Published Date:

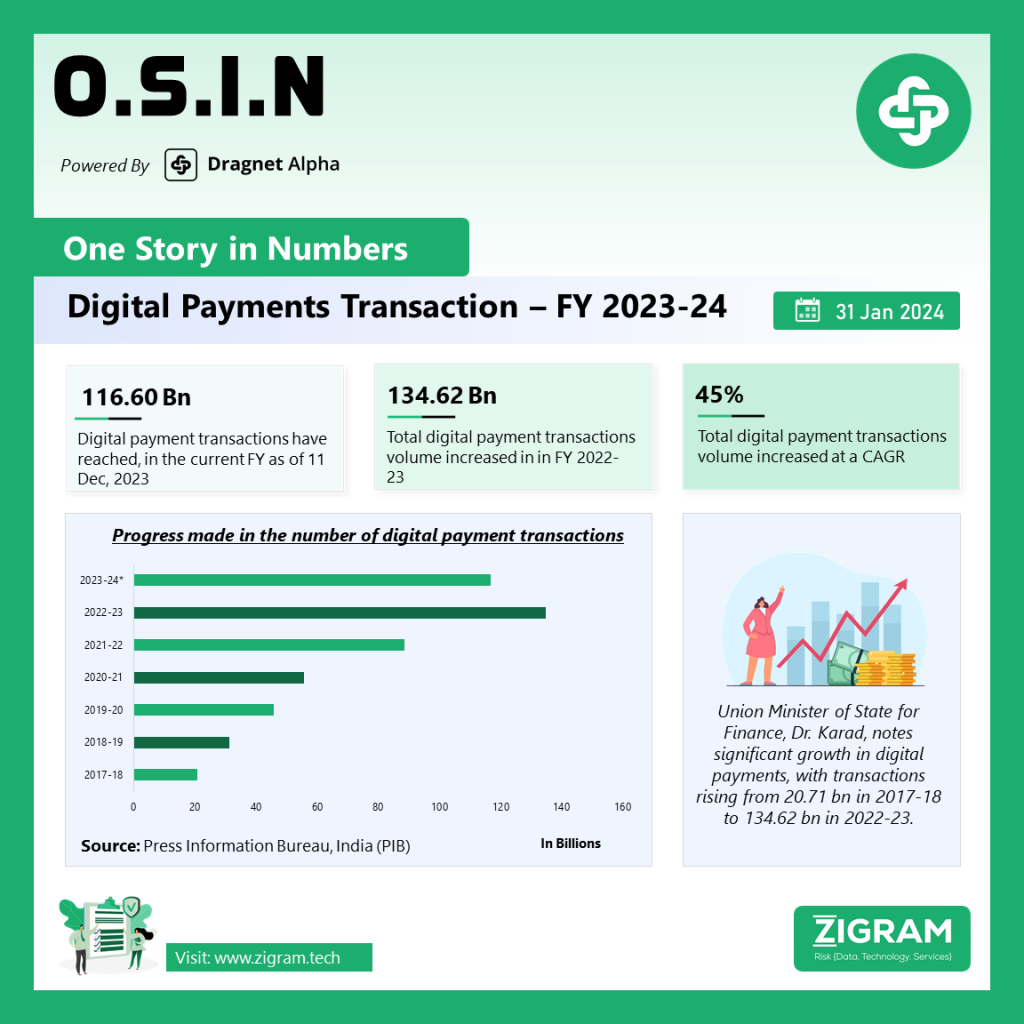

The Union Minister of State for Finance highlighted the government’s efforts in enhancing digital payments, noting a substantial rise from 20.71 bn transactions in FY 2017-18 to 134.62 bn in FY 2022-23, with a 45% CAGR. In FY 2023-24, transactions reached 116.60 bn by December 11.

Various digital payment products include RTGS for wholesale and UPI, NEFT, IMPS, cards, prepaid instruments, NACH, AePS, BHIM Aadhaar Pay, and NETC for retail. Progress over six years:

– 2017-18: 20.71 bn

– 2018-19: 31.34 bn

– 2019-20: 45.72 bn

– 2020-21: 55.54 bn

– 2021-22: 88.39 bn

– 2022-23: 134.62 bn

– 2023-24: 116.60 bn (till 11th Dec)

The government, in collaboration with the RBI, focuses on user-friendly and secure digital payments. Initiatives include conversational payments, offline UPI transactions, e-RUPI vouchers, linking RuPay Credit Cards to UPI, and interoperable card-less cash withdrawals.

Government initiatives to promote digital transactions:

– Incentive schemes for RuPay Debit cards and low-value BHIM-UPI transactions

– Advisories to improve payment infrastructure

– Year-wise digital payment transaction and merchant acquisition targets for banks

– PMGDISHA for rural digital literacy

– Awareness campaigns with stakeholders and LEAs

RBI contributes to digital literacy through financial camps, awareness messages, and public campaigns. A benchmarking exercise in 2022 categorized India as a leader or strong in 25 out of 40 indicators in the Payments Ecosystem.

Regarding cybercrimes, the Ministry of Home Affairs emphasizes the state’s role in prevention, detection, and prosecution. The Central Government supports states through advisories and financial assistance. Measures include spreading awareness, issuing alerts, capacity building, and establishing I4C and a National Cyber Reporting Portal.

The Indian Computer Emergency Response Team collaborates to track and disable phishing websites. RBI’s circulars guide banks on customer liability in unauthorized digital transactions.

In summary, the government’s coordinated efforts, RBI’s initiatives, and state-level actions have led to a significant surge in digital payments, with a focus on security and user-friendliness. Awareness campaigns, benchmarks, and cybercrime prevention measures contribute to a comprehensive digital payments ecosystem.

- #DigitalPayments

- #FinancialInclusion

- #RBI

- #Cybersecurity

- #UPI

- #BHIM

- #FinancialLiteracy

- #I4C

- #PMGDISHA

- #EconomicProgress