The latest Financial Scams Report by the GCFFC APAC Chapter reveals an alarming increase in scam activity across the globe, particularly in affluent nations like those in the G7, EU, and OECD. The report focuses on Australia, Hong Kong SAR, and Singapore, offering a detailed analysis of the scam landscape in these regions, while also drawing parallels with other countries such as New Zealand, Taiwan, Canada, the UK, and the USA.

The report identifies over 20 primary scam types, with some involving hybrid or additional criminal activities. These scams lead to significant financial losses, lifestyle disruptions, and severe personal consequences. The report estimates that around 500,000 people are victims of modern slavery or human trafficking, coerced into criminal activities like romance baiting, with numerous suicides resulting from sextortion scams.

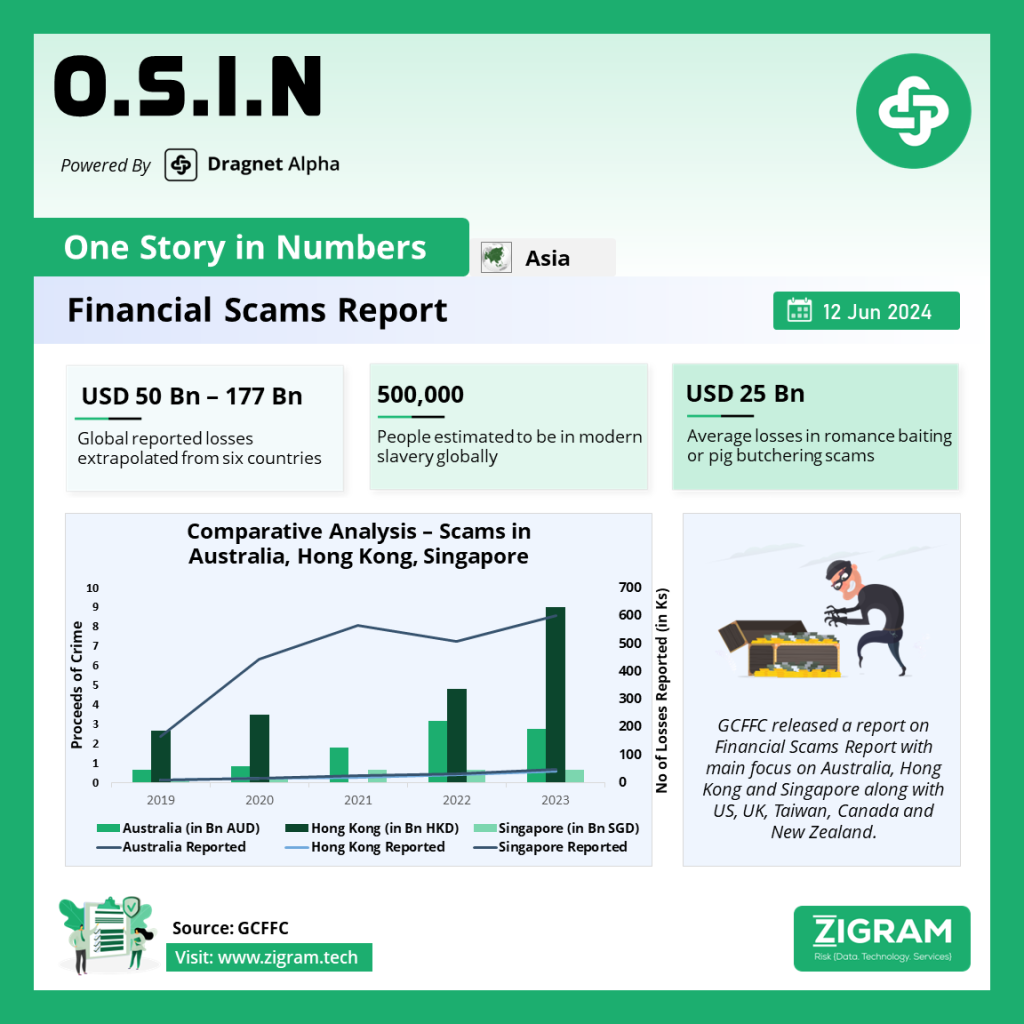

The financial impact of these scams is staggering. Extrapolating reported losses from Australia, Hong Kong SAR, Singapore, and other comparable countries (including the UK, Canada, and the USA) to a global scale, the estimated losses range between US$50 billion and US$177 billion, with a midpoint estimate of US$114 billion. This figure would position scam-related losses as equivalent to the 64th largest country by GDP. Average losses per victim are estimated at US$12,000, and average losses per citizen are approximately US$62. Despite these figures, it is widely acknowledged that scam losses are significantly underreported.

Several factors make countries more attractive to scammers, including higher wealth levels, advanced digital infrastructure, the prevalence of digital banking and faster payments, extensive use of virtual currencies, significant online and social media engagement, the popularity of e-commerce, and linguistic commonalities with scammers. Additionally, a general lack of awareness among citizens about scam types and defense mechanisms exacerbates the problem.

The GCFFC APAC Chapter recommends several responses to combat these scams and is consulting on which focus areas and actions could be most effective in enhancing scam prevention and response strategies.

Reported Financial Losses

The report highlights the scarcity of publicly available information on scam losses and cases, with only a few countries, including those in APAC (Australia, Hong Kong SAR, and Singapore), Canada, the UK, and the USA, providing regular reports. These six jurisdictions represent about one-third of global GDP and offer a basis for estimating global scam losses.

Key findings from the report include:

– Reported scam losses from these six countries amount to US$15.7 billion.

– Extrapolating these losses globally suggests potential losses of approximately US$50 billion. Just from pig butchering scams alone, losses are estimated at US$64 billion.

– Variations in losses among the six jurisdictions were significant, with losses per GDP ranging from 0.03% (Canada) to 0.3% (Hong Kong). Applying these figures globally results in estimated losses between US$32.1 billion and US$321 billion, with a midpoint estimate of US$177 billion.

– Based on the midpoints of various estimates, the global scam loss is around US$114 billion.

– Average losses per victim range from US$502 (UK) to US$29,000 (Hong Kong), averaging around US$12,000 per victim.

– Losses per citizen vary from US$11 (Canada) to US$155 (Hong Kong), with an average of about US$62 per citizen.

This comprehensive assessment underscores the critical need for enhanced global cooperation, better reporting mechanisms, and more robust preventive measures to tackle the escalating threat of financial scams. The GCFFC APAC Chapter aims to drive these efforts forward by identifying and promoting effective responses and strategies to protect citizens and economies from the pervasive impact of financial scams.

Read the report here.

- #FinancialScams

- #ScamPrevention

- #CyberSecurity

- #DigitalFraud

- #GCFFC

- #APAC

- #Australia

- #HongKong

- #Singapore

- #FinancialCrime