Sanctions Watch Vol 60

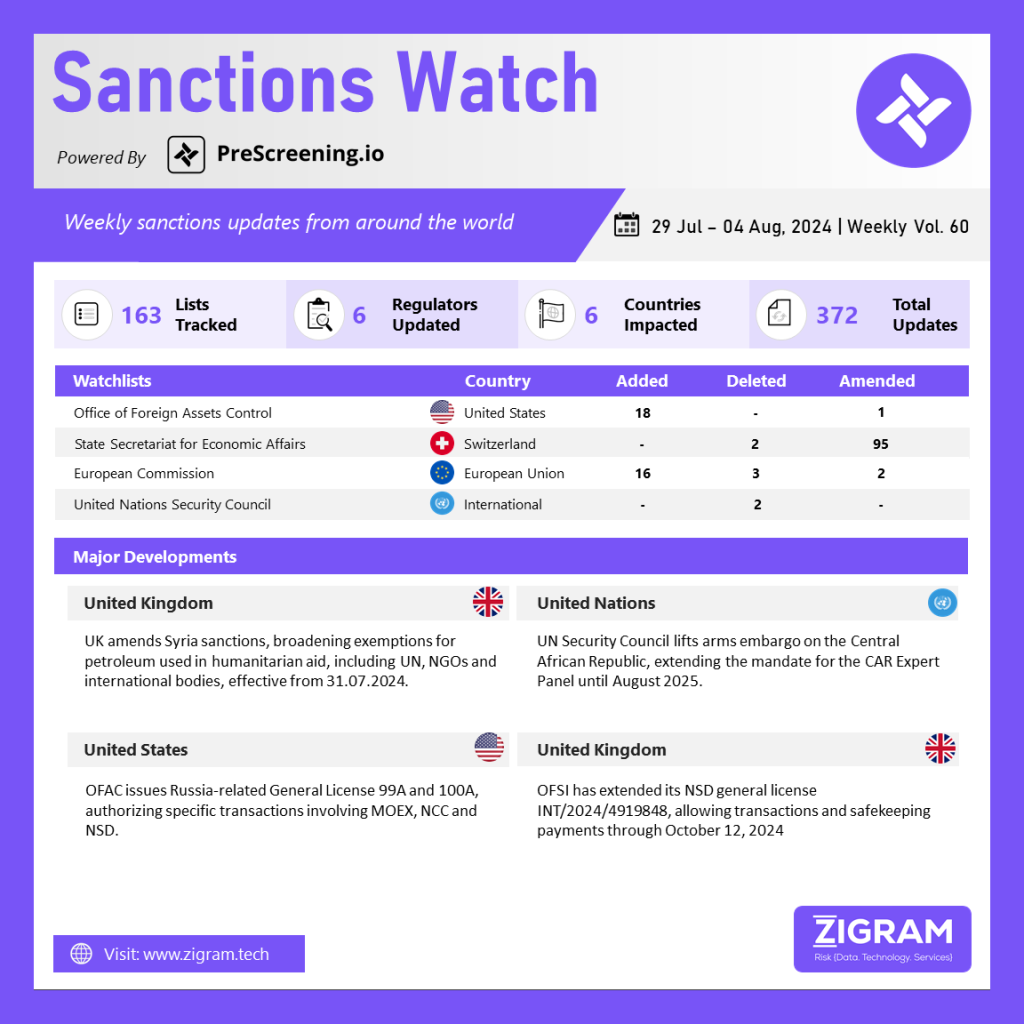

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

UK Introduces Updated Syria (Sanctions) Regulations, Expanding Humanitarian Exceptions and Amending Notification Requirements

The UK has introduced the Syria (Sanctions) (EU Exit) (Amendment) (No. 2) Regulations 2024, effective from July 31, 2024, amending the 2019 Syria (Sanctions) (EU Exit) Regulations. The updated Regulation 57 now includes expanded exceptions for purchasing, supplying, or delivering petroleum products used solely for humanitarian aid in Syria. This expansion covers the UN, international and humanitarian organizations, and NGOs, in addition to those previously funded by the UK government.

The amendment also shifts the notification requirement from the Secretary of State to the Treasury and broadens the exception to encompass “acquisition” as well as “purchase” of petroleum products. Additionally, record-keeping requirements for trade licenses have been updated. This amendment also revokes and replaces the earlier Syria (Sanctions) (EU Exit) (Amendment) Regulations 2024 to ensure compliance with parliamentary approval requirements.

UN Security Council Lifts Arms Embargo on Central African Republic, Extends Expert Panel Mandate

The UN Security Council has unanimously passed Resolution 2745 (2024), which lifts the arms embargo on the Central African Republic (CAR). This resolution mandates that all Member States implement necessary measures to prevent any direct or indirect supply, sale, or transfer of arms and related materials to armed groups and associated individuals operating within CAR until July 31, 2025. Additionally, the Security Council has extended the mandate for the CAR Expert Panel until August 31, 2025.

The Expert Panel is tasked with providing regular progress updates and submitting a comprehensive final report by June 15, 2025. This decision reflects ongoing efforts to address security and stability in the region while ensuring stringent controls to prevent the proliferation of arms to armed factions.

OFAC Issues New Russia-Related General Licenses, Replacing June 2024 Licenses and Specifying Transaction Conditions

The Department of the Treasury’s Office of Foreign Assets Control (OFAC) has issued two Russia-related general licenses: General License 99A and General License 100A. General License 99A permits the wind-down of transactions involving the Moscow Exchange (MOEX), National Clearing Center (NCC), Non-Bank Credit Institution Joint Stock Company National Settlement Depository (NSD), and their affiliates, through October 12, 2024. It covers transactions necessary for divestment, transfer, and settlement of trades related to these entities, with specific conditions.

General License 100A authorizes transactions related to the divestment of debt or equity or currency conversions involving MOEX, NCC, or NSD, also through October 12, 2024. Both licenses replace their June 2024 predecessors, General License No. 99 and No. 100, and do not permit transactions prohibited under Directive 2 or 4 of Executive Order 14024, or any other transactions not separately authorized under the Russian Harmful Foreign Activities Sanctions Regulations (RuHSR).

OFSI Extends General License for Financial Transactions Involving National Settlement Depository, Effective Through October 2024

The Office of Financial Sanctions Implementation (OFSI) has extended its general license (INT/2024/4919848) for the sale, divestment, and transfer of financial instruments held by the National Settlement Depository (NSD), as well as the payment of safe-keeping fees, through October 12, 2024. This license, issued under Regulation 64 of the Russia (Sanctions) (EU Exit) Regulations 2019, exempts actions otherwise prohibited under Regulations 11 to 15 of the Russia Regulations, to the extent necessary to implement its permissions.

It applies to individuals, bodies of persons, and institutions authorized under specific financial regulations, including those carrying out regulated activities or operating recognized payment systems. Licensees must keep accurate records for at least six years and comply with data protection laws. The license is effective from July 3, 2024, to October 12, 2024, and may be varied, revoked, or suspended by HM Treasury at any time.

Know more about the product: PreScreening.io

Click here to book a free demo.

- #UnitedKingdom

- #Syria

- #HumanitarianAid

- #TradeLicenses

- #UnitedNationsSecurityCouncil

- #ArmsEmbargo

- #OFAC

- #GeneralLicense

- #Russia

- #ExecutiveOrder

- #OFSI

- #DataProtectionLaws

- #HMTreasury

- #InternationalLaw

- #SanctionsWatch

- #InternationalSanctions

- #EconomicSanctions

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsViolations