Monitor Customer Transactions And Payment Screening Risk

Transaction monitoring platform for customer transaction and payment screening, designed to detect suspicious activities using configurable rules and an AI/ML-powered system for enterprises

Why Transact Comply?

50 Millisecond Processing Time

Provides instant results for faster decision-making

AI/ML-Powered Pattern Anomaly Detection

Uses AI and machine learning to identify patterns and anomalies

Case And Workflow Management

Enhances compliance processes with effective case and workflow management

Risk Scoring

Calculates risk scores to guide automatic or manual transaction reviews

Configurable Rules Library

Offers customizable and flexible rulesets to fit business needs

Streamlined SAR/STR Reporting Automation

Automates suspicious activity and transaction report creation for timely compliance

Quick Frictionless Integration

Integrates seamlessly with existing systems for a smooth setup

Real-Time Alerts

Flags suspicious activities instantly for immediate action

AML Transaction Monitoring with Transact Comply

Detect suspicious patterns across customer transactions with AI-powered, real-time monitoring and intelligent alerting.

Real-Time Risk Detection

Monitor transactions across channels to identify unusual behavior, fraud indicators, structuring patterns, and high-risk activity using configurable rules and advanced analytics.

Intelligent Alert & Case Management

Generate prioritized alerts with dynamic risk scoring, reduce noise through scenario testing, and streamline investigations with integrated case management and audit trails.

Continuous Monitoring & Compliance Readiness

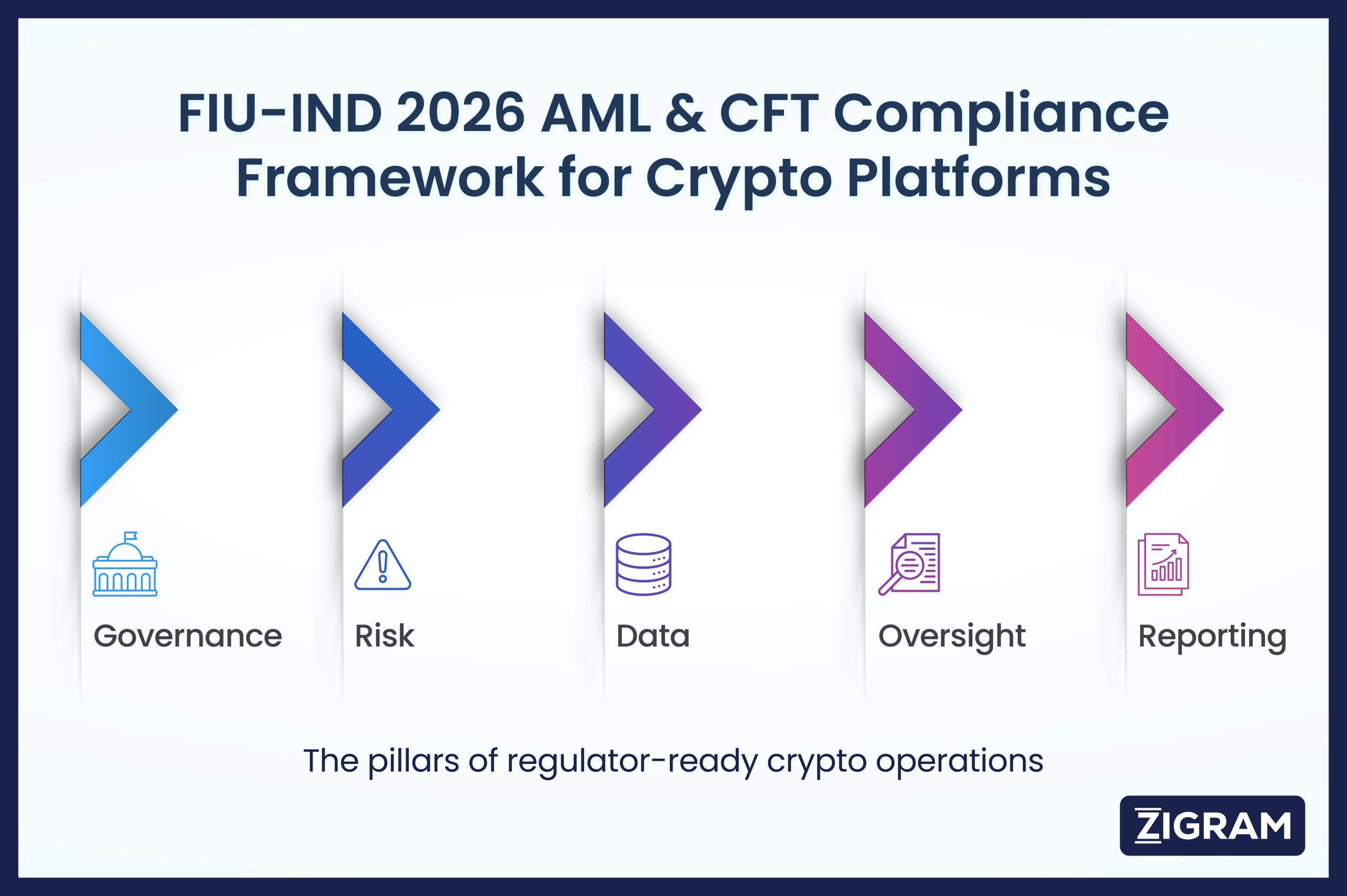

Support real-time and batch monitoring with cross-border risk tracking, regulatory reporting (STR/SAR), and ongoing rule optimization to stay aligned with evolving AML/CFT requirements.

Industries

Comprehensive solutions for diverse sectors to ensure security at every step of your compliance journey

Financial Services

Insurance

Banking

Investment Management

Fintech

Legal and Compliance Services

Healthcare and Pharmaceuticals

Retail and E-commerce

Government and Public Sector

Telecom

Energy and Natural Resources

Manufacturing

Technology and Software

Hospitality and Tourism

Transportation and Logistics

Real Estate

Articles

Explore insightful articles on cutting-edge topics like regulations, technological advancements, and critical insights into AML and financial crime risks

Resources

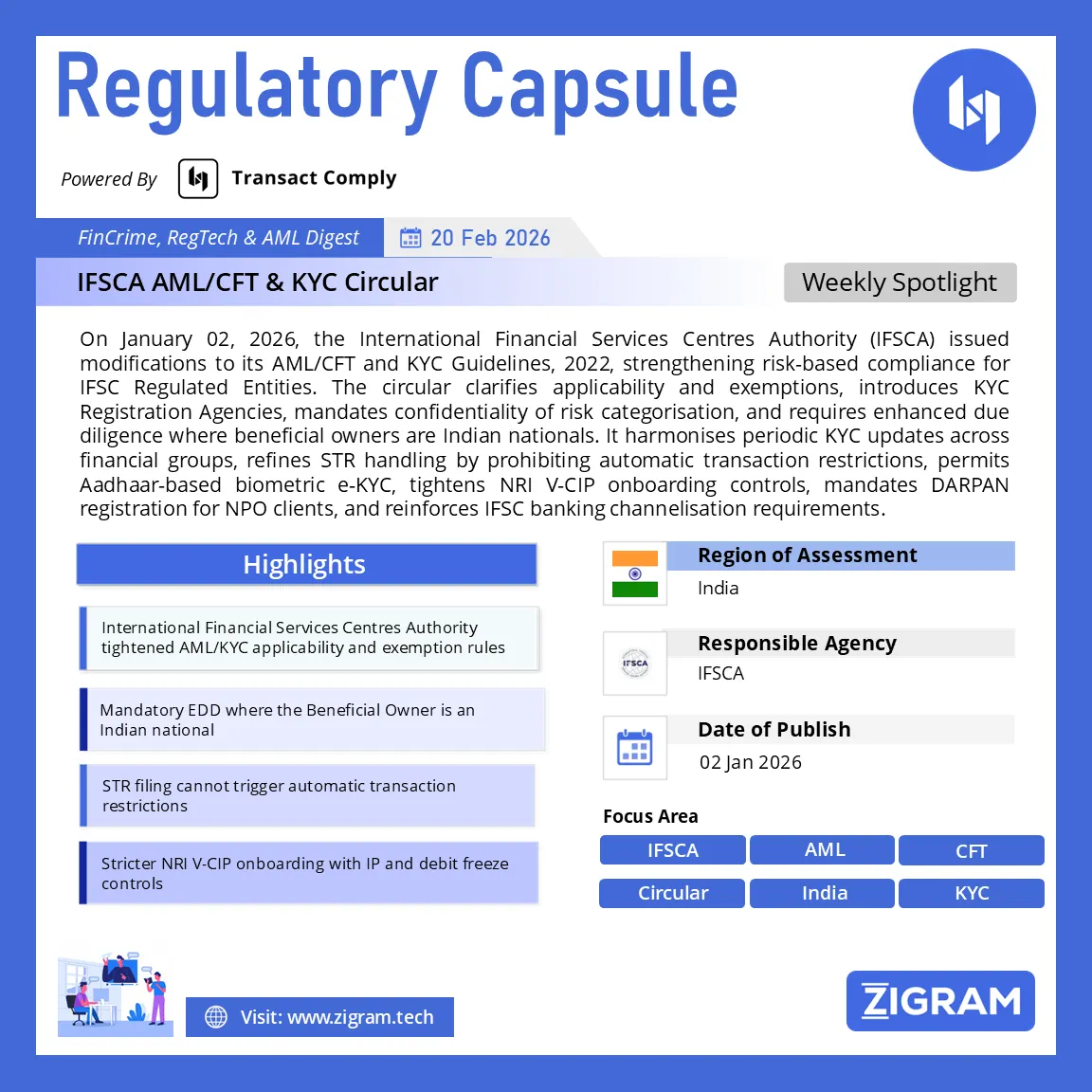

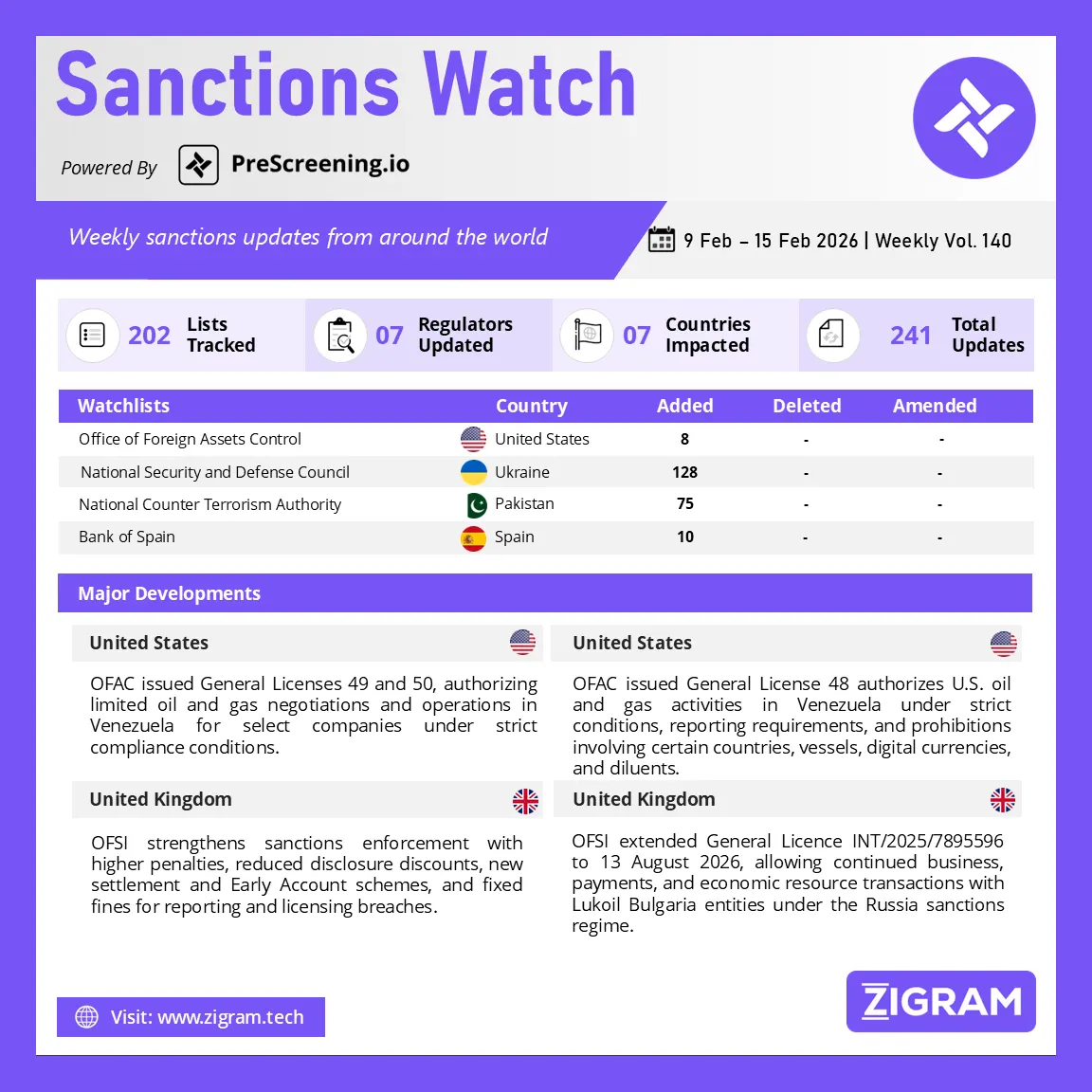

Our weekly dose of knowledge on the latest developments in anti-money laundering, financial crime, and other offenses, including news, regulations, and reports from around the world

LEARN MORE

Let's Find the Right Solution for You

Discover how our technology and data solutions can accelerate your compliance goals.

Explore Our Solutions

Explore Our Solutions Request Custom Pricing

Request Custom Pricing Schedule A Free Trial Or Demo

Schedule A Free Trial Or Demo