Published Date:

This week’s Subject Matter is about The Guidance – Swift RMA Due Diligence

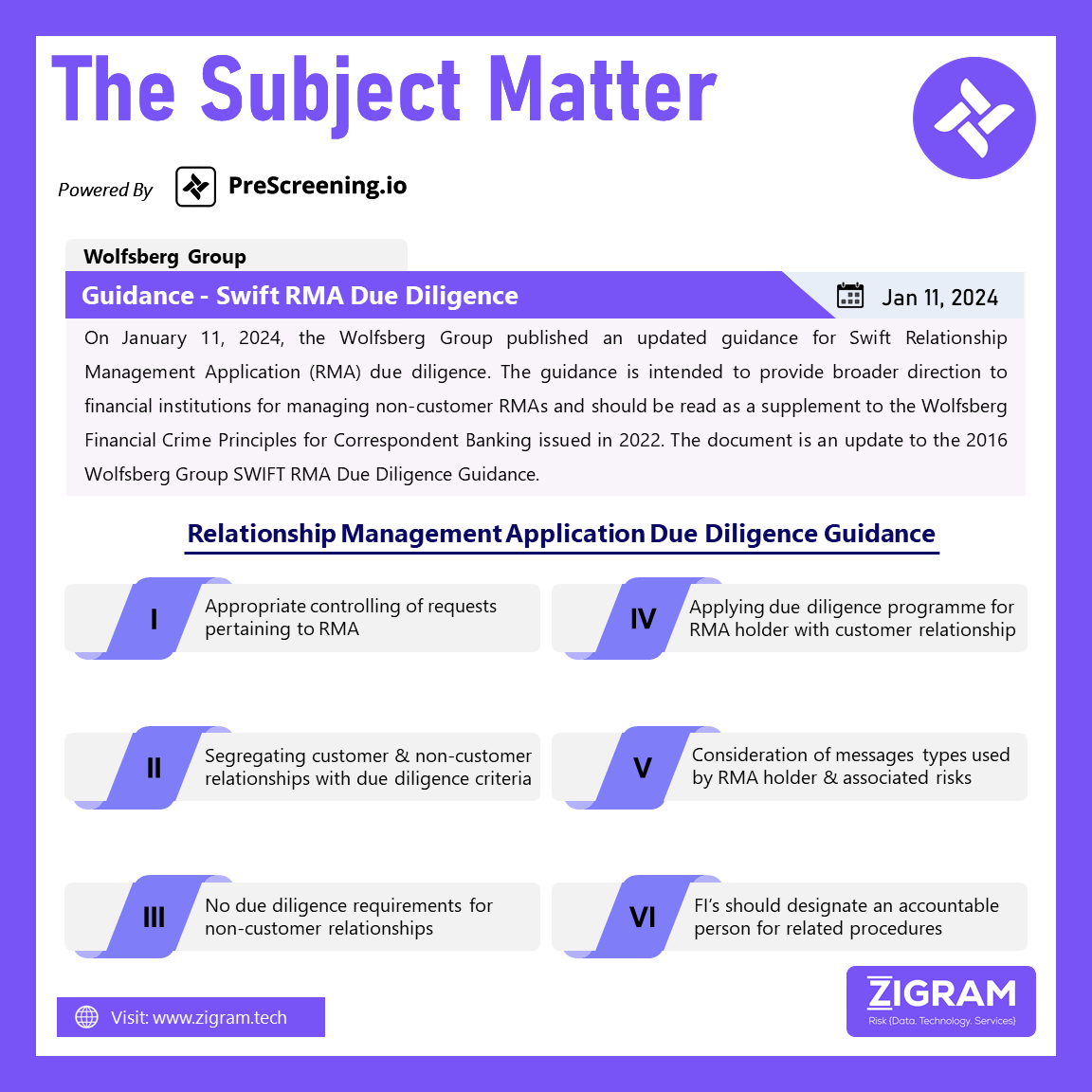

On January 11, 2024, the Wolfsberg Group published an updated guidance for Swift Relationship Management Application (RMA) due diligence. The guidance is intended to provide broader direction to financial institutions for managing non-customer RMAs and should be read as a supplement to the Wolfsberg Financial Crime Principles for Correspondent Banking issued in 2022. The document is an update to the 2016 Wolfsberg Group SWIFT RMA Due Diligence Guidance.

The overall objective of Swift Relationship Management is to stop unwanted messages before they leave the sender’s messaging interface. The Swift user can control the following types of information:-

1- which other Swift users can send them traffic

2- The messages the Swift user can send

3- The validity period of the RMA relationships

The possible use of an RMA arrangement for purposes not intended, or agreed to, at the time of

establishment is predominantly an operational risk, not a financial crime risk. The financial institutions (FI’) should incorporate RMA due diligence standards into their risk management programs where the following concepts or principles should be considered:-

1- Due to the potential risks that may be associated with the establishment of an RMA, approval

of such requests needs to be controlled appropriately

2- RMA requests may be segregated between customer relationships and non-customer

relationships, with distinct due diligence criteria

3- Within the set of non-customer relationships maintained by an FI, those relationships that are

limited to a purely reporting-related exchange of messages, with no transactional activity

involved, should be considered lower-risk

4- Where an RMA holder has a customer relationship subject to due diligence, the requirements

under that due diligence programme will apply

5- Due diligence on the RMA holder should consider the message types used by the RMA holder

and the risk associated with the activity conducted

6- FIs should consider designating an accountable person for related procedures

The important changes to industry messaging standards mean that FIs should revisit their approach to Swift RMA due diligence and FIs should review and as appropriate update their policies and procedures relating to risk assessment and due diligence for such relationships.

- #moneylaundering

- #compliance

- #antimoneylaundering

- #prescreening

- #prescreening

- #subjectmatter

- #amlcft

- #sanctions

- #duediligence

- #rma

- #financialinstitutions

- #wolfsberggroup