIGRAM is the one-stop solution for all your compliance needs. Try our FREE DEMO to experience the AI developed to fight against money laundering.

- #BaselAMLIndex 2023

- #Antimoneylaundering

- #FATF

- #RiskScoring

- #TerroristFinancing