Published Date:

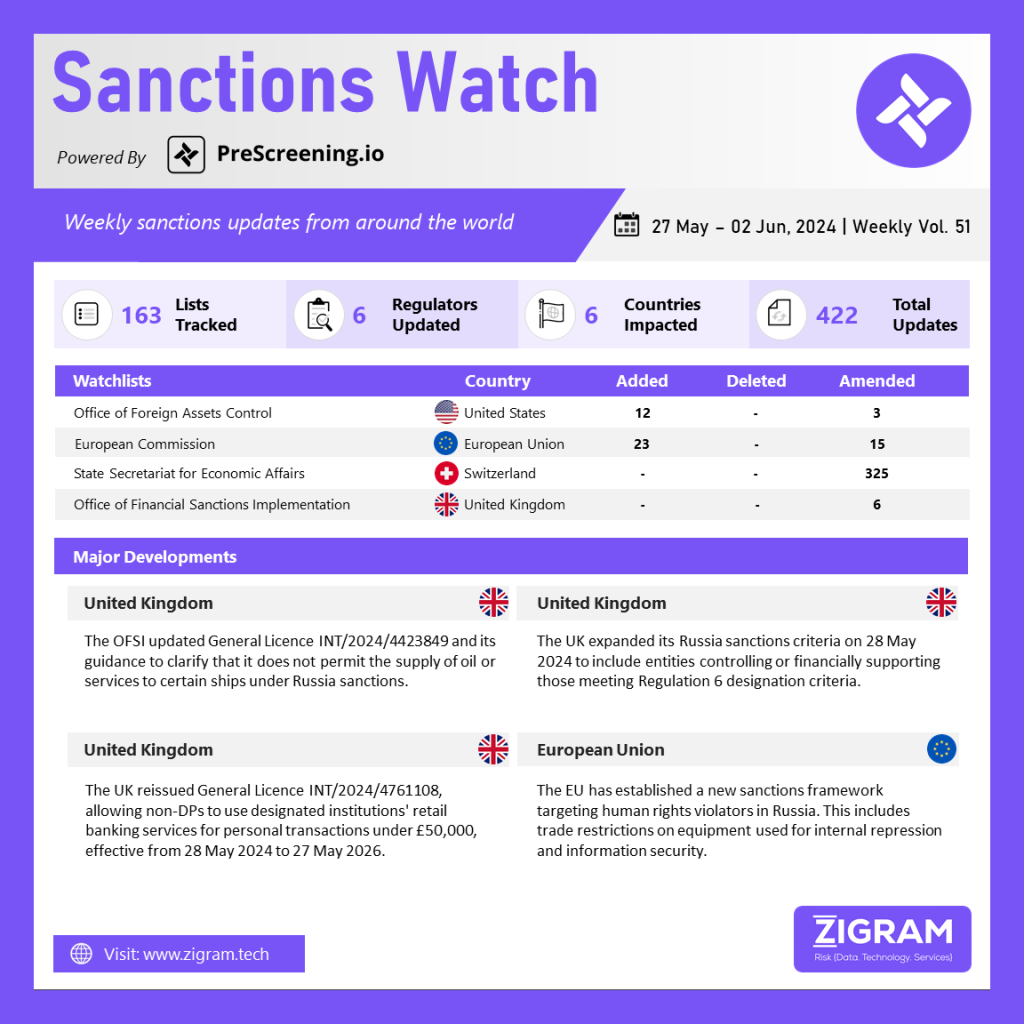

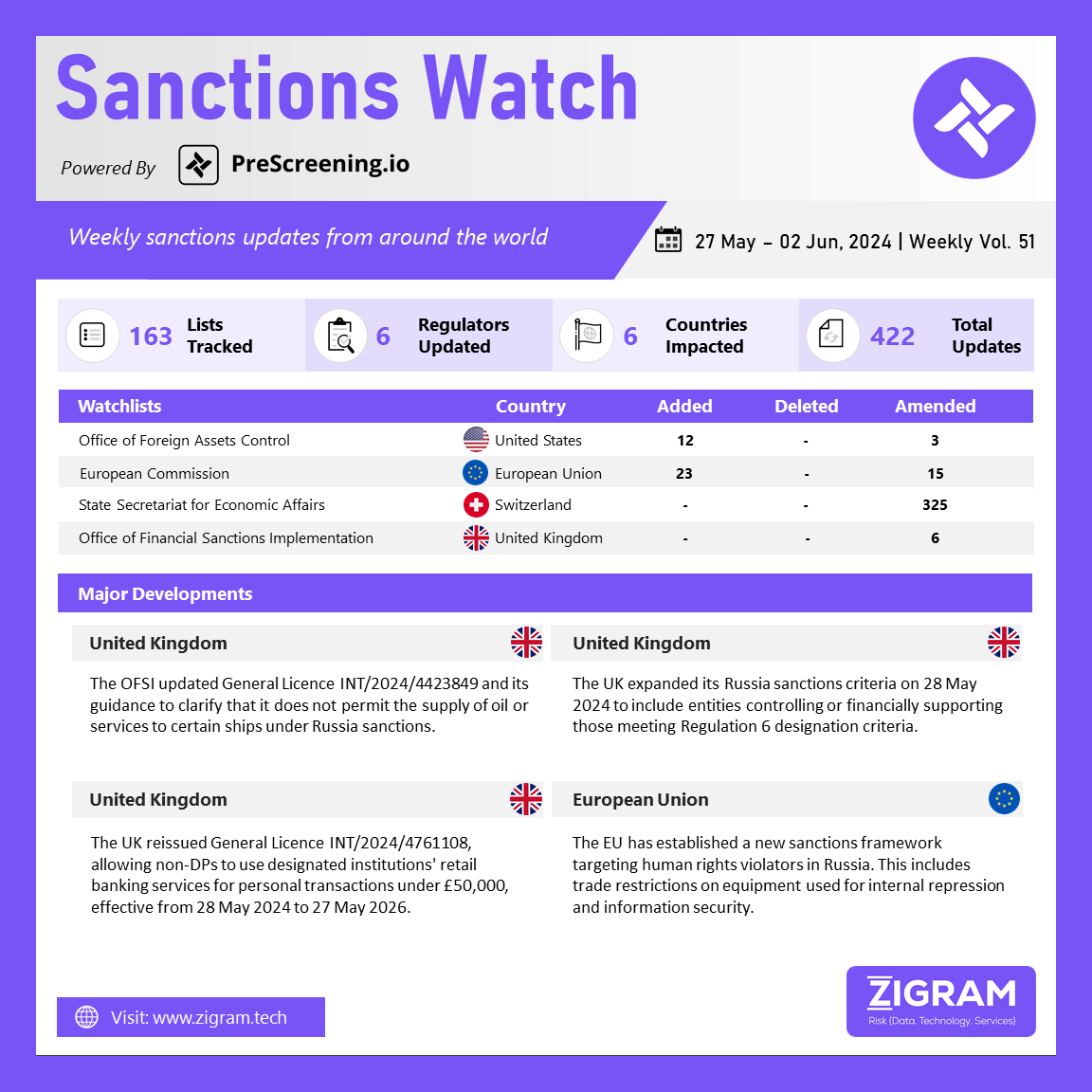

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

The OFSI has updated General Licence INT/2024/4423849 “Oil Price Cap” and its associated guidance, specifically Chapter 4, to clarify that the licence cannot be used to provide oil or related services to ships designated under regulation 57F of the Russia Sanctions Regulations 2019. This regulation allows the UK government to identify ships suspected of being used to violate or bypass Russia sanctions. The revision emphasizes that the general licence cannot be relied upon to supply oil to these specified ships, highlighting a significant change in policy.

The UK has broadened the criteria for its targeted Russia sanctions under Regulation 6 of the Russia (Sanctions) Regulations 2019, effective from 28 May 2024. The amendments, detailed in The Russia (Sanctions) (EU Exit) (Amendment) (No. 2) Regulations 2024, introduce new criteria allowing the designation of individuals or entities that own or control entities meeting the designation criteria specified in Regulation 6(3)(a)-(g). Additionally, the criteria now cover those who provide financial support to entities falling under the designation criteria outlined in Regulation 6(4)(a)-(e). This expansion aims to enhance the UK’s ability to target individuals and entities involved in supporting activities that are contrary to its sanctions objectives, thereby strengthening the overall impact and enforcement of the sanctions regime against Russia.

The UK has reissued General Licence INT/2024/4761108, which permits non-designated persons (non-DP) to utilize retail banking services offered by specified credit or financial institutions. This authorization is subject to certain conditions, including that the transactions are intended for personal use, the