Published Date:

Welcome to our weekly newsletter that provides the most recent updates and insights regarding AML, financial crime compliance, and emerging risks.

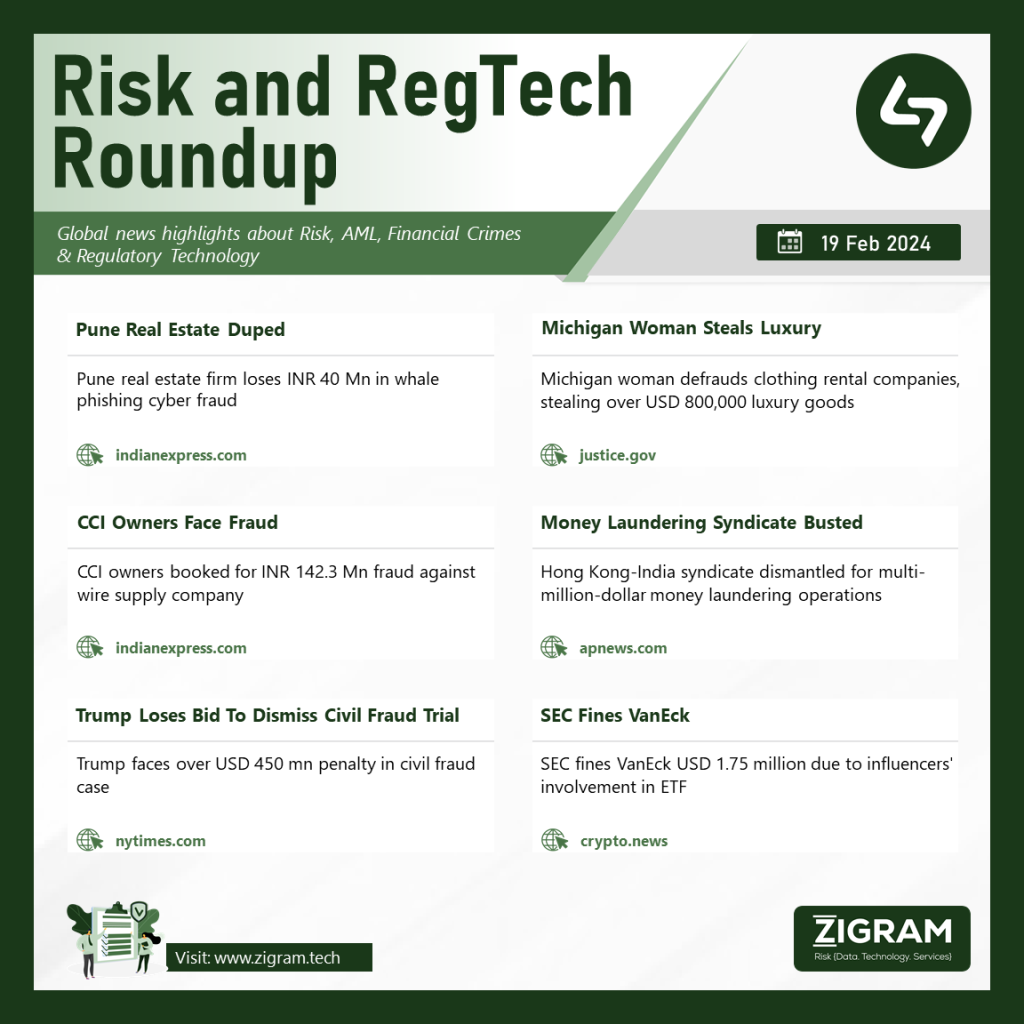

This week a Pune-based real estate firm lost INR 40 mn in a cyber fraud involving whale phishing. The fraudsters sent a fake email posing as the CMD, instructing fund transfers. Falling for the scam, the firm transferred the money, only realizing later that it was a scam. This incident highlights the increasing sophistication of cyber frauds targeting businesses and the need for robust security measures. Furthermore, Brandalene Horn from Michigan engaged in a scheme from April 2022 to February 2024, defrauding clothing rental companies by opening numerous accounts, renting luxury items, keeping them instead of returning, and selling them online. She stole over $823,000 worth of goods, selling over $750,000 worth. Horn faces charges of mail fraud, wire fraud, and interstate transportation of stolen property, carrying potential sentences up to 20 years.

Moving on Mumbai Police’s Economic Offences Wing registered an FIR against Cable Corporation of India owners, Hiten Khatau and Rohan Khatau, and company office-bearers for allegedly defrauding a wire supply company of Rs 14.23 crore. The complaint was lodged by the chairman of an Andheri-based wire supply firm. The accused are charged under IPC sections 420, 406, and 120B for cheating, breach of trust, and criminal conspiracy. In a major crackdown, Law enforcement agencies successfully dismantle a sophisticated transnational money laundering syndicate operating between Hong Kong and India. The syndicate, involved in multi-million-dollar operations, saw authorities seize luxury goods and freeze millions in assets. The bust underscores the growing challenges posed by organized crime networks utilizing complex financial systems for illicit activities, highlighting the need for international cooperation and robust enforcement measures.

Moving forth In a setback for former President Donald Trump, his bid to dismiss a civil fraud trial has been denied by a New York judge. The trial, centered on allegations of deceptive business practices, will proceed. This ruling marks a significant development in ongoing legal battles faced by Trump post-presidency, suggesting potential accountability for his business dealings and raising questions about the scope of executive immunity. Lastly, VanEck, a prominent investment management firm, has been fined $1.75 million by the U.S. Securities and Exchange Commission (SEC) for the involvement of social media influencers in promoting one of its cryptocurrency exchange-traded funds (ETFs). This penalty underscores increasing regulatory focus on cryptocurrency-related investment vehicles and the necessity for transparency in marketing strategies within the rapidly evolving digital asset landscape.

- #WhalePhishing

- #CyberFraud

- #RealEstate

- #Fraud

- #LuxuryGoods

- #MoneyLaundering

- #TransnationalCrime

- #DonaldTrump

- #CivilFraud

- #SEC

- #RegulatoryScrutiny

- #Cryptocurrency

- #ETF