Published Date:

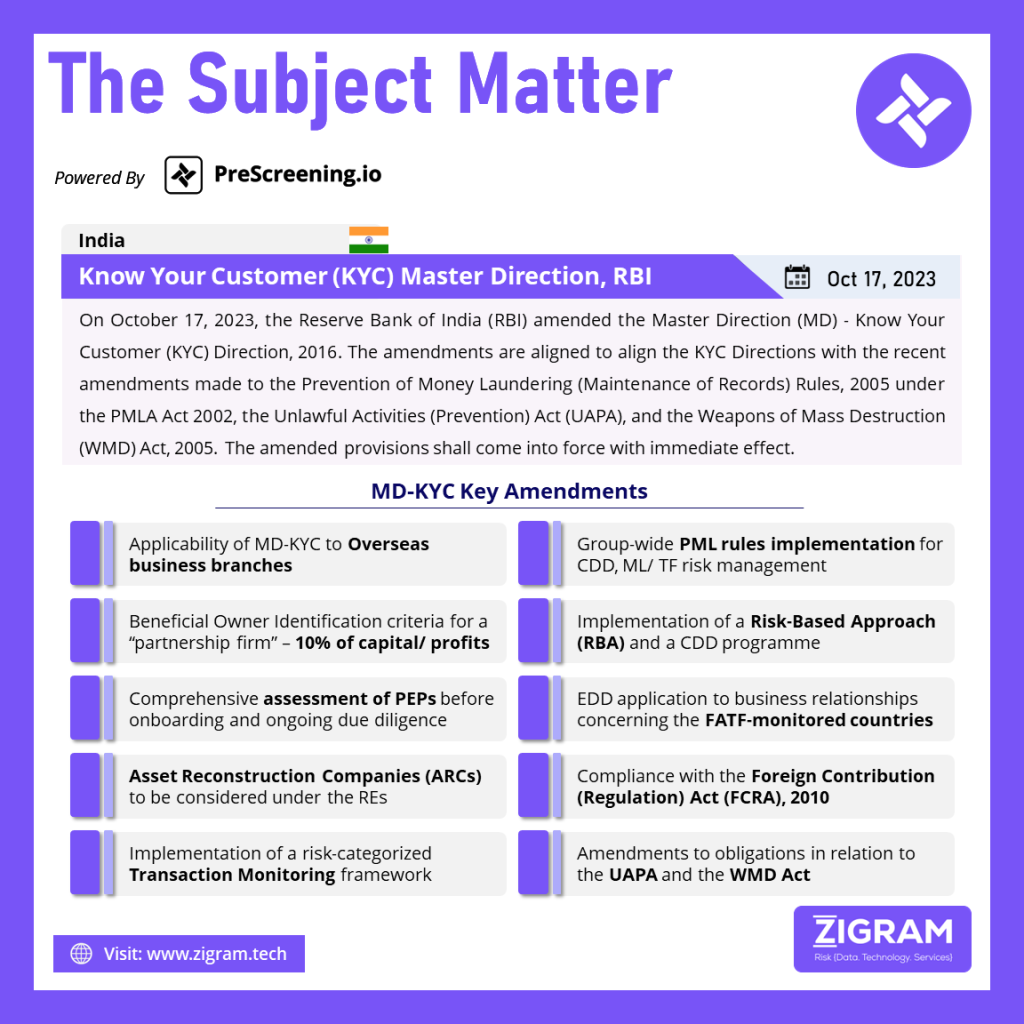

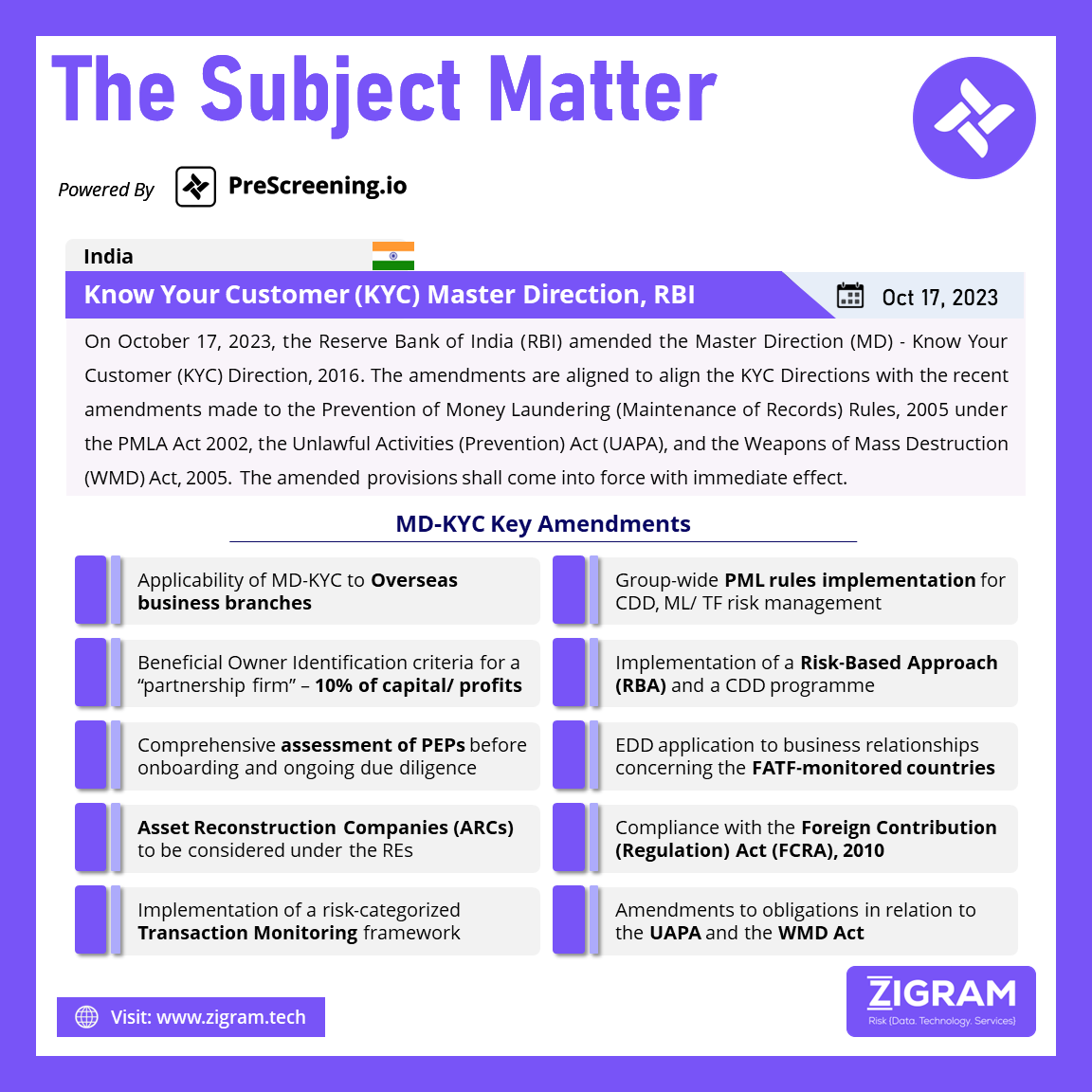

This week’s Subject Matter is about the Know Your Customer (KYC) Master Direction, RBI

On October 17, 2023, the Reserve Bank of India (RBI) amended the Master Direction (MD) – Know Your Customer (KYC) Direction, 2016. The amendments are aligned to align the KYC Directions with the recent amendments made to the Prevention of Money Laundering (Maintenance of Records) Rules, 2005 under the PMLA Act 2002, the Unlawful Activities (Prevention) Act (UAPA), and the Weapons of Mass Destruction (WMD) Act, 2005. The amended provisions shall come into force with immediate effect.

The amendments to the Master Direction (MD) – Know Your Customer (KYC), 2016 are:-

1- Applicability of MD-KYC to Overseas business branches

2- Beneficial Owner Identification criteria for a “partnership firm” – 10% of capital/ profits

3- Comprehensive assessment of PEPs before onboarding and ongoing due diligence

4- Asset Reconstruction Companies (ARCs) to be considered under the REs

5- Implementation of a risk-categorized Transaction Monitoring framework

6- Group-wide PML rules implementation for CDD, ML/ TF risk management

7- Implementation of a Risk-Based Approach (RBA) and a CDD programme

8-EDD application to business relationships concerning the FATF-monitored countries

9-Compliance with the Foreign Contribution (Regulation) Act (FCRA), 2010

10-Amendments to obligations in relation to the UAPA and the WMD Act

- #moneylaundering

- #compliance

- #antimoneylaundering

- #prescreening

- #subjectmatter

- #amlcft

- #riskbasedsupervision

- #riskassessment

- #kyc

- #pmla

- #uapa

- #wmd

- #rbi

- #india