Published Date:

Welcome to our weekly newsletter that provides the most recent updates and insights regarding AML, financial crime compliance, and emerging risks.

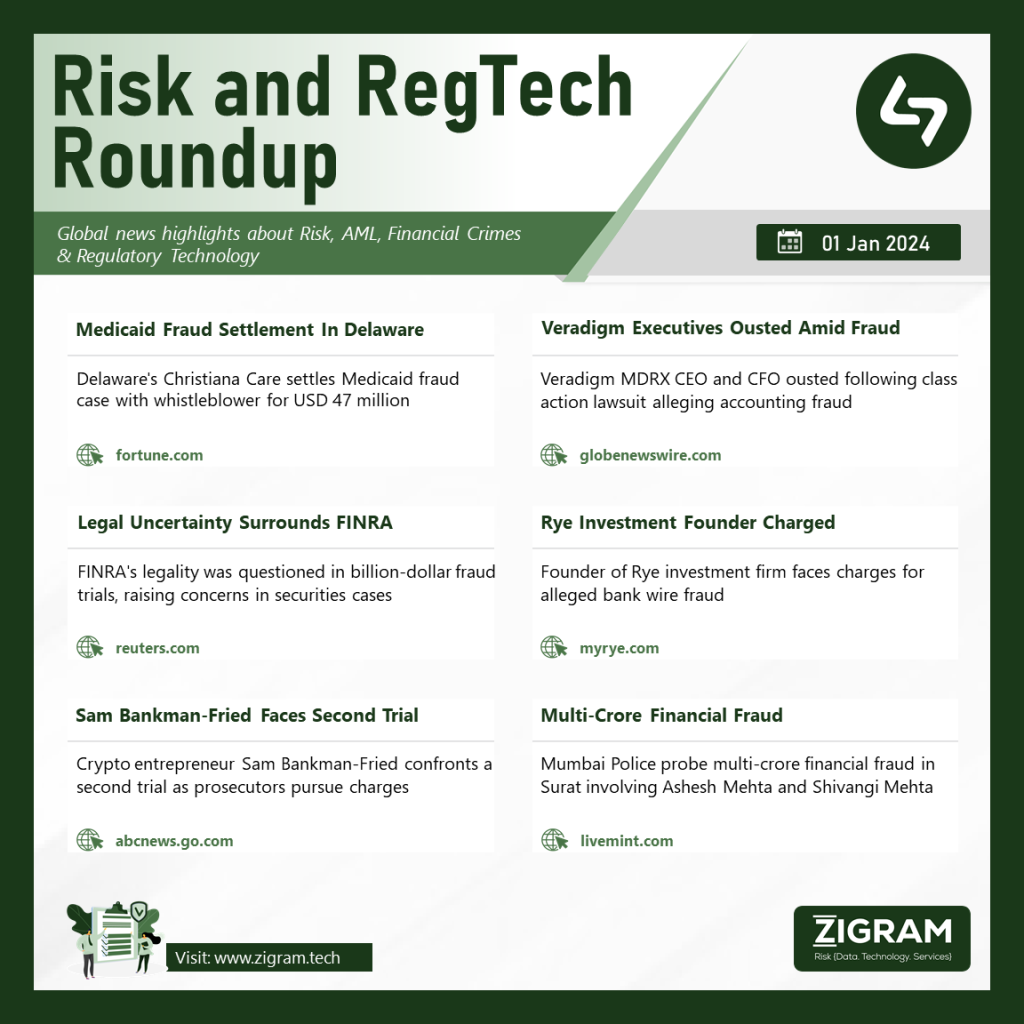

This week we begin with Christiana Care in Delaware has reached a $47 million settlement in a Medicaid fraud case in a significant development. The resolution stems from a whistleblower exposing fraudulent billing practices. The case underscores the importance of whistleblowers in uncovering healthcare fraud and the financial implications for institutions engaging in such practices, highlighting the ongoing need for vigilance in Medicaid oversight. Furthermore, Veradigm MDRX witnesses executive upheaval with the removal of the CEO and CFO amidst a class action lawsuit alleging accounting fraud. The legal challenges add uncertainty to the company’s future as it grapples with addressing the allegations. Shareholders are closely monitoring the developments, emphasizing the potential impact on Veradigm’s standing and the need for transparency in corporate governance.

Moving on In a pivotal development, the legality of the Financial Industry Regulatory Authority (FINRA) is under scrutiny, casting shadows over billion-dollar fraud trials in 2024. Questions about FINRA’s legitimacy add complexity to ongoing securities cases, with potential repercussions on their outcomes. The financial industry closely watches these legal challenges, as they may shape the regulatory landscape and influence future approaches to handling high-stakes fraud allegations within the securities sector. In another story, A noteworthy development unfolds as the founder of a Rye investment firm faces charges related to bank wire fraud. The legal proceedings bring attention to potential financial misconduct within the local investment sector. The outcome of this case may have lasting implications on regulatory measures and investor confidence in Rye. Stakeholders closely monitor the situation, emphasizing the importance of addressing and preventing fraudulent activities within the financial landscape.

Moving forth Renowned crypto entrepreneur Sam Bankman-Fried enters a second trial as prosecutors press charges, shedding light on regulatory challenges in the cryptocurrency sphere. The case’s outcome holds broader implications for the industry, emphasizing the need for legal clarity and oversight. Stakeholders keenly observe the proceedings, considering the potential impact on the evolving landscape of cryptocurrency regulations and the accountability of key figures within this dynamic and rapidly growing sector. Lastly, Mumbai Police delve into a major financial fraud in Surat, uncovering a multi-crore scam involving Ashesh Mehta and Shivangi Lad Mehta. The investigation intensifies scrutiny on fraudulent activities, highlighting the need for vigilance in financial sectors. The unfolding details prompt concerns about the impact on investors and the broader implications for financial regulations in Maharashtra. Authorities strive to address and prevent such scams, reinforcing the importance of robust oversight in economic systems.

- #MedicaidFraud

- #VeradigmMDRX

- #AccountingFraud

- #FINRAUncertainty

- #SecuritiesCases

- #RyeInvestmentFraud

- #BankWireFraud

- #CryptoEntrepreneur

- #RegulatoryScrutiny

- #SuratFraudInvestigation

- #MumbaiPolice

- #AMLNewsletter