total amount does not exceed £50,000 and the relevant institution reports the transactions to HM Treasury. The license, effective from 28 May 2024, provides a window for eligible individuals to access these services, with the authorization expiring on 27 May 2026. This reissuance underscores the UK’s commitment to ensuring accessibility and transparency in financial transactions, aligning with regulatory measures aimed at combating financial crime and promoting economic stability.

The EU has established a new framework for imposing restrictive measures against individuals involved in serious human rights violations, repression of civil society and undermining democracy in Russia. This decision, responding to increasing repression in Russia, follows the proposal by High Representative Josep Borrell after the death of Alexei Navalny in February. The framework allows targeting individuals providing support to those committing human rights violations. It also introduces trade restrictions on certain equipment and technology. The Council has listed one entity and 19 individuals under this new regime, including the Federal Penitentiary Service of the Russian Federation and several judges and prosecutors involved in Navalny’s case. These listings entail asset freezes and travel bans, aiming to hold the Russian leadership accountable for violating human rights. The EU continues to condemn Russia’s repression of civil society and calls for the release of political prisoners.

- #OFSI

- #GeneralLicence

- #OilPriceCap

- #UnitedKingdom

- #DesignationIndividual

- #RussiaSanctions

- #FinancialCrime

- #RestrictiveMeasures

- #EuropeanUnion

- #EU

- #SanctionsWatch

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsMonitoringBoard

- #RegulatoryObligations

- #SanctionsBreaches

- #HumanRightsViolations

- #TradeRestrictions

- #AssetFreezes

- #TravelBans